Donald Trump-Inspired World Liberty Financial Exploring $1.5B Crypto Vehicle to Hold WLFI Tokens

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The Donald Trump-inspired World Liberty Financial is exploring plans to create a publicly traded crypto vehicle to hold its WLFI tokens.

Notably, World Liberty Financial is already pitching the idea to top Wall Street investors and targets $1.5 billion in fundraising to create and launch the company, Bloomberg

reported

on August 8. The new prospect adds to the Trump family-backed venture’s many explorations of the digital asset landscape, this time joining the crypto treasury firm boom.

Details of Deal Still Unclear

Meanwhile, the report, which cited people familiar with the issue, noted that the groundwork of the deal is still being finalized. While they did not reveal further details, they disclosed that World Liberty Financial has involved big investors and major crypto industry leaders, and discussions are advancing rapidly.

Notably, the teased $1.5 billion public firm would hold the WLFI token. World Liberty created the token as a non-transferable governance asset, but the public listing would make the tokens tradable in the open market.

World Liberty Financial, which initially set out as a DeFi platform to disrupt the traditional financial giants, would further broaden its crypto venture with the public firm. Recall that in March, it

launched

its dollar-pegged stablecoin, USD1, on Ethereum and BNB Chain.

World Liberty Financial to Leverage the Crypto Treasury Buzz

With

Strategy’s

(formerly MicroStrategy) treasury success, several other corporate firms have mirrored its Bitcoin strategy. Firms like Metaplanet and Semler Scientific have all abandoned their primary business model to offer indirect exposure to the orange pill.

Bitcoin treasury firms have

raised

approximately $79 billion this year alone, outdoing the US Bitcoin ETFs in the first half of the year. Notably, these numbers suggest growing demand for Bitcoin exposure amid mainstream emergence.

Meanwhile, Ethereum treasury firms are also increasing rapidly, with the SharpLink and

Bitmine

leading the pack. As a result, World Liberty Financial aims to leverage this corporate treasury buzz to expand its crypto business.

Notably, the report, citing previous deals, suggested that the World Liberty treasury venture would take over a shell company already listed on major stock exchanges to enter the public market.

Recall that World Liberty Financial

raised $550 million

from the sale of its WLFI token, with a considerable percentage of it

going to Trump’s purse

. The firm has used some proceeds from the sales to buy cryptocurrencies like Ethereum, Ondo, and Aave in preparation for its DeFi business.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521545.html

Related Reading

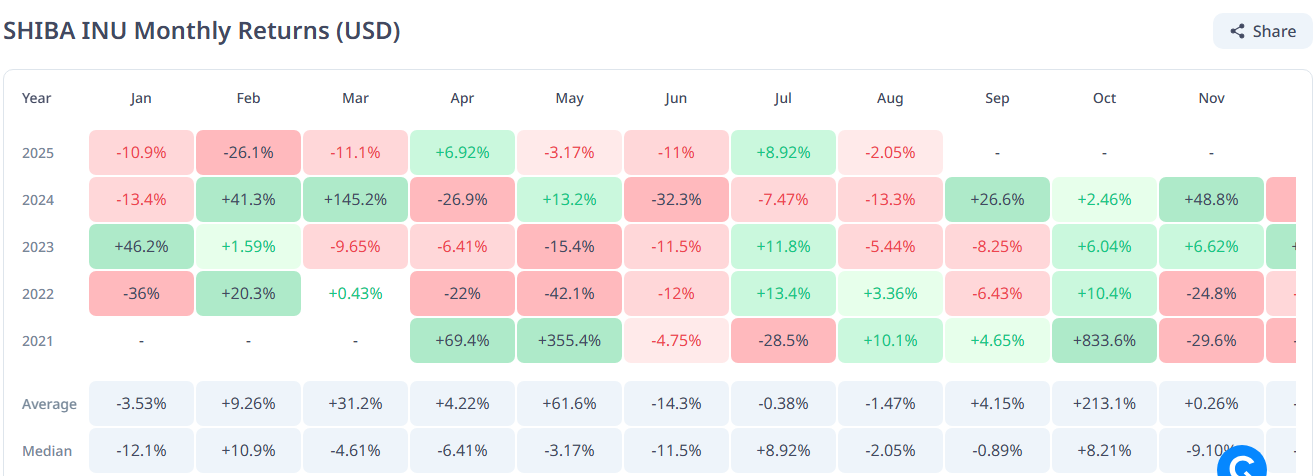

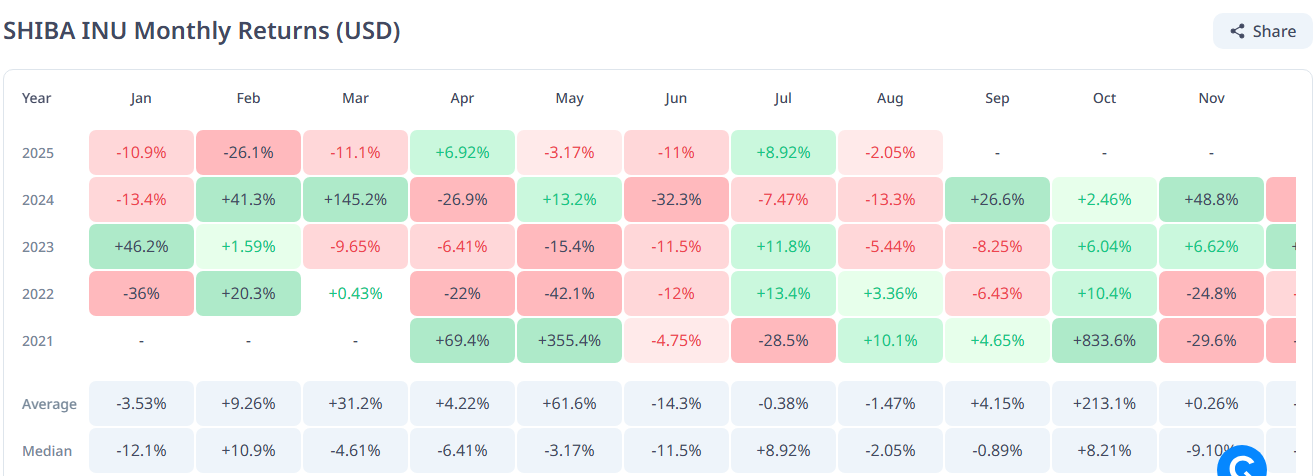

Here’s Potential Price for Shiba Inu if Dogecoin Hits $1.50

A veteran crypto investor has predicted that Shiba Inu could clinch a new all-time high (ATH) if Dog...

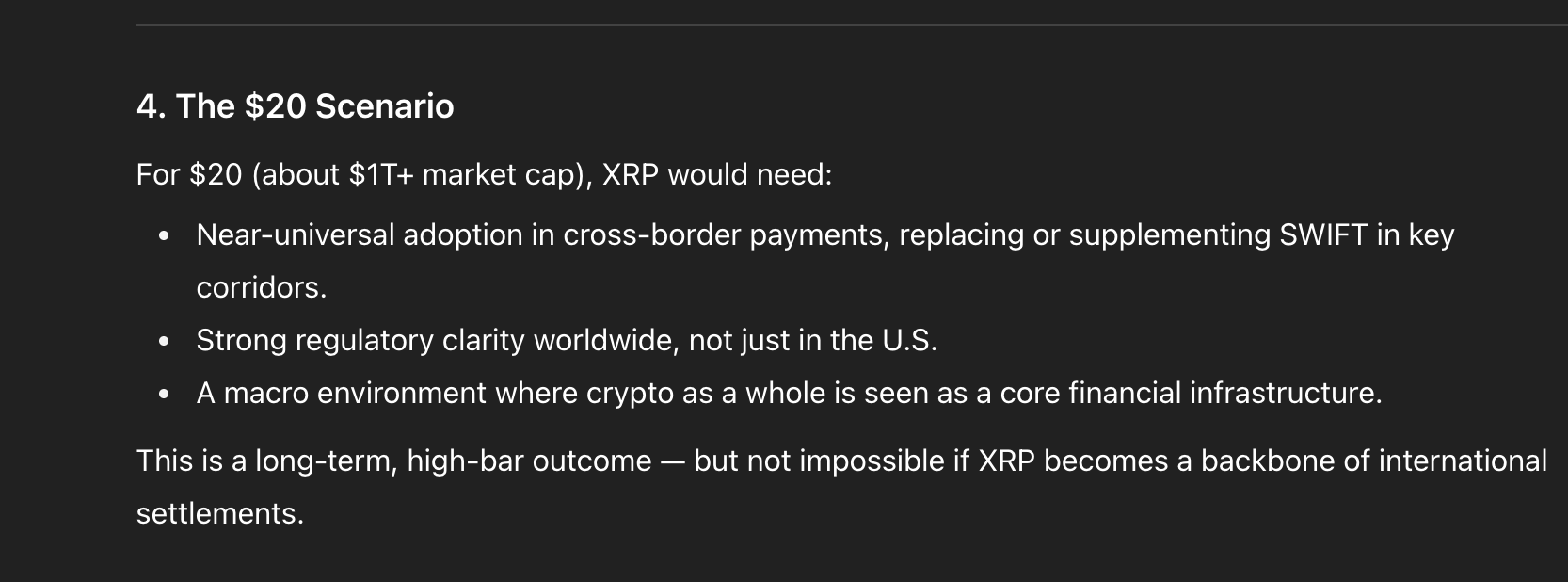

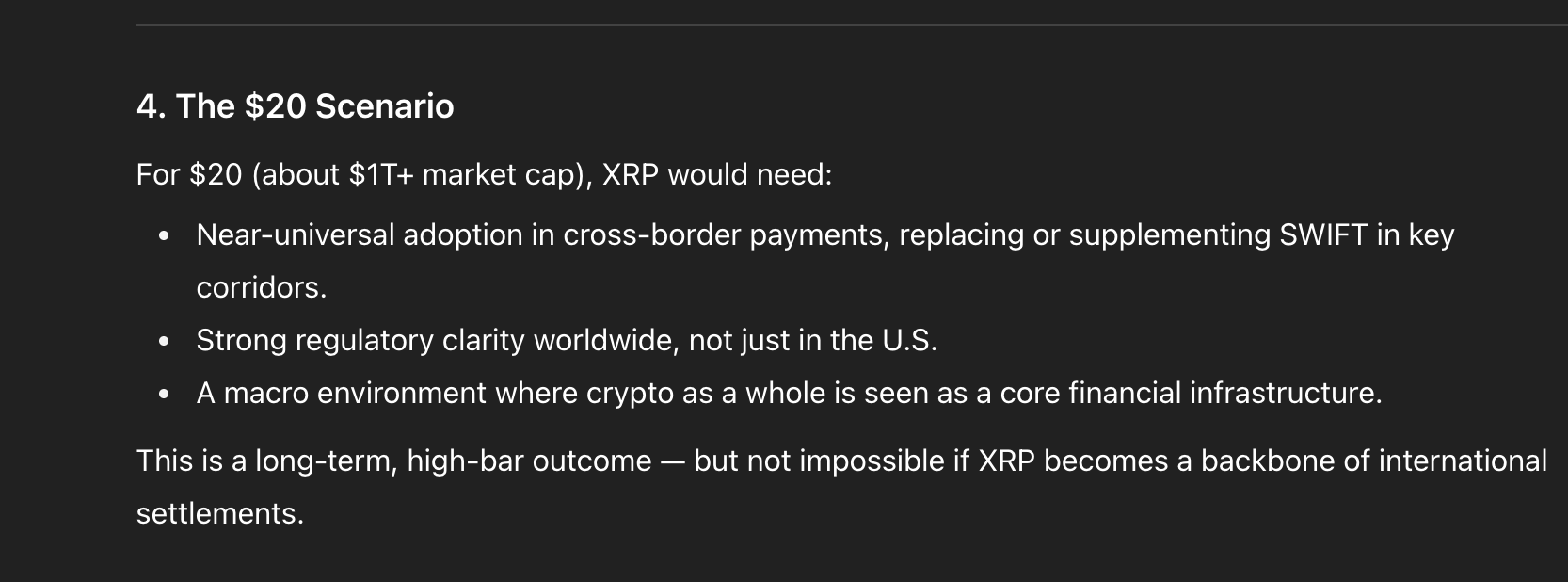

XRP Price News: With SEC Battle Over, Can XRP Hit $5, $10, or $20

The nearly five-year legal battle between Ripple and the U.S. SEC is officially over, and attention ...

Expert Predicts XRP Price Targets for Wave 5

XRP could be entering the final stage of its current bullish cycle, according to crypto analyst Mr. ...