New Hedge Fund Falconedge To Devote Nearly 100% Of IPO Funds For A Bitcoin Treasury

Falconedge, a newly established hedge fund advisory firm that emerged from Falcon Investment Management, has revealed a new strategy among publicly traded companies: to allocate nearly all of the proceeds from its upcoming initial public offering (IPO) to building a Bitcoin (BTC) treasury.

Bitcoin-Focused IPO Strategy

On Wednesday, the firm’s announcement disclosed that Falconedge’s leadership views Bitcoin not merely as a hedge against inflation but as a cornerstone asset for institutional treasury management.

By emphasizing Bitcoin as a primary reserve asset, the firm aims to scale its cryptocurrency holdings significantly, thereby enhancing its balance sheet with BTC’s potential and institutional credibility.

Roy Kashi, CEO of Falconedge, expressed enthusiasm about the firm’s launch in a press release statement . The executive said:

We’re proud to launch Falconedge as a next-generation platform that puts Bitcoin at the heart of institutional treasury strategy. This pre-IPO raise positions us to accelerate growth and deepen our impact in digital asset finance.

Flaconedge would join a growing trend of public traded companies adopting similar investment options, mulling Strategy’s (MicroStrategy) approach with years accumulating Bitcoin and so far enjoying billionaire returns.

Falconedge Completes Pre-IPO Fundraising

The firm disclosed it has completed its pre-IPO fundraising and is gearing up for a public offering in September. Falconedge has indicated that the majority of the IPO proceeds will be allocated to Bitcoin accumulation , further solidifying Falconedge’s vision.

Falconedge’s IPO is set to be one of the first to dedicate proceeds primarily to Bitcoin reserves, effectively positioning the firm as a hybrid entity that straddles the line between an advisory firm and a digital asset holding company.

USDT stablecoin issuer Circle has also been in the spotlight with its debut on the New York Stock Exchange (NYSE). Its shares, traded under the ticker symbol CRCL , surged over 150% in the first days of its debut, highlighting the interest by investors in crypto-focused IPOs.

Despite being newly formed, Falconedge benefits from the significant credibility and expertise inherited from Falcon Investment Management, a top player in United Kingdom-regulated crypto investing.

The firm’s legacy includes launching one of the earliest regulated crypto funds in the UK in 2018, managing over $850 million in crypto assets at its peak, and successfully establishing a decentralized finance-focused fund that has performed well.

As of this writing, Bitcoin, the market’s leading cryptocurrency, is trading at $112,100 — nearly 10% below its record high of $124,000 earlier this month. This is in line with the broader correction in the market, which has seen digital asset prices retrace to key support levels.

Featured image from DALL-E, chart from TradingView.com

XRP Price Holds Macro Consolidation Zone, Wave 3 Surge Could Send Price To $5

After the Bitcoin price retracement, XRP seems to have entered into another bearish trend that has s...

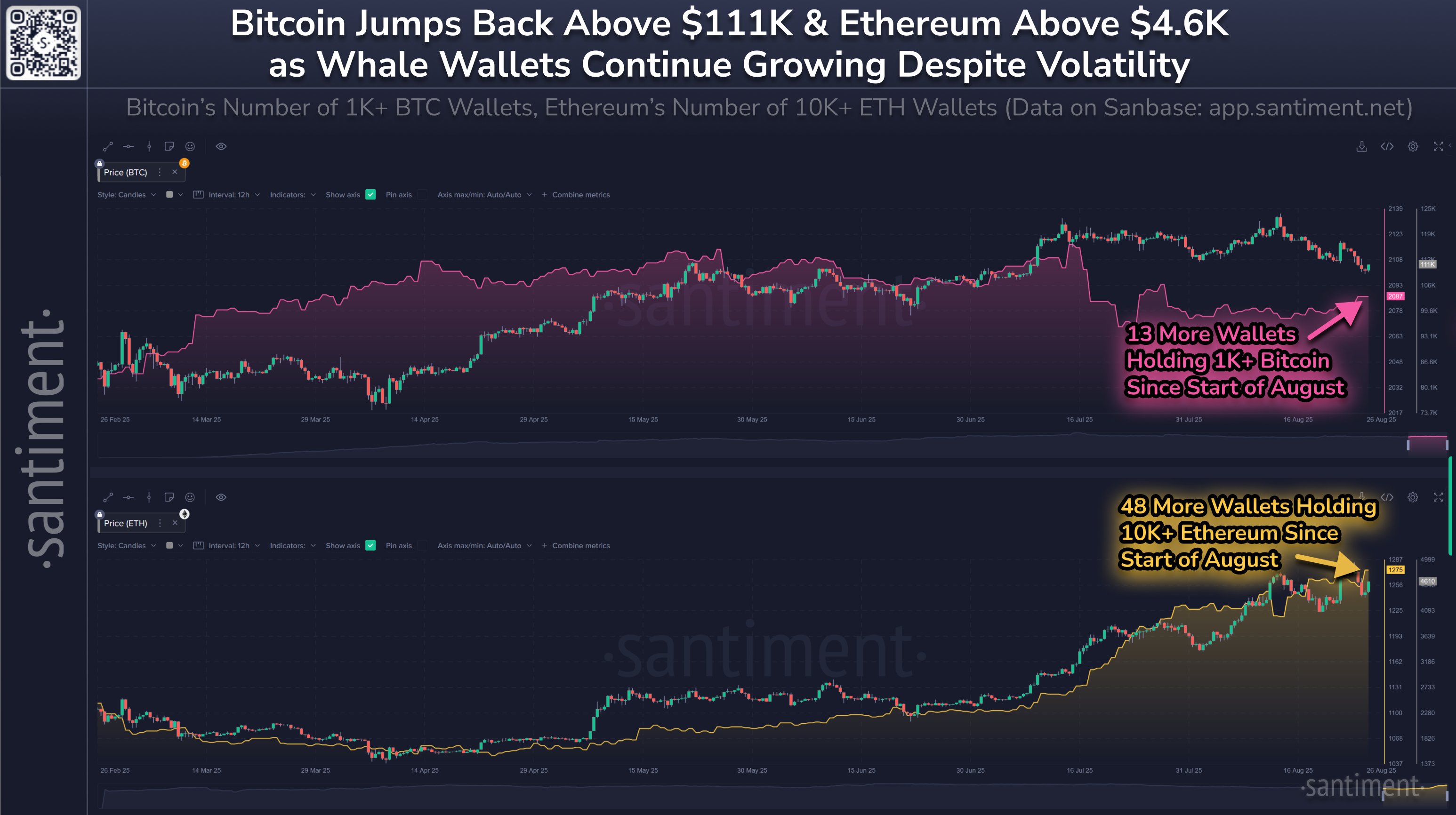

Bitcoin & Ethereum Whale Populations Quietly Growing, On-Chain Data Reveals

On-chain data from Santiment shows both Bitcoin and Ethereum whale address counts grew in August, si...

XRP Shows Strength Amid $3 Retest, But Analyst Warns Of Potential Correction

XRP has recovered from the recent market pullback and is attempting to confirm the $3.00 level as su...