BNB Price Rockets Past $1,370, Is Another ATH Possible?

The post BNB Price Rockets Past $1,370, Is Another ATH Possible? appeared first on Coinpedia Fintech News

Today’s action in BNB price has been nothing short of electrifying. In the last 24 hours, BNB soared 15.22% to hit $1,355.67, outshining Bitcoin’s modest +3.27% and handily outperforming Ethereum’s steep -21% drop.

This sharp rally is driven by a combination of bullish ecosystem news, technical rebound signals, and Binance’s $283 million user compensation after a wrapped token crash. The market-wide recovery added fuel, thanks to President Trump’s recent statements easing trade war tensions. However, it is undeniable that BNB clearly led the crypto field with unmatched momentum.

Open Interest Surge Big

Diving into the futures data, credits to CoinGlass , BNB’s open interest has rocketed alongside price. Further reflecting intense trader participation and institutional accumulation. Successively, the chart shows open interest climbing to uncharted heights just as spot prices breached the $1,300 mark.

This metric signals leveraged bets building up, which often amplifies volatility but also strengthens the conviction behind the bullish move. In recent times, these spikes in open interest have led to incoming price swings, making this a crucial indicator.

Binance Coin Price Analysis

BNB’s price journey has been dramatic, bouncing back from a flash-crash low near $860 and staging a textbook V-shaped recovery. Two hours ago, it claimed a new all-time high of $1,370.55, and now trades around $1,339.05.

Talking about indicators, the MACD histogram just turned positive, pointing to ongoing bullishness. While BNB has reclaimed key technical levels, above the 23.6% Fibonacci retracement at $1,236 and decisively over the 30-day SMA at $1,066.

That being said, traders have clearly interpreted the deep dip as a golden buying opportunity. If the current steam holds, the next logical target is the 127.2% Fibonacci extension at $1,452.

FAQs

Bullish ecosystem developments, technical rebound signals, and Binance’s $283M user compensation all drove this rally.

While momentum signals remain bullish and open interest is high, rapid price appreciation increases short-term reversal risk.

The critical resistance zone is the $1,452 Fibonacci extension. Sustained momentum above $1,236 and continued bullish technical indicators hint that this level could be tested soon.

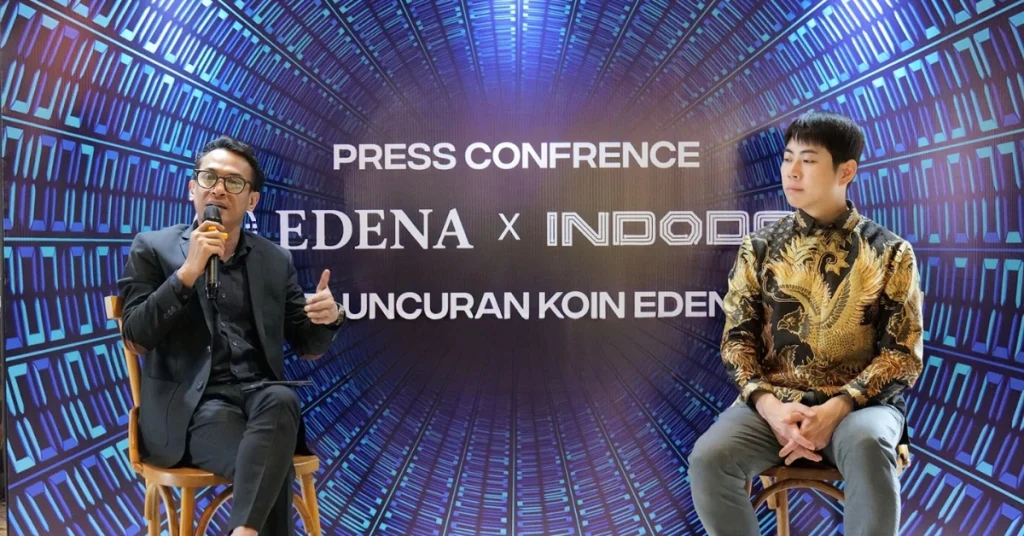

EDENA Token Lists on Indonesia’s Largest Exchange Indodax, Followed by Mobee Exchange

The post EDENA Token Lists on Indonesia’s Largest Exchange Indodax, Followed by Mobee Exchange appea...

Michael Saylor’s Strategy Buys 220 BTC Amid Crypto Market Dip, Holdings Hit $79B

The post Michael Saylor’s Strategy Buys 220 BTC Amid Crypto Market Dip, Holdings Hit $79B appeared f...

How uTrade’s $UTT Token Builds Sustainable Value in today’s Digital Economy

The post How uTrade’s $UTT Token Builds Sustainable Value in today’s Digital Economy appeared first ...