Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million

The post Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million appeared first on Coinpedia Fintech News

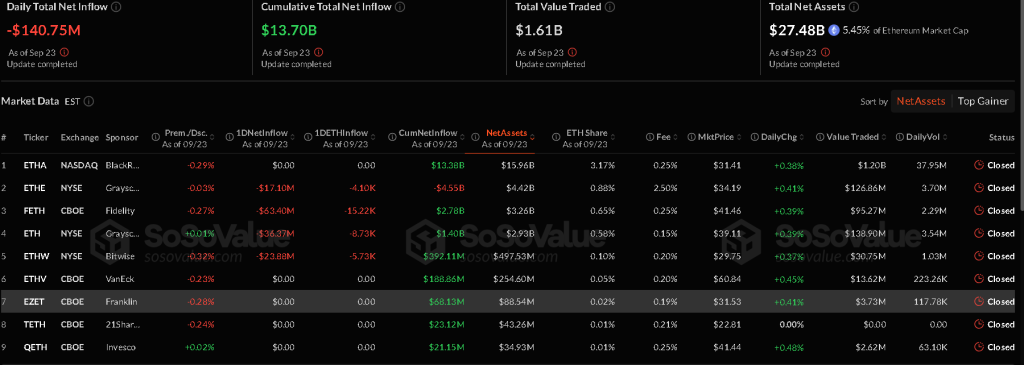

On September 23, both spot Bitcoin and Ethereum ETFs recorded a second straight day of net outflows. Data from SoSoValue shows Bitcoin ETFs lost $103.61 million, while Ethereum ETFs saw outflows of $140.75 million.

Bitcoin ETF Breakdown

Bitcoin ETF s posted a total outflow of $103.61 million. Fidelity’s FBTC led withdrawals at $75.56 million. Ark & 21Shares’ ARKB followed with $27.85 million, and Bitwise’s BITB shed $12.76 million.

Only two products managed to attract inflows. Invesco’s BTCO added $10.02 million, while BlackRock’s IBIT brought in $2.54 million.

Trading activity in Bitcoin ETFs reached $3.16 billion, with total net assets of $147.17 billion, representing about 6.6% of Bitcoin’s market cap. This reflected a decline from the prior day.

Ethereum ETF Breakdown

Ethereum ETFs recorded heavier outflows at $140.75 million. Fidelity’s FETH led selling pressure with $63.40 million. Grayscale’s ETH fund withdrew $36.37 million, followed by Bitwise’s ETHW at $23.88 million and Grayscale’s ETHE at $17.10 million.

None of the nine Ethereum ETFs reported inflows. Total trading volume dropped to $1.61 billion, while net assets fell to $27.48 billion, equal to 5.45% of Ethereum’s market cap.

Source: SoSoValue

Market Context

Bitcoin is trading at around $112,348, signalling a 3.4% drop compared to a week ago. Its market cap is also experiencing a dip, and fell to $2.238 trillion today, along with its daily trading volume, which descended to $48.874 billion.

Ethereum is priced at around $4,155.29, with a market cap of $502.099 billion. Its trading volume marked a sharp decrease of $38.585 billion, reflecting a slow market sentiment.

Despite dominating the crypto market, both Bitcoin and Ethereum are showing negative momentum in ETF flows and trading activity. Analysts expect Ethereum to face short-term bearish pressure through late September, while Bitcoin is forecast to stabilize in the $112,000–$119,000 range.

This downturn has led market watchers to label the current pullback “Red September 2025.”

Ethereum Founder Vitalik Buterin Urges Open Systems to Protect Democracy and Privacy

The post Ethereum Founder Vitalik Buterin Urges Open Systems to Protect Democracy and Privacy appear...

Crypto Bull Run Set to Ignite This October 2025?

The post Crypto Bull Run Set to Ignite This October 2025? appeared first on Coinpedia Fintech NewsA...

Bitcoin Bear Market Confirmed? Peter Schiff Highlights 20% Gold-Based Loss

The post Bitcoin Bear Market Confirmed? Peter Schiff Highlights 20% Gold-Based Loss appeared first ...