Ethereum Bulls Target $8,500 With Big Money Backing The Move – Details

Ethereum rallied again this week as fresh institutional demand and heavy ETF inflows pushed traders to consider higher price paths.

According to market reports, some analysts now see a possible run toward $8,500 if current buying continues and macro conditions remain calm.

Institutional Flows Drive Interest

Based on reports, one day of ETF inflows was reported at close to $730 million, a figure that traders said helped limit selling pressure and lift market confidence.

Standard Chartered has been cited with a year-end forecast of $7,500, while other market commentators and smaller research groups have floated targets as high as $8,500.

That mix of big-name bank views and crypto-focused analysis is what is feeding the talk on an extended rally.

After meeting the $4,811.71 target, prices of $ETH (Ethereum) pulled back but bull signal(s) have confirmed, suggesting movement back to and above this target level!

With a break above this target, we could see an additional +77% run to $8,557.68… https://t.co/sDDNVSijoi pic.twitter.com/4uPpJHDsgS

— JAVON

MARKS (@JavonTM1) September 15, 2025

Technical Levels And On-Chain Signals

Reports have disclosed technical setups that traders are watching closely. A pivot point near $4,811 was named by some analysts as the level that needs to clear for a larger advance to become more likely.

Ethereum’s recent trading band has been roughly in the $4,400–$4,600 range in many charts, which means significant upside would be required to reach the lofty targets being discussed.

What Would Need To Happen For $8,500According to market commentary, several things would have to line up. Continued ETF inflows and steady institutional accumulation are key. Also important are clearer rules for ETF products and a soft macro backdrop that keeps risk appetite intact.

Some analysts add that if Bitcoin moves higher — a move to roughly $150,000 has been used in scenarios — Ethereum could gain as investors reallocate across major crypto assets.

Risks That Would Halt The Rally

Risks That Would Halt The Rally

News cautions that the $8,500 concept is built on several positive developments occurring simultaneously. Policy shifts, softer ETF demand, or a change in macro sentiment might also stop a rally in a hurry.

Unless Layer 2 growth or network usage equates to increased mainnet demand, price appreciation may be capped. Regulation news in big markets also reverses flows rapidly.

Meanwhile, forecasts span a broad range. Standard Chartered’s $7,500 view is on the higher side among big banks. Other companies provide more modest estimates, and smaller analysts suggest more bullish estimates up to $8,500.

The disparity highlights the extent to which price targets are reliant on assumptions regarding flows, adoption, and macro considerations.

Featured image from Meta, chart from TradingView

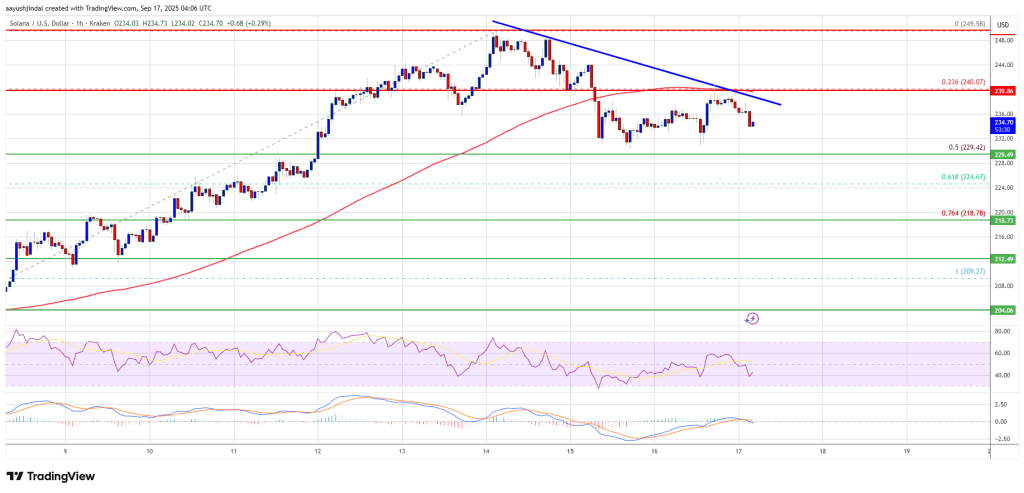

Solana (SOL) Holds Recent Gains – Key Levels Before Another Surge

Solana started a fresh increase above the $240 zone. SOL price is now consolidating gains below $240...

‘It’s Hyperliquid Moment,’ Circle States, Seizing HYPE’s 1,500% Surge With New Investment

Circle Internet Financial (CRCL), the firm behind the USDC stablecoin, has announced a significant i...

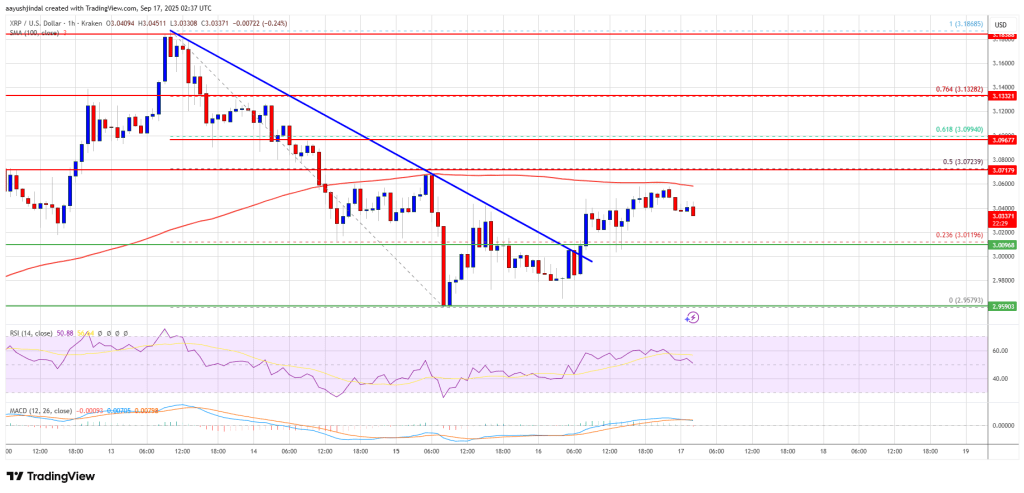

XRP Price Reclaims $3 – Bulls Struggle to Build on Gains

XRP price started a downside correction below the $3.050 resistance. The price is now recovering los...