Ethereum Still A Bargain? StanChart Exec Says ETH Is ‘Cheap’ And Ready To Rally

Standard Chartered’s digital assets research chief says Ethereum still has room to rise, even after recent swings in price. According to Geoffrey Kendrick, growing institutional demand and shrinking exchange liquidity are tightening supply and could push Ether higher toward his year-end target of $7,500.

Institutional Demand Up

Reports have disclosed that corporate digital asset treasury firms have bought about 2.5% of circulating ETH since June. Spot ETH exchange-traded funds added close to 5% over the same period.

Based on those figures, roughly 7.5% of supply has been drawn into corporate treasuries and ETFs since June, a large shift in a relatively short time. Kendrick expects these firms could eventually hold up to 10% of all circulating Ether, a projection that underpins his bullish view.

Exchange Outflows And Price Moves

Exchange-balance trackers show a substantial movement of coins off trading platforms. In a single day, over 74,000 ETH — roughly $340 million at recent prices — was withdrawn from exchanges, led by Binance.

Such outflows are often read as a sign of reduced near-term selling pressure. Ethereum did slip about 5% on Tuesday before bouncing back. According to CoinMarketCap, it trades near $4,618, marking a 4.6% gain in the last 24 hours and a weekly rise of 10%.

Resistance Levels To WatchTraders are watching short-term barriers around $4,600. A clear move above that level could open $4,700, with $4,800 the next checkpoint before the prior high.

The asset briefly hit an all-time high of $4,950 on August 24. Kendrick’s forecast of $7,500 by year-end implies a roughly 60% climb from current prices, a scenario that would require continued strong flows and calm macro conditions.

Corporate Moves Versus Market Supply

Corporate Moves Versus Market Supply

Reports point to firms such as SharpLink Gaming and Bitmine Immersion being valued in relation to their ETH exposure. Kendrick compared these companies to Strategy’s approach with Bitcoin, arguing some are priced below what he considers fair value.

SharpLink has announced a share repurchase program that would trigger if its metric net asset value falls below 1.0, a move that could set a price floor for the stock.

That corporate behavior, while supportive for those equities, is not identical to permanent removal of ETH from circulation the way staking or ETF custody can be.

The bullish picture rests on a few big assumptions. Macro shocks, quick shifts in investor sentiment, or regulatory moves could reverse flows fast.

Crowded positions can be created when many buyers chase the same theme, and those positions can amplify volatility if sentiment changes.

Featured image from Unsplash, chart from TradingView

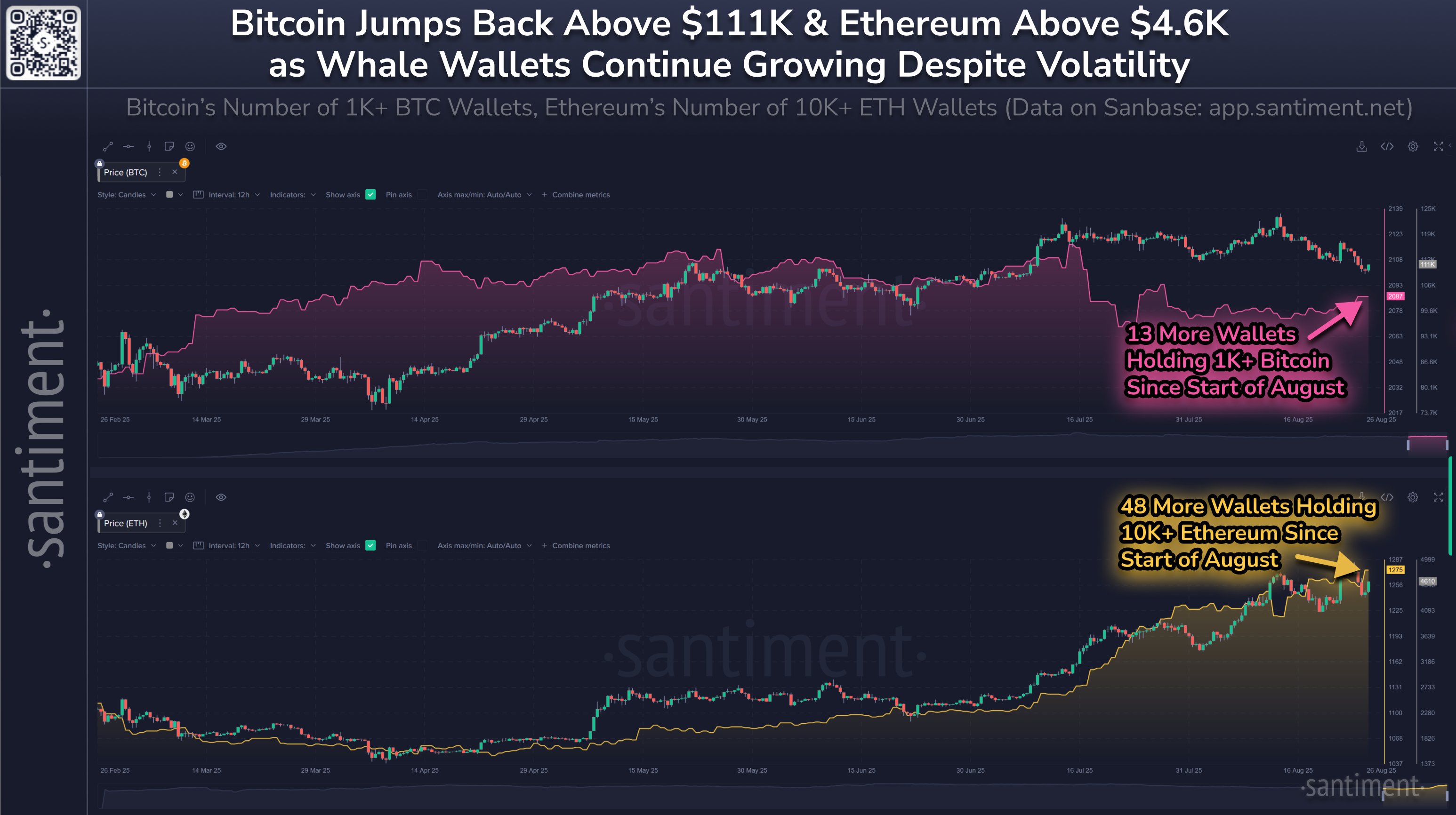

Bitcoin & Ethereum Whale Populations Quietly Growing, On-Chain Data Reveals

On-chain data from Santiment shows both Bitcoin and Ethereum whale address counts grew in August, si...

New Hedge Fund Falconedge To Devote Nearly 100% Of IPO Funds For A Bitcoin Treasury

Falconedge, a newly established hedge fund advisory firm that emerged from Falcon Investment Managem...

XRP Shows Strength Amid $3 Retest, But Analyst Warns Of Potential Correction

XRP has recovered from the recent market pullback and is attempting to confirm the $3.00 level as su...