American Bitcoin, Backed By Trump, Ends Nasdaq Debut Up 17%

American Bitcoin, a mining company tied to US President Donald Trump’s sons Eric and Donald Trump Jr ., wrapped up its first day of trading on the Nasdaq with sharp swings but still managed to finish 16.75% higher at just over $8. After-hours trading pushed the stock up another 6% to $8.50, reports confirmed.

Wild Price Swings On First Day

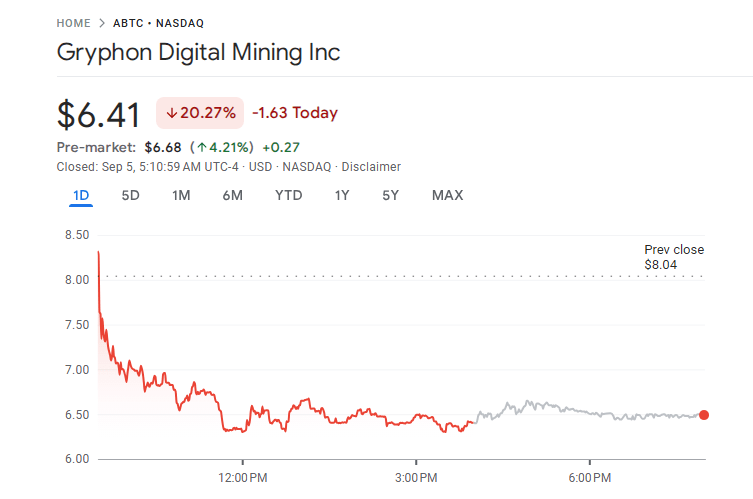

Trading opened with a rush. The newly rebranded company, formed through a merger with Gryphon Digital Mining (GRYP), jumped as high as $13.21 from Gryphon’s previous close of $6.90, a 90% surge.

That early momentum collapsed quickly, sending the stock down to $6.70 in the afternoon before it recovered part of the loss. Nasdaq halted trading five times due to extreme volatility.

Despite the erratic moves, Bloomberg estimated Eric Trump’s 7.5% stake at roughly $548 million by the end of the session. His fortune is now tied directly to how American Bitcoin performs in the market.

Dual Strategy Of Mining And Buying

According to Eric Trump, the company will not only mine Bitcoin but also buy it when conditions make more sense. He described the approach as switching “to whichever is better at the time.”

The company’s existing treasury already holds 2,443 BTC, making it the 25th-largest stash among public companies. With Bitcoin trading above $112,000, that holding is worth about $275 million.

Eric Trump emphasized that the business will aim to maximize shareholder value by balancing mining output and market purchases:

“We’re going to harness daily mining to the fullest, but we can also go out and purchase Bitcoin to support the treasury,” the presidential son said.

Political Undertones And A Second Venture

Political Undertones And A Second Venture

The launch has stirred questions about whether American Bitcoin benefits from President Trump’s crypto-friendly stance.

Eric Trump dismissed criticism that his family is profiting directly from political ties, saying his father has “nothing to do with this business.”

The American Bitcoin debut came just days after another Trump-linked venture. Tokens for World Liberty Financial (WLFI), a separate crypto project involving President Trump and his sons, were listed on exchanges earlier in the week.

WLFI’s performance has so far been weak, dropping 30% from its debut price and losing another 7% in the last 24 hours to about 21 cents, based on CoinMarketCap data. A company tied to the Trumps owns nearly a quarter of all WLFI tokens, estimated at $4.6 billion in value.

While WLFI struggles to gain traction, American Bitcoin’s opening has given the Trump family another high-profile position in the crypto sector.

Whether the stock can maintain its momentum after a chaotic debut remains uncertain, but Eric Trump called the launch “an unbelievable day” and insisted “the floodgates are just starting to open.”

Featured image from Meta, chart from TradingView

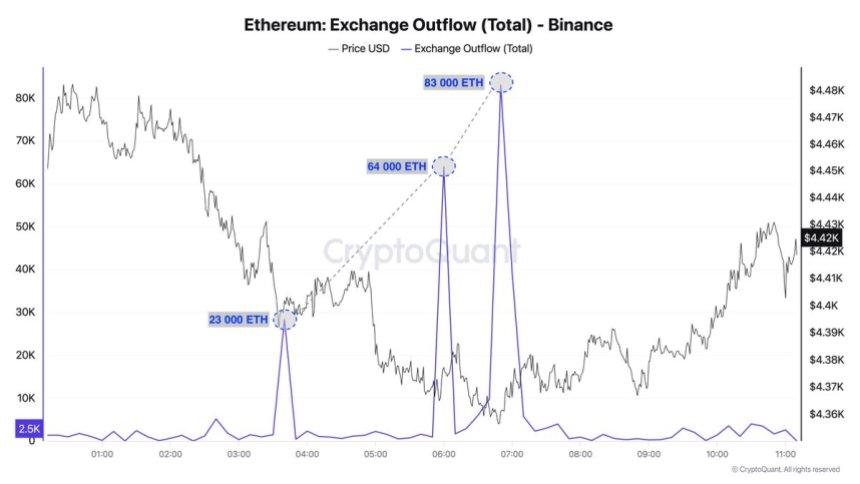

Binance Sees Massive Ethereum Whale Outflows: Demand Remains Strong

Ethereum has entered a consolidation phase after losing the $4,500 level, now trading within a tight...

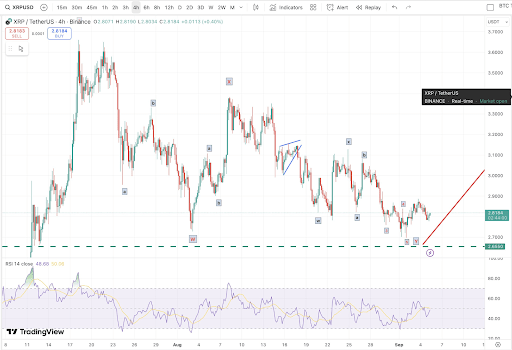

Analyst Predicts The XRP Price If 10% Of Global Assets Are Tokenized

Crypto analyst Costa has made an ultra-bullish prediction for the XRP price, stating that it could r...

First US Dogecoin ETF Could Debut Next Week—How Will It Impact Price?

The first US exchange-traded fund offering exposure to Dogecoin (DOGE) could debut as soon as next w...