With SEC Easing ETF Paths, Uptober Could Be Altcoin Launchpad — Top Picks Inside

The latest decisions from the SEC have made it easier for new funds to enter the market. This change is expected to benefit many digital coins beyond Bitcoin. As October begins, investors and traders are searching for the tokens most likely to surge. The top choices for potential growth may surprise many in the coming weeks.

Ethereum’s Next Leap: Why the Smart Contract Giant Still Shines

Ethereum began as Vitalik Buterin’s bold idea in 2013 and went live in 2015. It lets anyone write tiny bits of self-running code called smart contracts, and thousands of apps now sit on top of it, from games to big money markets. In 2022 the network moved from energy-heavy mining to clean staking, rewarding users who lock coins to keep the chain safe. Extra layers like Arbitrum and Polygon make trades quick and cheap, while the coming sharding step should cut costs even more. Every move still needs ETH, giving the coin a steady, built-in role.

Market watchers see fresh fuel ahead. Bitcoin’s halving next year often pulls the whole space higher, and Ethereum usually outruns most rivals once momentum starts. Based on past cycles, the forecast puts ETH in a $2,700–$6,580 range for 2025, climbing roughly each year to around $18,500 by 2030. Steady staking rewards, rising use of ERC-20 tokens, and growth on Layer 2s add extra push. While newer chains promise speed, few match Ethereum’s deep pool of apps and developers, so many traders view dips under $3,000 as a long-term chance rather than a threat.

UNI Rise: Why Uniswap’s Voice Token Could Lead the Next DeFi Wave

Uniswap changed online trading in 2018 by letting people swap coins without giving up control of their wallets. In 2020 it added UNI, a coin that acts like a vote. Owners pick rules for fees, rewards, and new tools. The team dropped 150 million UNI on early users to beat a new rival, SushiSwap. Each early user woke up to 400 UNI, worth more than $1,000 on day one. That gift won quick loyalty and put UNI on the map.

Today Uniswap ranks fourth in all of decentralized finance with over $3 billion locked. Its open code, free listings, and no order book model keep costs low and access wide. Many traders now prefer self-custody after last year’s big exchange failures, and that trend lifts UNI demand. While Bitcoin and Ethereum still set the tone, fresh cash often flows next into tokens that give real use. UNI ticks that box by turning holders into voters. If online finance heats up in this cycle, UNI could move from backstage to spotlight.

Undervalued $XYZ Meme Coin Gears Up for Listing on a Major CEX

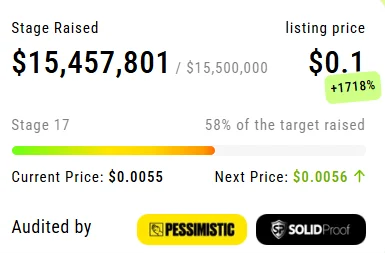

XYZVerse ($XYZ) is the meme coin that has grabbed headlines with its ambitious claim of rising from $0.0001 to $0.1 during a presale phase.

So far, it has gone halfway, raising over $15 million, and the price of the $XYZ token currently stands at $0.0055 .

At the next stage of the presale, the $XYZ token value will further rise to $0.0056 , meaning that early investors have the chance to secure a bigger discount.

Following the presale, $XYZ will be listed on major centralized and decentralized exchanges. The team has not disclosed the details yet, but they have put a teaser for a big launch.

Born for Fighters, Built for Champions

XYZVerse is building a community for those hungry for big profits in crypto — the relentless, the ambitious, the ones aiming for dominance. This is a coin for true fighters — a mindset that resonates with athletes and sports fans alike. $XYZ is the token for thrill-seekers chasing the next big meme coin.

Central to the XYZVerse story is XYZepe — a fighter in the meme coin arena, battling to climb the charts and make it to the top on CoinMarketCap. Will it become the next DOGE or SHIB? Time will tell.

Community-First Vibes

In XYZVerse, the community runs the show. Active participants earn hefty rewards, and the team has allocated a massive 10% of the total token supply — around 10 billion $XYZ — for airdrops, making it one of the largest airdrops on record.

Backed by solid tokenomics, strategic CEX and DEX listings, and regular token burns, $XYZ is built for a championship run. Every move is designed to boost momentum, drive price growth, and rally a loyal community that knows this could be the start of something legendary.

Airdrops, Rewards, and More — Join XYZVerse to Unlock All the Benefits

Avalanche Surge: Why AVAX Is Racing Ahead in Crypto’s New Season

Avalanche, or AVAX, runs on its own eco-friendly network. It moves fast, settling deals in under two seconds and handling roughly 4,500 moves every second. Tiny fees keep wallets happy. The system has three linked chains that split up jobs like payments, apps, and record keeping. Users can even launch private “Subnets,” building their own mini blockchains without slowing the main road. A special mix of voting rules, borrowed from both old and new ideas, keeps everything safe. The AVAX coin powers it all, paying fees, rewarding stakers, and booting up new Subnets.

The market is waking up after a sleepy year, and fast chains are in style. While Bitcoin steals headlines, fresh money often rolls next into smart-contract coins. Ethereum still feels crowded and costly, and rivals like Solana have faced stops and starts. Avalanche keeps ticking, offering speed with no drama. Big brands are testing gaming and asset projects on Subnets, a hint of growing demand. Staking also locks up many coins, squeezing supply. Recent analysis from crypto research firms, including platforms like cryptona , suggests AVAX could see significant momentum as institutional interest in high-performance blockchain solutions grows. If the cycle keeps heating, these points could lift AVAX higher. For traders eyeing the next sprint, Avalanche looks ready out of the blocks.

NEAR: A Fast, Friendly Home for the Next Wave of Web Apps

NEAR is a fresh network that wants to make building open apps as easy as using a website. It breaks its workload into small pieces, a trick called sharding, so many users can join at once without slowdowns. The core plan came from Alex Skidanov and Illia Polosukhin, and big investors gave them over $20 million to grow it. Tools such as Nightshade, the Rainbow Bridge, and Aurora link NEAR to Ethereum and cut fees, letting tokens move freely between the two worlds.

Market watchers love speed and low cost, so NEAR fits the story of this cycle. While some older chains struggle when traffic spikes, NEAR stays smooth because each shard runs in parallel. That gives it a feel more like cloud storage than a scattered ledger. If the next wave of apps needs quick finality and cheap transfers, NEAR could capture attention much like Solana did last year. Prices still swing with Bitcoin’s mood, yet growing use and bridges to Ethereum hint that the coin may have room to climb.

Conclusion

ETH, UNI, AVAX, and NEAR look strong in the 2025 bull run. Yet XYZVerse (XYZ) fuses meme buzz with sports passion, giving early joiners a community-led, GameFi growth path.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/ , https://t.me/xyzverse

BlockDAG Is Already One of 2025’s Fastest-Growing Cryptos With $416M+ Presale & BWT Alpine Formula 1® Team Deal

Discover why BlockDAG is racing ahead: $416M+ raised, 26.5B coins sold, 3M miners, and a historic Al...

Polygon Labs Partners with Immutable to Roll Out Dedicated Web3 Gaming Hub

Immutable and Polygon Labs partner to launch a new “Gaming on Polygon” hub inside Immutable Play, br...

Is MoonBull the Next Big Crypto in Chicago? Explosive Presale Surges Ahead as Polkadot and Monero Make Waves

The next big crypto in Chicago 2025 with 100x potential? Compare MoonBull, Polkadot, and Monero, wit...