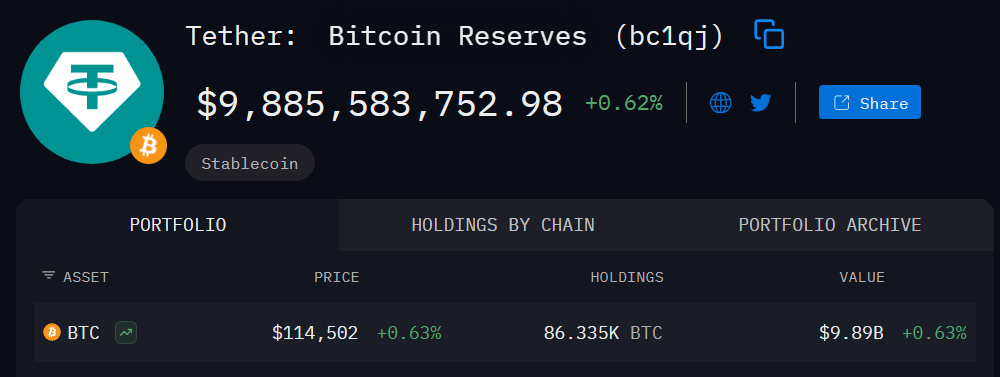

Tether Scoops $1 Billion In Bitcoin, Strengthening $10-B Stockpile

According to Arkham, a wallet labeled “Tether: Bitcoin Reserves” received 8,889 Bitcoin in a single transfer from Bitfinex.

The move added roughly $1 billion to Tether’s holdings and pushed the firm’s Bitcoin stash to about $9.8 billion based on the market price. It was one of the biggest single top-ups to its BTC balance this year.

Quarter-End Buying Pattern

Based on reports, the timing of the buy was not random. Blockchain records show Tether has made similar quarter-end additions in September 2024, December 2024, and March 2025.

Analysts say the pattern points to a deliberate effort to bolster reserves ahead of public attestations. Tether’s second-quarter attestation listed close to $9 billion in Bitcoin.

The next official report is expected in late October and will show whether recent purchases are reflected on paper.

A One-Time Transfer And Wider Moves

The transfer from Bitfinex highlights close ties between the exchange and the company behind USDT. Activity like this has drawn attention because of the size and the source.

In June, Tether also routed roughly $1.4 billion worth of BTC to Twenty One Capital, which is run by CEO Jack Mallers. That deal fed talk that Tether might reallocate some reserves into other assets, including gold, but CEO Paolo Ardoino pushed back on those claims and said Bitcoin remains central to the company’s plan.

US Push And New Stablecoin

US Push And New Stablecoin

Tether is also expanding in the US. The firm has set up a domestic branch led by Bo Hines, who previously advised the White House on crypto policy.

Reports say Tether is planning a federally compliant stablecoin called USAT as part of that effort. The move suggests the company wants a bigger foothold inside US regulatory frameworks while keeping its global operations intact.

USDT Growth And Market RoleCrypto trackers show USDT’s circulating supply at roughly $175 billion, a 10% rise over the last quarter. That growth underscores the stablecoin’s role as a go-to dollar proxy for traders and DeFi users. With more USDT in circulation, exchanges and liquidity pools rely on it heavily during sharp market moves.

Reserves And Market SignalsLarger Bitcoin holdings and a push into the US raise fresh questions. Attestations are meant to build confidence, but critics still press for clearer transparency on how reserves are managed.

Markets will be watching the late-October report closely. If Tether’s filings match on-chain activity, that could calm some concerns. If they do not, scrutiny is likely to grow.

Featured image from Unsplash, chart from TradingView

XRP Flips Green For First Time Since 2017, Pundit Predicts 500% Rally

Crypto pundit Mikybull Crypto has revealed that XRP has flipped green for the first time since 2017....

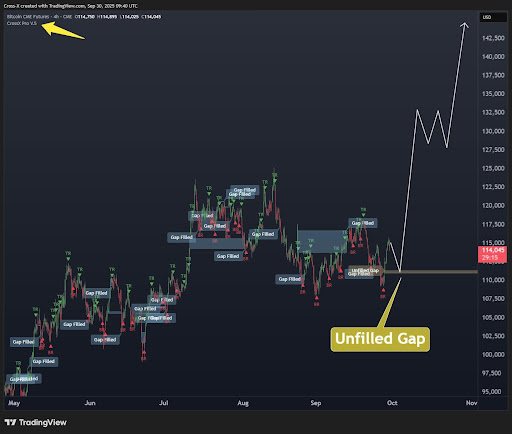

Bitcoin Bulls Eye $117,000, But CME Gap Closure Could Delay The Breakout

The recent technical picture for Bitcoin presents a tug-of-war between short-term momentum and macro...

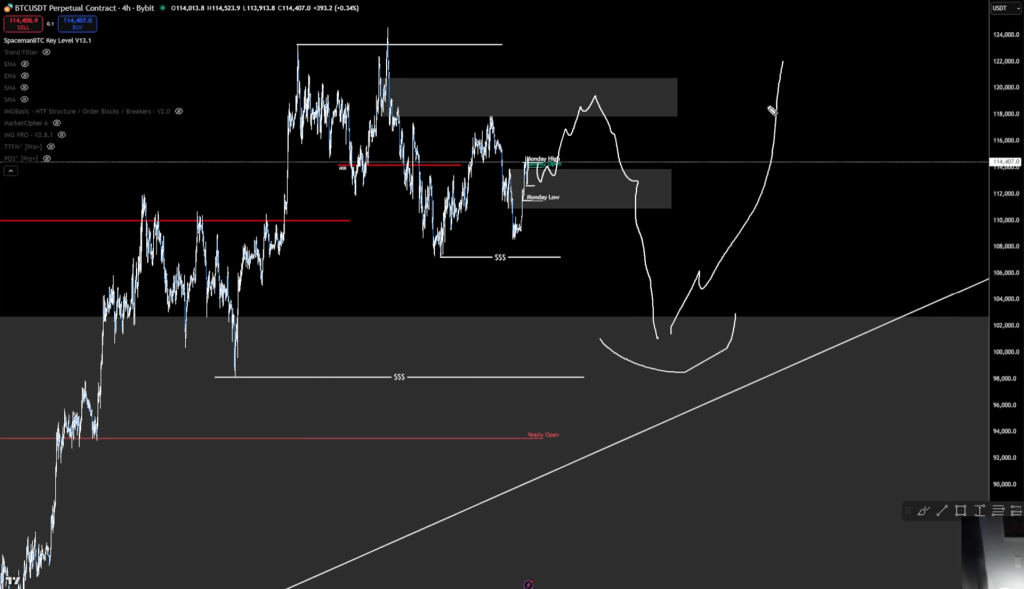

Did Bitcoin Top? Top Trader Warns Of Brutal $98,000 Liquidity Sweep

Crypto analyst Trader Mayne is cautioning that Bitcoin may be setting up for a sharper drawdown befo...