Bitcoin Drops Below $118.5K as Fed Decision and Tariff Fears Shake Crypto Market

Bitcoin faced renewed selling pressure on Wednesday, falling 0.45% to $118,446.5 as traders braced for pivotal macroeconomic events.

This drop comes amid heightened caution ahead of the Federal Reserve’s July policy meeting and the looming implementation of steep U.S. tariffs on August 1. Despite a strong July performance, the flagship cryptocurrency remains under pressure due to profit-taking and broader market uncertainty.

The decline follows a stretch of consolidation near the $120,000 level, a psychological resistance zone that prompted selling from long-term holders and institutions. Even Strategy’s historic $2.5 billion Bitcoin acquisition, adding 21,021 BTC, failed to spark a rally, suggesting investor fatigue and risk aversion are taking hold.

Fed Decision and Tariff Jitters Weigh on Sentiment

Investor focus remains fixed on the Federal Reserve’s rate decision, with expectations that the central bank will hold interest rates steady. However, analysts remain divided on the Fed’s longer-term stance amid calls for cuts by President Trump and signs of economic cooling.

Market concerns are further amplified by impending U.S. tariffs ranging from 15% to 50%, set to take effect at the start of August. Although tariffs don’t directly impact crypto prices, they influence global sentiment and contribute to increased volatility across risk assets like Bitcoin.

Meanwhile, the market is also awaiting a White House report that could outline the U.S. government’s Bitcoin holdings and clarify its stance on establishing a strategic Bitcoin reserve.

Altcoins Follow Bitcoin’s RetreatBitcoin’s pullback echoed throughout the broader crypto market. Ethereum , the leading altcoin was one of the assets that made a dip, falling by over 2% to $3,781.5.

This caused a ripple in the altcoin space with some of the major names recording similar drops:

- XRP fell 0.6% to $3.1290

- Solana dropped 2.1%

- Cardano declined 1.6%

- Dogecoin slipped 2.2%

- $TRUMP coin shed 2.6%

With volatility indicators tightening, analysts warn that a significant price move may be imminent as the market awaits the Fed’s outcome and macroeconomic clarity.

Cover image from ChatGPT, chart from Tradingview

Ripple Exec Reveals What Will Drive The XRP Price Value

Ripple Labs Chief Technology Officer, David Schwartz, has offered rare and pointed clarity on what d...

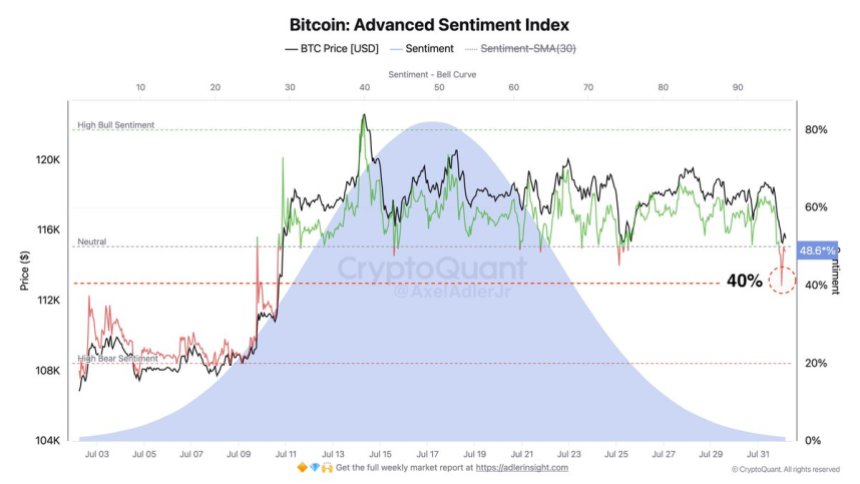

Bitcoin Advanced Sentiment Index Reaches Bearish Levels: Futures Traders Show Caution

Bitcoin has broken down from the two-week consolidation range that held the market between $115,724 ...

SEC Delays Appeal Withdrawal In Ripple Lawsuit, Pro-XRP Lawyer Says Expect To Hear Something In This Timeframe

The Ripple vs. SEC lawsuit appears to be nearing its final stages, but the path is not yet clear. Al...