Citi’s Ethereum Forecast: No New All-Time High Expected, Year-End Target At $4,300

Following an all-time high (ATH) reached last August, Ethereum (ETH), the market’s second-largest cryptocurrency, has found itself in a consolidation phase, trading between $4,200 and $4,700.

This price range reflects a broader stagnation in the cryptocurrency market, as various digital assets, including Bitcoin (BTC), struggle to regain the momentum that led both BTC and ETH reach new records above $124,000 and $4,9000 respectively.

Notably, Citigroup, the third-largest investment bank in the United States, has tempered expectations for the Ethereum price, forecasting a year-end price target of $4,300 for the altcoin.

Citi Forecasts Moderate ETF Inflows Into Ethereum

According to a report by Reuters, Citigroup’s analysis attributes the current demand for Ethereum to burgeoning interest in Ethereum-based applications, including stablecoins and tokenization.

However, the bank cautions that the recent price strength may be more a reflection of market sentiment than underlying fundamentals.

In a note released on Monday, Citi remarked, “Current prices are above activity estimates, potentially driven by recent buying pressure and excitement over use-cases.”

Ethereum’s appeal has grown among investors looking for more than just price appreciation. Analysts forecast increased price growth for the altcoin due to the recent passage of bills, including the GENIUS Act, which aims to provide a new framework for stablecoins, as well as the surge in interest in tokenization.

Despite these developments, Citigroup predicts that the inflow of exchange-traded funds (ETFs) into Ethereum will be less robust compared to Bitcoin. In contrast, Standard Chartered has recently revised its year-end target for Ethereum significantly upward, from $4,000 to $7,500.

Bearish And Bullish Scenarios For ETH

This adjustment reflects stronger engagement within the industry and increasing corporate investments. The bank anticipates that the stablecoin sector could grow eightfold by 2028, which would likely drive up Ethereum network fees and demand.

Citi also presented a more optimistic bull case, projecting a potential price of $6,400 if activity and adoption of Ethereum-based applications continue to rise. This would represent a major 42% uptrend ahead for the leading altcoin.

Conversely, the bank outlined a bearish scenario in which the Ethereum price would drop to $2,200 in the event of a macroeconomic downturn or a decline in the equity market. If this scenario plays out, it could spell major trouble for bulls, as it would represent a 50% drop from current levels.

Interestingly, a recent report from Sygnum, a digital asset bank, has painted a more favorable outlook for Ethereum. The bank highlights Ethereum’s upgrades and increasing institutional interest as significant factors that could position ETH to benefit from anticipated trends in stablecoin issuance and broader adoption.

Furthermore, the digital asset bank highlighted that as liquid Ethereum reserves on exchanges diminish and demand intensifies, the possibility of a supply squeeze arises, potentially sending the altcoin into a new leg up to retest all-time high levels.

As of this writing, ETH is trading at $4,480, which is up 5% on the weekly time frame. Compared to record prices, the altcoin is trading nearly 10% below all-time high levels.

Featured image from DALL-E, chart from TradingView.com

Zinsschock oder Kursexplosion? Bitcoin vor der Entscheidung

Der Markt wartet gespannt auf die Zinsentscheidung der US-Notenbank. Im Vorfeld zeigt Bitcoin eine a...

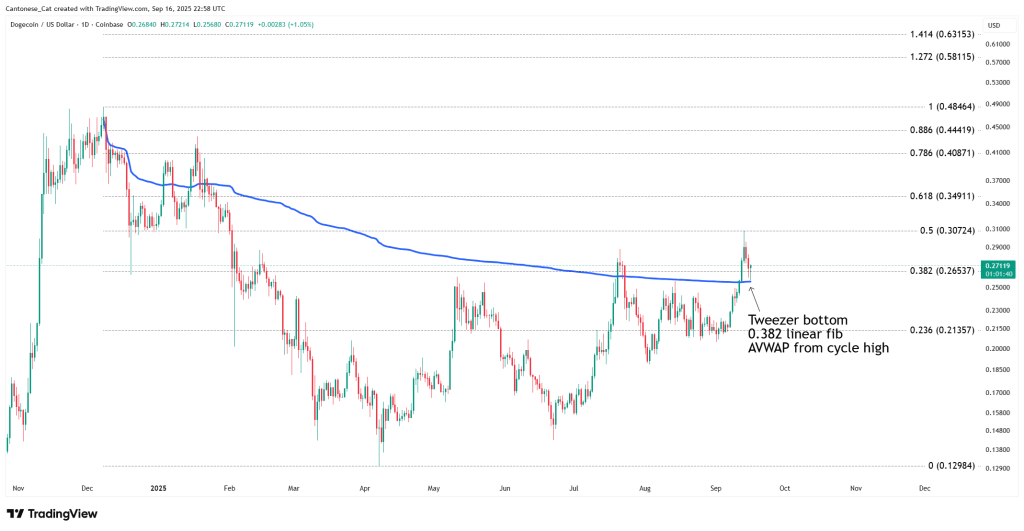

Is The Dogecoin Bottom In? Confluence Of Signals Says Yes

The Dogecoin daily chart is clustering several classical support signals around $0.256–$0.265, as hi...

Dogecoin Price Eyes 1,250% Surge To $3.5 – Here’s The Roadmap

The Dogecoin price recorded one of the most notable recoveries over the weekend, rising by more than...