Bakkt Acquires 30% of Japan’s MarushoHotta, Plans Bitcoin Pivot

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Bakkt, a crypto infrastructure and service provider company has agreed to acquire a stake in a Japanese company, paving the way for Bitcoin accumulation.

According

to a press release, Bakkt Holdings Inc. will acquire a 30% stake in Japanese kimono manufacturer MarushoHotta Co., Ltd. for CNY 1.68 billion. After this purchase, the company will be renamed to bitcoin.jp and shift to a Bitcoin-based treasury model.

Bakkt Holdings Acquisition Details

Bakkt announced a share purchase agreement with RIZAP Group Inc., selling 16,864,650 shares of MarushoHotta.

The purchase will make Bakkt the largest shareholder in the Tokyo-listed company. Accordingly, a total of CNY 1.68 billion, approximately $235.2 million in cash, will be paid by Bakkt Opco Holdings, LLC, a subsidiary of Bakkt.

Following the acquisition, Phillip Lord, President of Bakkt International, will be appointed as the new Chief Executive Officer of MarushoHotta.

This announcement comes a week after Bakkt Holdings completed a $75 million public offering, with the proceeds intended for purchasing Bitcoin and other digital assets, working capital, and general corporate purposes.

MarushoHotta Rebrands to bitcoin.jp

Subject to shareholder approval, MarushoHotta will be renamed bitcoin.jp, reflecting its strategic shift toward cryptocurrency. Bakkt has also secured the domain name www.bitcoin.jp to support the rebrand.

This move will align the company's brand and operations with its new focus on digital assets. The rebranding signals a broader change in MarushoHotta's financial direction, away from traditional manufacturing toward digital finance.

Co-CEO of Bakkt, Akshay Naheta, noted that Japan’s well-defined regulatory framework has made it a favorable environment for Bitcoin-focused business expansion. Bakkt sees this as a strategic advantage as it works to integrate Bitcoin into MarushoHotta’s operations and financial structure.

Bitcoin.jp Will Join the List of Companies with a Bitcoin Treasury Strategy

The acquisition marks the beginning of Bakkt’s multinational Bitcoin treasury strategy, which involves integrating Bitcoin and other digital assets into corporate balance sheets. This model mirrors similar strategies from publicly listed companies like Strategy, but it is notable for targeting a traditional Japanese firm in a regulated environment.

Several Japanese companies are increasingly adding Bitcoin to their corporate treasuries. Metaplanet Inc. leads with 17,595 BTC, representing approximately $2 billion in holdings. NEXON Co., Ltd. follows with 1,717 BTC, while Remixpoint holds 1,168 BTC. Anap Holdings owns 831 BTC, and Convano Inc. holds 80 BTC.

Smaller allocations include SBC Medical Group with 66 BTC, Value Creation Co., Ltd. with 30 BTC, and AI Fusion Capital Group Corp. with 25 BTC. This trend highlights Japan’s growing institutional interest in Bitcoin as a reserve asset.

Notably, six U.S.-based firms lead all the global companies in accumulating Bitcoin as part of their treasury strategies. Leading the list is Strategy with 628,791 BTC, followed by MARA Holdings with 50,000 BTC. XXI holds 43,514 BTC, while Bitcoin Standard Treasury Company owns 30,021 BTC. Riot Platforms has 19,239 BTC in its reserves, and Trump Media & Technology Group holds 18,430 BTC.

Meanwhile, President Donald Trump’s media company, Trump Media and Technology Group (TMTG), was reportedly in

advanced talks to acquire Bakkt

. The news sent Bakkt shares soaring over 160%, with the stock trading at $33.56. Meanwhile, the stock is trading at $9.64, a 1.21% rise in the past day.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520961.html

Previous:8.7比特币/以太坊凌晨行情分析

Related Reading

Sygnum Bank Launches SUI Custody, Trading, Staking, and Lending Services for Institutional Clients

Following a partnership with the Sui Foundation, Sygnum Bank is offering a range of institutional-gr...

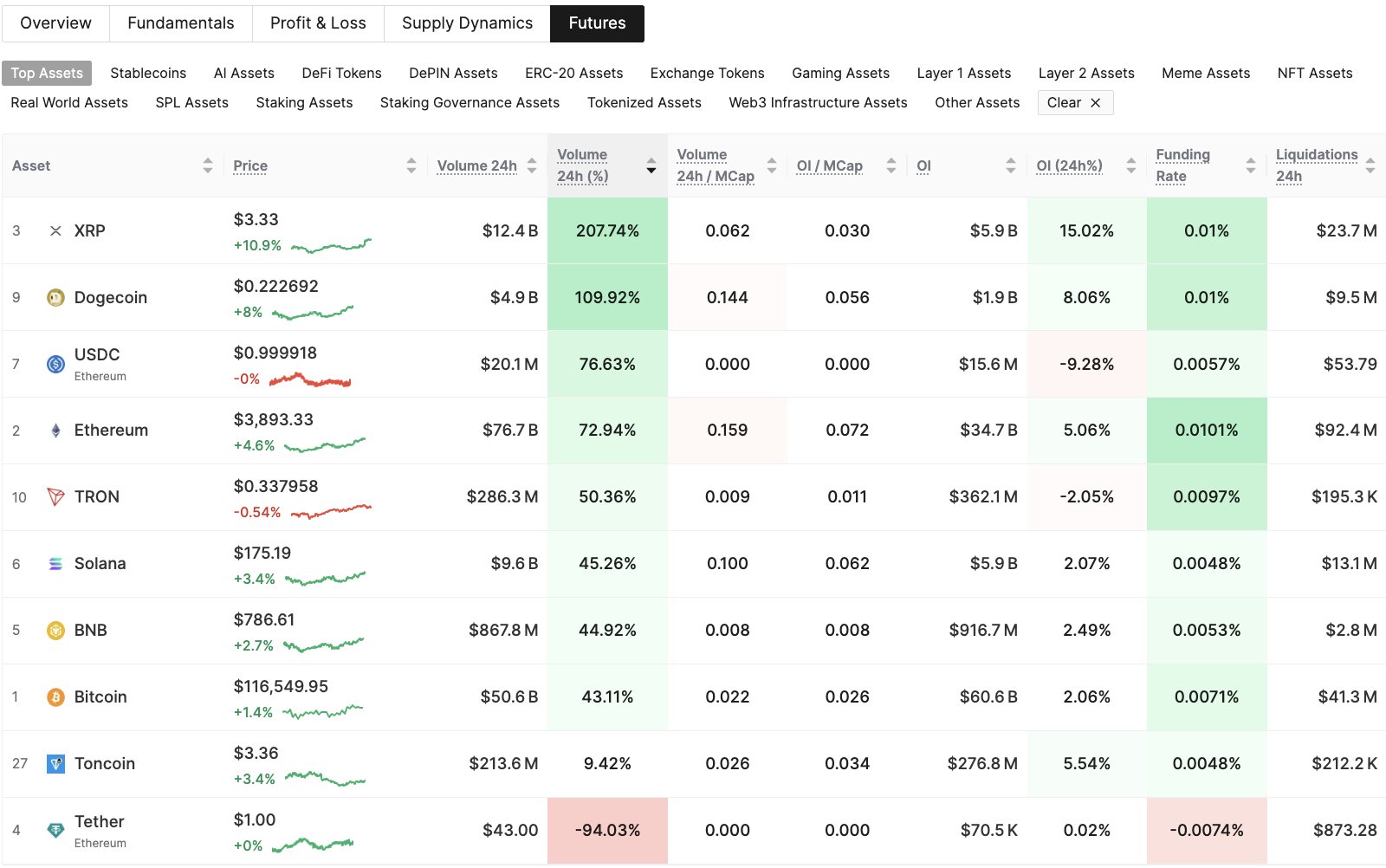

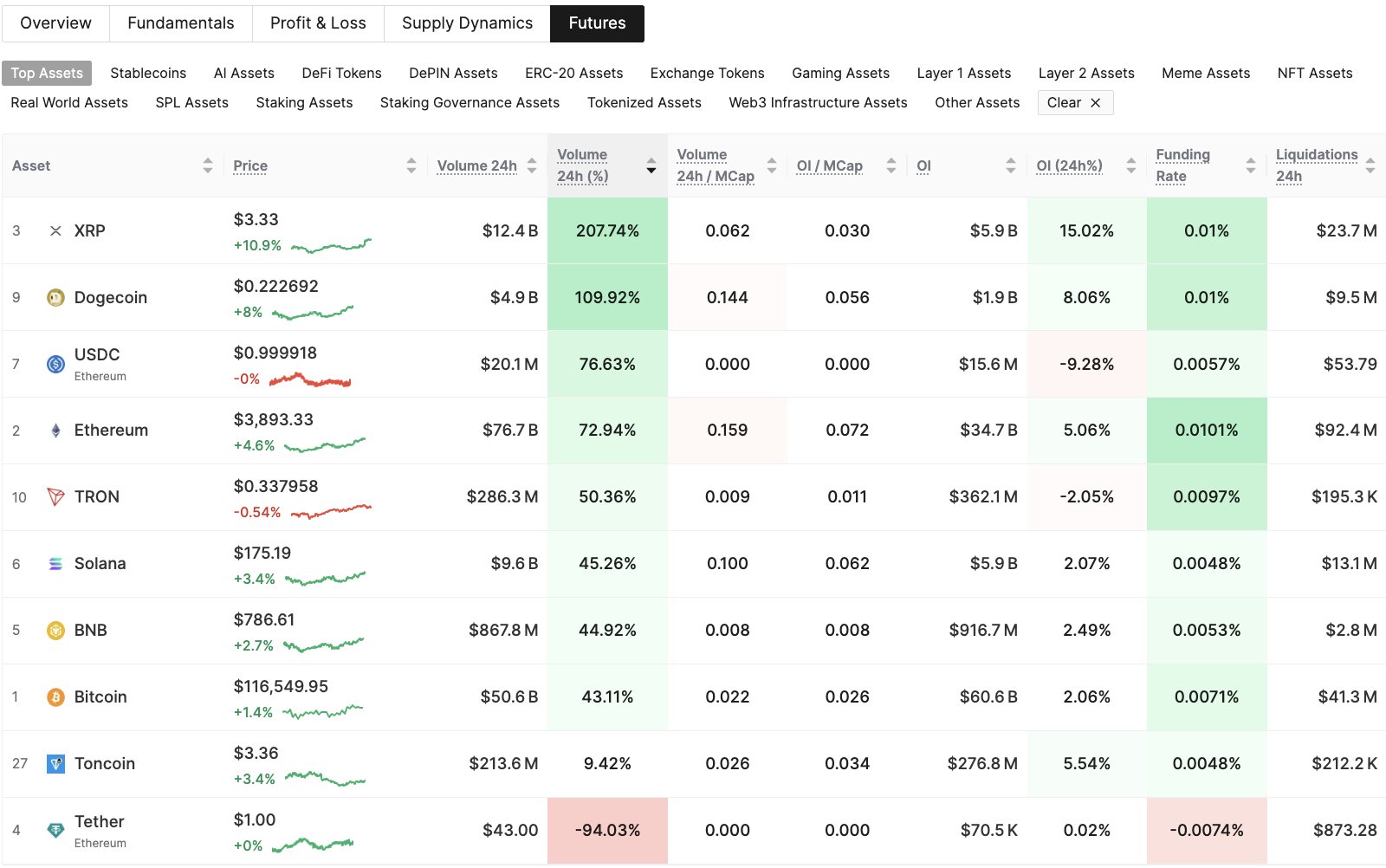

XRP Futures Activity Spikes in the Past 24 Hours: Here’s What It Means for Prices

On-chain leverage activities around XRP spiked in the past 24 hours amid its rally. Are there furthe...

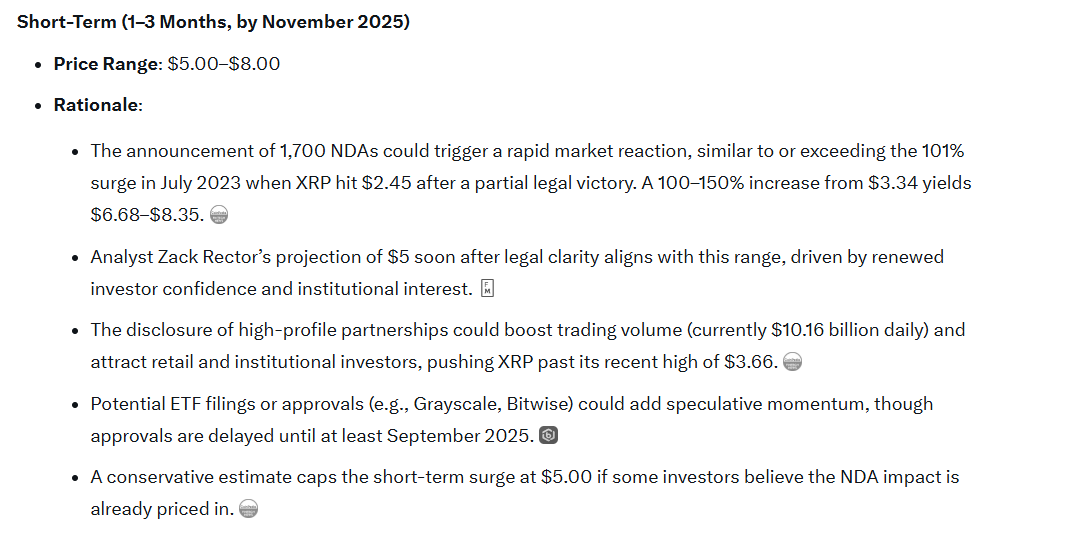

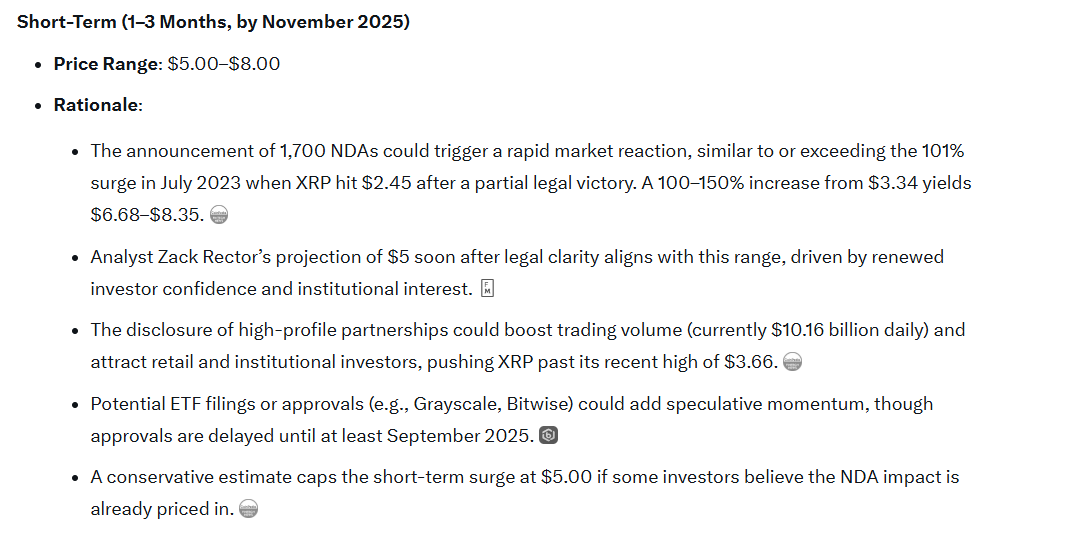

Here’s Where XRP Price Could Go if Ripple Reveals All 1,700 Banking Agreements as SEC Case Ends

With the SEC vs. Ripple case now over, some expect Ripple to reveal the content of its 1,700 institu...