Digitap Vs Remittix: Who Wins The $1 Trillion Global Payments Market?

Global payments are entering a new era. The remote work boom, digital-first business models, and increasing globalization have pushed international money transfers into a secular bull market. Cross-border payments alone are expected to reach $290 trillion by 2030 , and demand for remittances continues to go up-only. Markets are screaming for cheaper, faster, and more transparent payment networks—and the providers that meet these needs will print. Two names are emerging in this race: Remittix and Digitap ($TAP) . Both are building solutions to redefine how value moves across borders. Remittix offers a crypto-to-fiat payment network designed for bank account transfers, while Digitap is building the world’s first omni-bank—an app that fuses fiat and crypto into a single platform.

Who will win the $1 trillion global payment? Here’s everything investors need to know.

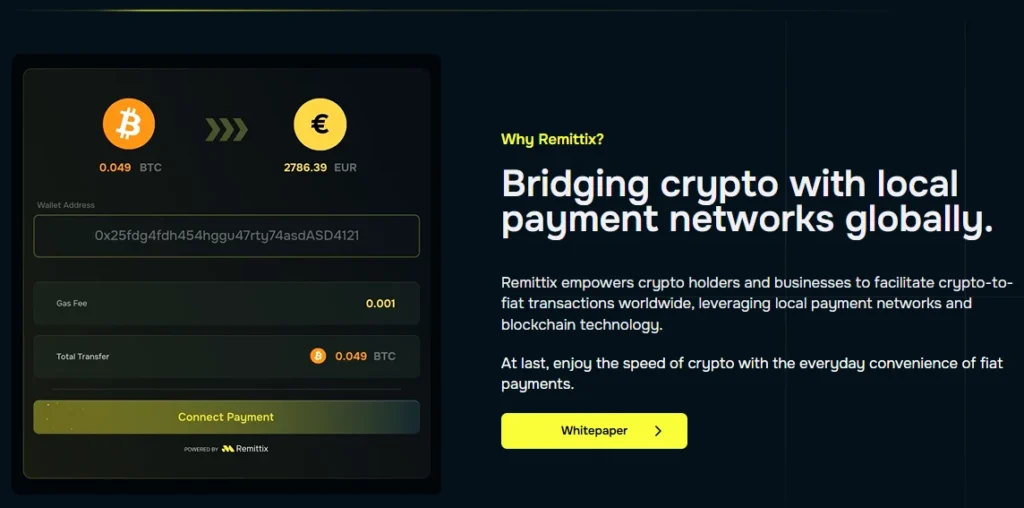

Remittix: A Niche Play in Remittances

Remittix is a bridge between crypto and traditional banking. It allows individuals and businesses to pay in crypto, which is then settled into fiat at bank accounts. For freelancers, small businesses, and families, this is a superior payment rail versus traditional wires. It is a simple product addressing a simple need. The hundreds of billions dollars remittance market has been plagued by inefficiency, with average fees topping 6.2% percent globally. Remittix aims to cut costs and speed up settlement by leveraging crypto rails in the background.

But the network is narrow in scope. It is built primarily for one function—payments into bank accounts—and lacks the broader ecosystem that creates a stickier user base. It is a solution for a pain point, but not yet a platform for a financial future.

Digitap: The Omni-Bank Advantage

Digitap takes the concept several steps further. Instead of offering a single narrow use case, it collapses the barriers between fiat and crypto into a unified omni-bank. Users can deposit, withdraw, exchange, transfer, and pay from one interface. Available on iOS, Android, and desktop today.

The key difference is in the architecture. Digitap employs a multi-rail system connecting traditional networks (SWIFT, SEPA, ACH) and blockchain rails. All transactions are optimized by the AI routing engine, which identifies the most cost-effective and efficient channel for each transfer.

Where Remittix sends crypto into bank accounts, Digitap gives users full control over how money moves—whether into a bank account, a crypto wallet, a merchant checkout, or an Apple Pay tap, thanks to its Visa-card integration. Anyone can now create a virtual card, and even better, it does not require KYC.

This flexibility makes Digitap much more than a remittance tool. It is a full-scale banking replacement. It is designed for consumers, freelancers, enterprises, and institutions alike. In a world where money is expected to move like information—instant, borderless, and frictionless —Digitap’s model is simply more advanced.

Why Digitap Wins the Global Payments Bull Run

The bigger picture matters. Global payments are not just growing; they are changing in nature. Consumers want on-demand payments more than anything, and in the global payments game, speed is king. And most users don’t understand the size of these markets.

Digital payments are set to exceed $33.5 trillion by 2030

, and crypto payments could grow 10X in the same window.

This is not a small shift—the entire global financial plumbing is being rewired. Remittix addresses one segment of that growth: the conversion of crypto into fiat at bank endpoints. Digitap sits across the entire flow.

Its omni-bank model makes all money, crypto, fiat, and stablecoins interoperable and spendable anywhere. Scope always matters, and in the same way that Solana became the hub for high-speed trading, Digitap is positioning itself as the hub for global payments.

Best Altcoins to Buy Now: Why Digitap Outpaces Remittix in the Payments Race

The global payments market is entering a secular boom, driven by globalization, remote work, and the rise of digital-first commerce. Both Remittix and Digitap see the opportunity, but their approaches are very different. Remittix offers a functional payments bridge. Digitap offers a full-spectrum omni-bank.

With more than 21 million $TAP tokens sold at $0.0125 and the next stage climbing to $0.0159, it is clear investors are feeling FOMO. Digitap is increasingly looking like one of the best altcoins to buy now.

Its architecture is more advanced, its tokenomics accrue value better, and its ecosystem is more comprehensive. In the trillion-dollar global payments bull run, Digitap is positioned not just to participate but to lead.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Bitcoin Falls Under $110K, but DNSBTC Best Free Cloud Mining Helps Users Make Money in BTC, LTC, and DOGE Without Risk

As Bitcoin dips below $110K, DNSBTC miners earn steady daily returns with free $60 bonus, eco-friend...

Why BlockDAG Leads Among the Best Crypto Presales of 2025 as Bitcoin Hyper, Jet Bolt & BFX Trail Behind!

Discover the top crypto presales of 2025. Compare BlockDAG, Bitcoin Hyper, Jet Bolt, and BlockchainF...

Bitcoin Price Forecast 2025: Can BTC Break $120K as Analysts Point to This Top Crypto Presale for Huge ROI?

Bitcoin consolidates near $111K with forecasts up to $145K, while BlockchainFX presale offers 100x R...