AMINA Bank Becomes First Regulated Bank to Offer SUI Trading and Custody

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Swiss-regulated AMINA Bank AG has launched custody and trading services for SUI, marking a global first in regulated banking support for the Sui blockchain.

This

initiative

reflects the bank’s strategy to give institutional clients early, compliant access to high-potential digital assets.

Meanwhile, the bank plans to introduce staking for SUI later this year. The offering will feature governance tools for deposits and withdrawals, no limits on trading volumes, and strict compliance safeguards.

Together, these capabilities will enable institutions to execute strategies at scale while meeting regulatory standards.

Institutional Adoption Accelerates

The rollout comes amid a surge in institutional engagement with SUI. Several ETF applications are moving forward, with Canary Capital’s SEC review and 21Shares’ Nasdaq listing bid already in progress.

In addition, SUI is planned for inclusion in Bitwise’s crypto index ETF. These developments indicate growing recognition of Sui as a viable asset for regulated investment products.

AMINA’s Chief Product Officer, Myles Harrison, says Sui’s design can replace traditional Web2 infrastructure, delivering speed, scalability, and efficiency beyond many competing Layer-1 networks.

SUI Price Trends and Major Corporate Endorsements

SUI has faced short-term price pressure, down 12% this week to $3.46, but network activity remains strong. In July 2025, Sui processed $224,181,854 in stablecoin transfers, topping Solana’s $210,196,551 over the same period.

As

reported

earlier by

The Crypto Basic

, U.S.-based Mill City Ventures has unveiled a $450 million private funding initiative as part of its new treasury strategy focused on SUI. The Nasdaq-listed firm intends to dedicate roughly 98% of that capital to SUI holdings.

It has already secured 76,271,187 tokens at an average of $3.6389 each through a combination of over-the-counter purchases and in-kind arrangements with the Sui Foundation. The company also signaled it will continue expanding its position through additional open-market acquisitions.

Developer and Ecosystem Growth

The Sui Network’s growth is keeping pace with its rising institutional profile. Developer events in Paris, Athens, Istanbul, Bangkok, and Vietnam are expanding their reach and attracting fresh talent.

The Sui Summer 2025 campaign has already engaged nearly 3,000 developers, a 50% increase from 2024. With $2 billion in assets locked across its ecosystem and a technical foundation built for enterprises, the network is strengthening its position among the leading Layer-1 blockchains.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520818.html

Related Reading

Tom Lee Picks Ethereum Over Bitcoin, Says Ether Is the Biggest Macro Trade for the Next Decade

Tom Lee, the co-founder and CIO of Fundstrat, has doubled down on Ethereum, picking the altcoin as h...

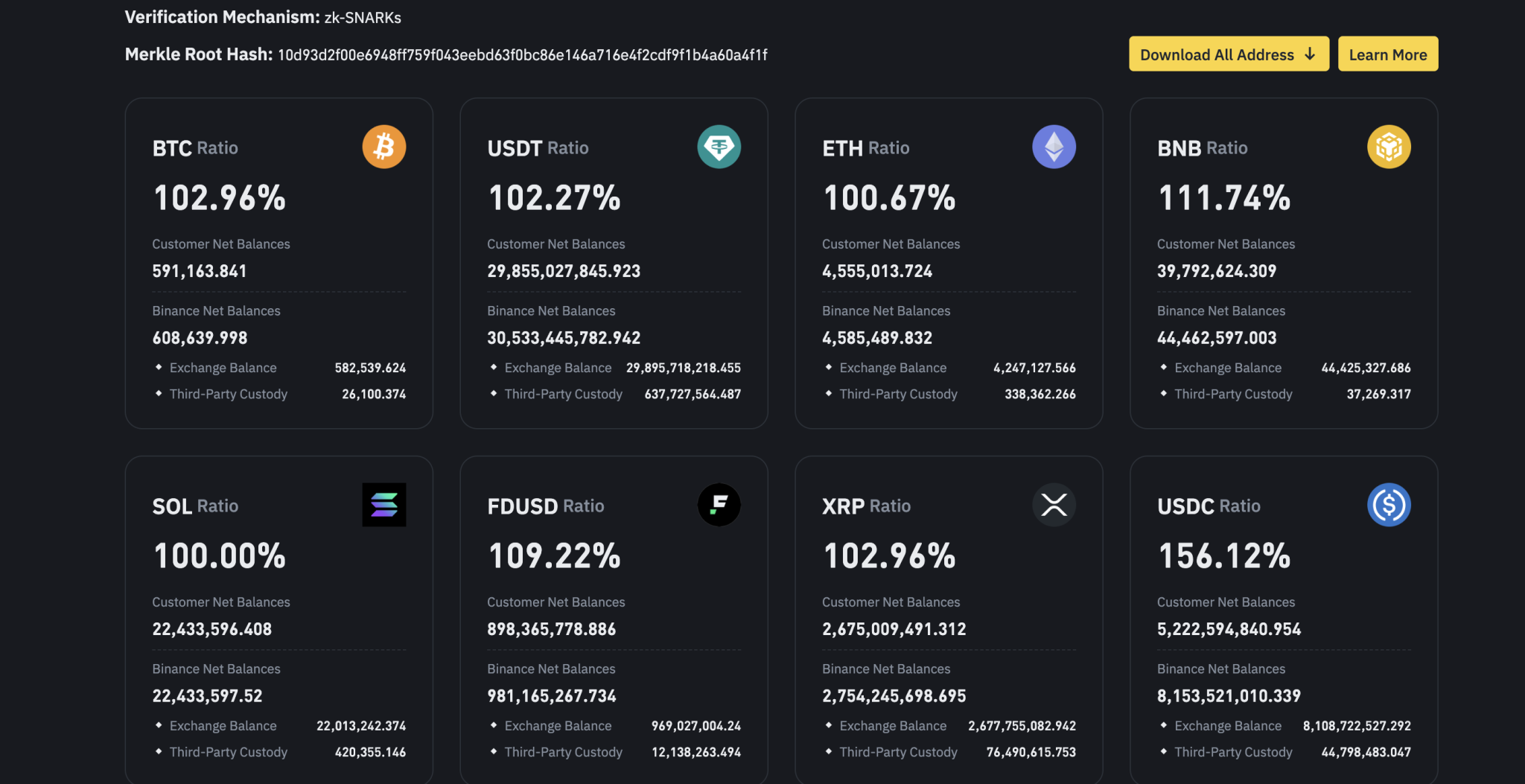

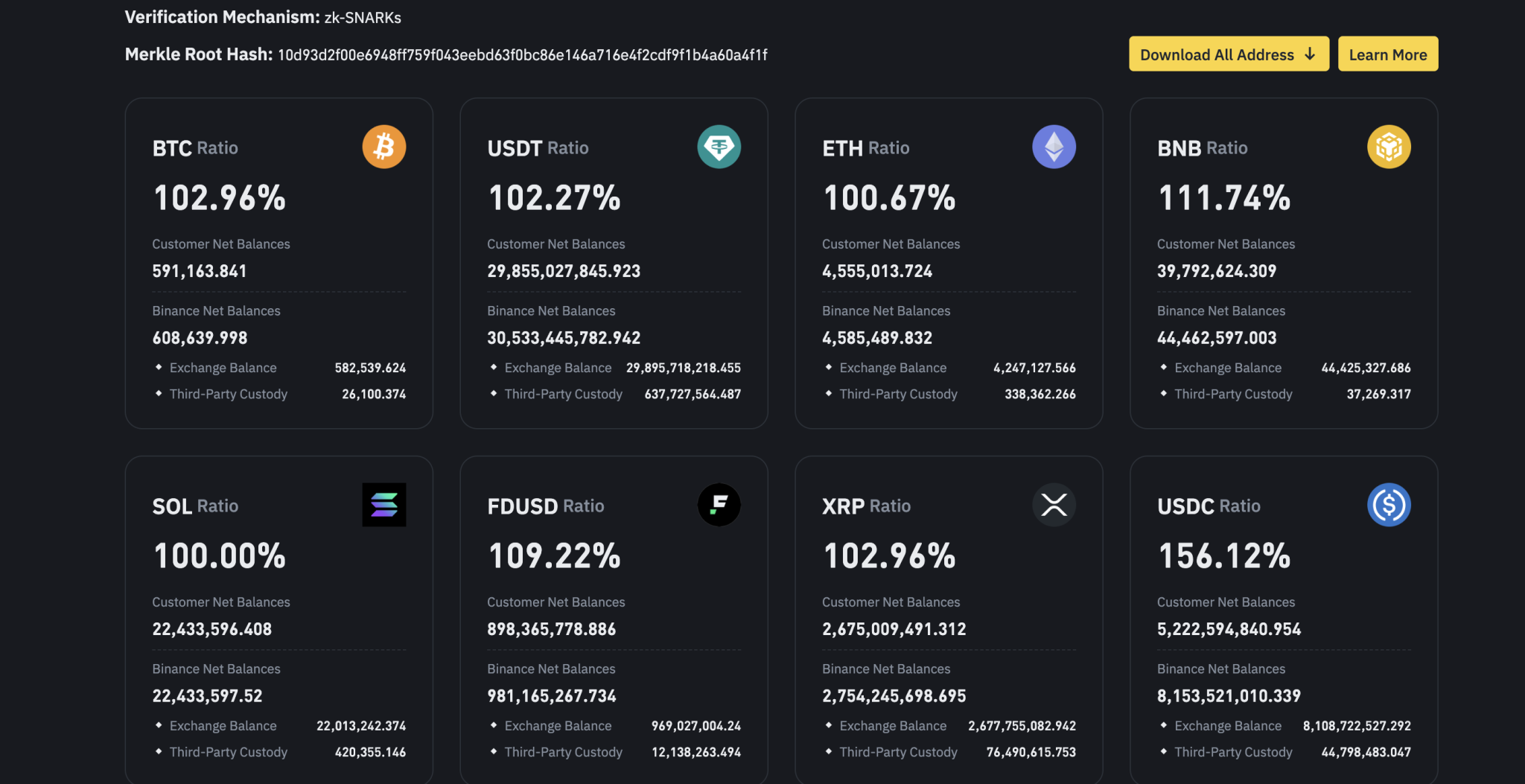

Here’s How Much XRP Binance Holds in Its Latest Proof-of-Reserves Report

The largest crypto exchange, Binance, has released its latest proof-of-reserves report, detailing in...

Bakkt Acquires 30% of Japan’s MarushoHotta, Plans Bitcoin Pivot

Bakkt, a crypto infrastructure and service provider company has agreed to acquire a stake in a Japan...