Sygnum Bank Launches SUI Custody, Trading, Staking, and Lending Services for Institutional Clients

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Following a partnership with the Sui Foundation, Sygnum Bank is offering a range of institutional-grade financial services for SUI.

The $1 billion digital asset banking group disclosed in a

press release

that it is offering SUI custody, spot and derivatives trading, staking, and lending solutions exclusively for professional and institutional clients.

Per the announcement, the initiative involves Sygnum integrating SUI into its banking platform. As a result, the token could enjoy accelerated inflows from asset managers, banks, and financial institutions, potentially boosting its adoption and credibility.

Executive Commentary

Speaking in a statement, Sygnum’s co-founder, Mathias Imbach, expressed delight about becoming a banking partner of the Sui Foundation. This alliance will expand its access to institutional and professional clients.

Christian Thompson, the CEO of the Sui Foundation, also commented on the significance of SUI’s integration into Sygnum’s banking platform. Thompson portrayed the initiative as a remarkable development extending SUI’s global reach among institutional investors.

He also framed Sygnum Bank as an ideal banking partner for the Sui ecosystem, citing its crypto-native expertise and fully regulated infrastructure.

Institutional Adoption Accelerates

Launched by a team of former Meta engineers in May 2023, Sui is a Layer-1 blockchain that supports various applications, including instant payments, decentralized finance (DeFi), and real-world assets (RWA) tokenization.

It has been attracting the attention of financial institutions recently. Earlier this month, Swiss-based AMINA Bank AG made history by

becoming

the first regulated bank to offer institutional trading and custody for SUI.

In a separate development, U.S.-based Mill City Ventures III., Ltd.

completed

a $450 million private placement, with 98% of the proceeds used to establish a strategic SUI treasury. Following the fundraiser, the company procured more than 76 million SUI tokens at an aggregate cost of $277 million.

Like most crypto assets, top asset managers are also seeking to launch spot exchange-traded funds (ETFs) tied to SUI. As previously reported, major players like

Canary Capital

and

21Shares

are seeking the SEC’s approval to debut SUI ETFs in the U.S. The SEC is currently reviewing these applications.

SUI Price Reacts to Sygnum Partnership News

News of Sygnum’s partnership with the Sui Foundation has slightly impacted the token’s performance. Before the announcement, SUI was hovering around $3.8.

However, it spiked immediately to an intraday high of $3.88 after Sygnum announced the token’s integration into its banking platform. At press time, SUI is trading at $3.84, representing a 24-hour increase of 2.56%.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521367.html

Related Reading

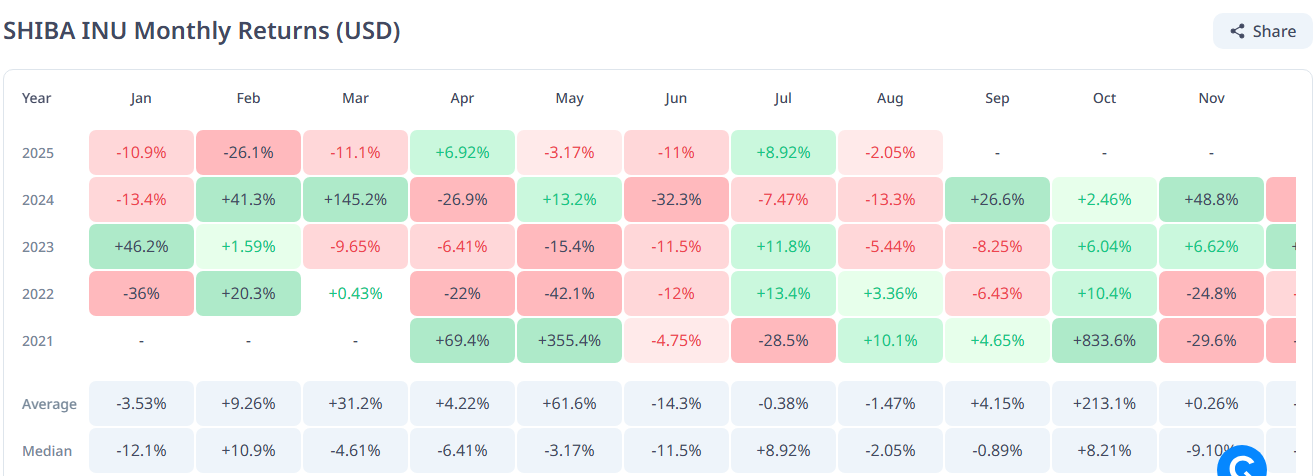

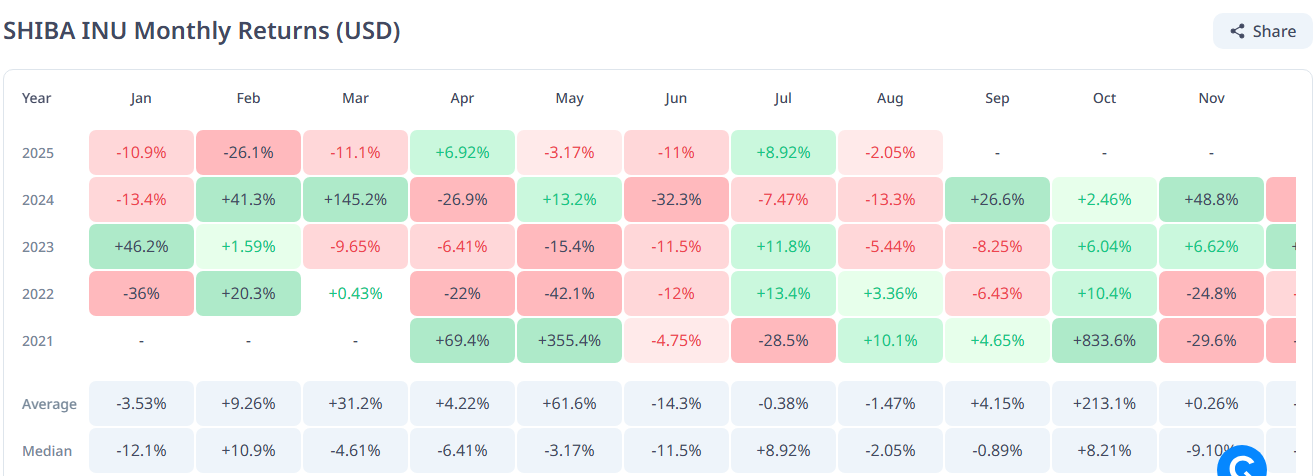

Here’s Potential Price for Shiba Inu if Dogecoin Hits $1.50

A veteran crypto investor has predicted that Shiba Inu could clinch a new all-time high (ATH) if Dog...

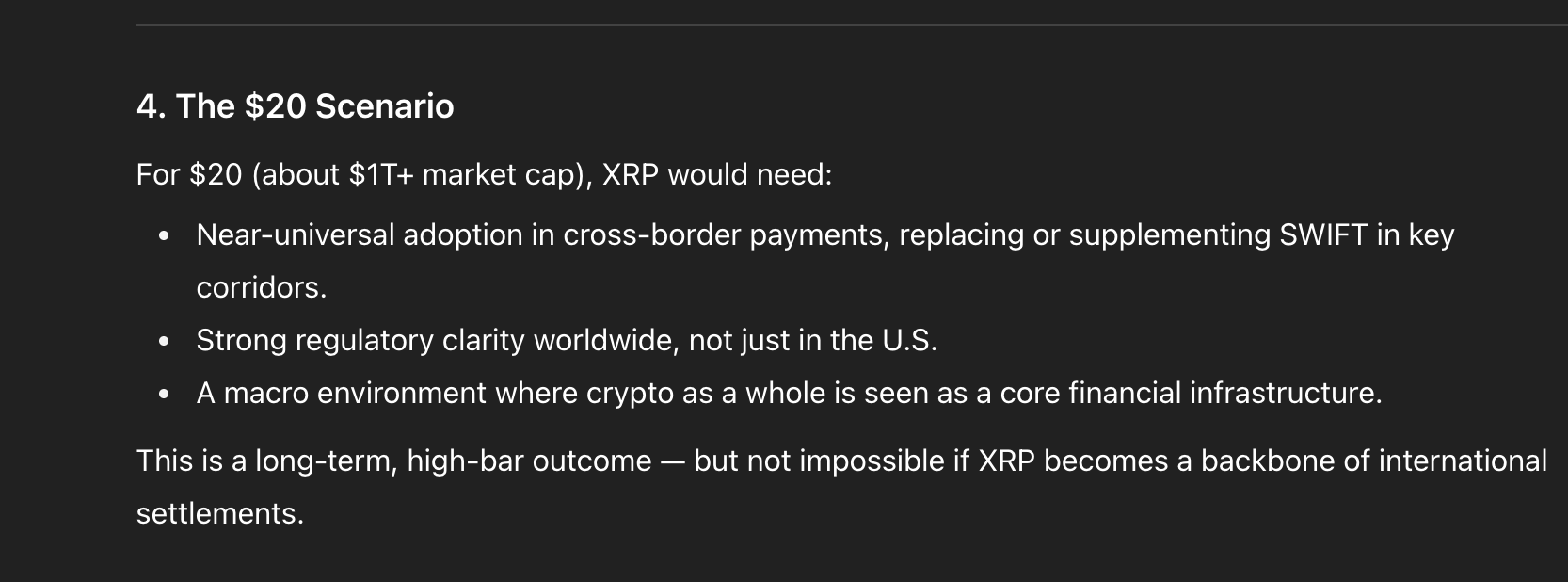

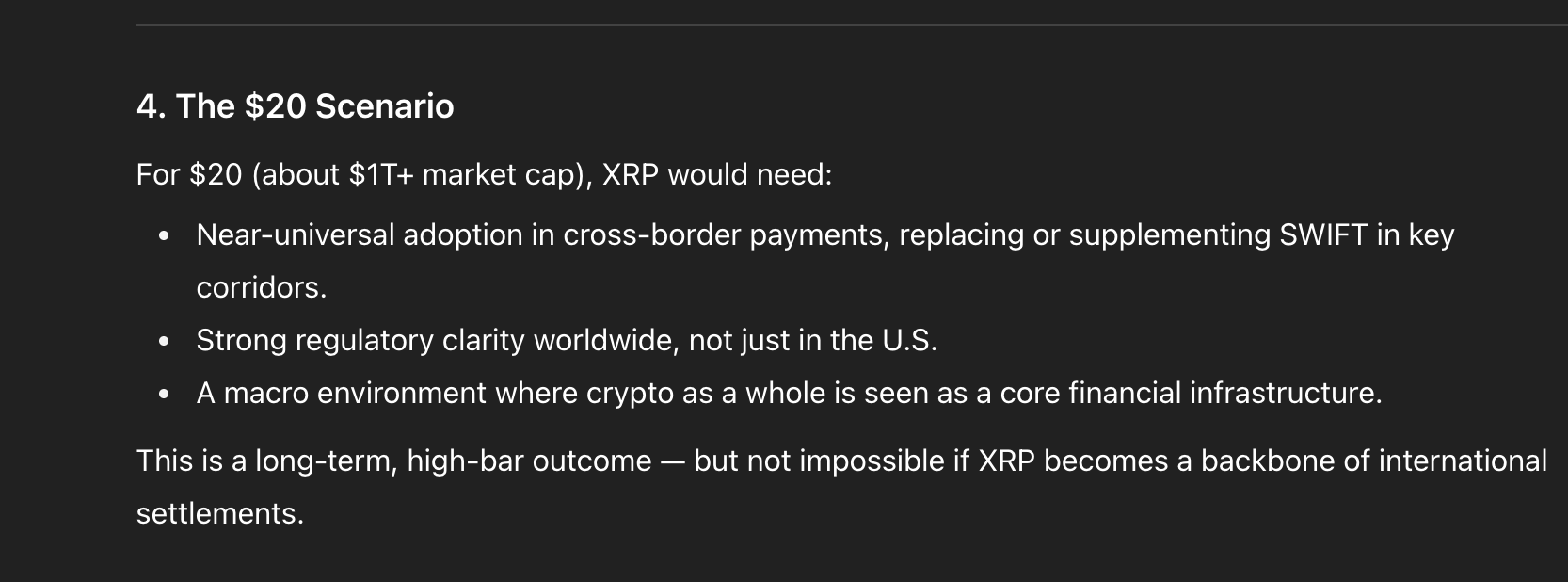

XRP Price News: With SEC Battle Over, Can XRP Hit $5, $10, or $20

The nearly five-year legal battle between Ripple and the U.S. SEC is officially over, and attention ...

Donald Trump-Inspired World Liberty Financial Exploring $1.5B Crypto Vehicle to Hold WLFI Tokens

The Donald Trump-inspired World Liberty Financial is exploring plans to create a publicly traded cry...