Don’t Fall Into Bear Trap – Here’s The Best Cryptocurrency to Stack During Quiet Periods On Market

Market downturns can test patience and shake confidence. However, calm stretches can also bring rare chances for savvy moves. With old habits, many miss hidden gems forming beneath the surface. One digital coin stands out as a smart stash while noise stays low. Uncover why this asset may lead the next uptrend when excitement returns.

Ethena (ENA)

Source: TradingView

ENA fell 16.54% in the last 7 days yet still stands 25.19% higher than a month ago and 40.10% up over 6 months. The token now trades between $0.64 and $0.82 as short term traders digest last month’s rally. Volatility has compressed, hinting that a decisive move is coming.

Price sits almost on top of both the 10-day SMA of $0.65 and the 100-day SMA of $0.67. RSI at 47.6 and stochastic at 41.39 show neither overbought nor oversold pressure. MACD is just below zero, so momentum has paused but not broken. Charts point to a neutral coil rather than a clear trend.

If buyers clear the nearest ceiling at $0.92, attention flips to $1.10, roughly 30% above the upper trade band. That breakout would put a fresh high on the table. Failure to rally could dump price toward support at $0.57, with a deeper slide to $0.39 trimming about 40% from current levels. Right now ENA waits for a catalyst.

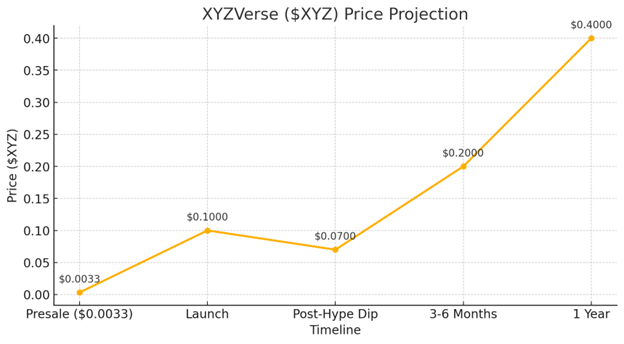

Price Prediction for XYZVerse ($XYZ): Is a 30x Jump Possible?

XYZVerse has entered the meme coin market at a time when community-driven tokens continue to dominate speculative trading. The rise of meme coins like PEPE , Dogwifhat , and Bonk proves that strong branding, viral marketing, and community engagement can drive massive gains.

The broader market sentiment also plays a key role in XYZVerse’s potential. As the altcoin season is about to start, lower-cap meme coins are seeing increased investor interest. Given that XYZVerse is still in presale, it could benefit from this wave if it secures strategic exchange listings and maintains community hype post-launch.

Key Strengths of XYZVerse in the Current Market:

- Strong branding with sports and influencer partnerships, broadening its appeal

- Deflationary mechanics (17.13% token burn) to reduce supply pressure

- Liquidity allocation (15%) to support stability after launch

- Community incentives (10%) fostering engagement and holding

Price Prediction for $XYZ

- Current Presale Price: $0.005

- Projected Post-Presale Target: $0.10 (as per project’s estimates)

- Potential ATH (First 1-2 Weeks Post-Launch): $0.15 – $0.25 (if demand surges and listings drive FOMO)

- Long-Term Potential (6-12 Months): $0.20 – $0.40 (if the project secures major partnerships and listings)

Buy $XYZ Early for Maximum Gains

Realistic Expectations: Will XYZ Hit $0.10?

A 30x jump from presale to $0.10 is possible but depends on:

- Strong Exchange Listings – If XYZVerse lands on major CEX platforms like KuCoin, OKX, or Binance, its price could skyrocket on launch day.

- Sustained Community Growth – Meme coins need viral momentum. If XYZVerse delivers on its sports influencer partnerships, it could drive massive social media engagement.

- Market Conditions – If Bitcoin and altcoins remain bullish, speculation-driven assets like XYZVerse tend to benefit.

Is a 3000% Surge Possible for $XYZ?

XYZVerse has the ingredients for a strong launch, but its long-term success depends on execution. If the team delivers strong marketing, high-profile listings, and real community engagement, the $0.10+ target, which is around 3000% from the current price, could be achievable.

Invest in $XYZ Before It Surges

Bonk (BONK)

Source: TradingView

Like many memecoins , BONK keeps traders guessing. The meme coin slid 19.72% in the last 7 days and 36.39% over 30 days, yet it still sits 43.33% higher than 6 months ago. With a current band of $0.0000215163-$0.0000273613, price hovers around both the 10-day SMA at $0.0000222222 and the 100-day SMA at $0.0000226313.

Momentum signals are flat. RSI sits at 50.33, Stochastic at 57.58, and MACD inches above zero. That mix hints at a pause rather than panic. The nearest support rests at $0.0000192096, about 12% below the midpoint of the range. A deeper floor lies at $0.0000133646, nearly 44% underneath.

If buyers return, the chart points first to $0.0000308996. Hitting that mark would mean a 25% jump from $0.0000245, the center of today’s range. A stronger surge could carry BONK to $0.0000367446, a potential 50% climb. Failure to clear the first ceiling risks a slide back to support, trimming roughly 20%. With mixed indicators and tight averages, traders will watch for a break of either boundary to pick the next move.

Raydium (RAY)

Source: TradingView

RAY slipped about 11.22 percent in the last seven days, moving inside 2.99 to 4.12. The month view is brighter with a 3.85 percent lift. Over six months the token still shows a hefty 21.91 percent slide. The 10 day and 100 day moving lines sit together near 3.35, showing price balance after a long sell off.

Buyers need a clear push above 4.68, the closest ceiling. That would open a path toward 5.80, roughly 40 percent above the current top of the daily range. If bulls fail and 2.43 gives way the chart points to 1.31, a fall near 50 percent from here. The RSI at 58 and Stoch at 73 hint that momentum favors a try at higher ground before any deep drop.

With averages tight and the main momentum gauge sitting slightly positive, short term action could grind upward. A rally back to 4.68 would mean a 15 to 20 percent gain from the midpoint; a decisive break could add another 20 percent toward 5.80. Losing 3.00 would flip the tone fast and raise odds of a 20 to 25 percent slide to 2.43. For now the range rules with a mild bull bias

Sei (SEI)

Source: TradingView

SEI spent the week under pressure. The token slid about 15% in 7 days and 14.88% in 30 days. Yet it still sits 19.30% above where it was 6 months ago. Price is trapped between $0.31 and $0.37, hugging the 10-day and 100-day averages at $0.31-$0.32. An RSI near 47 and a mild negative MACD signal hint at neutral momentum rather than panic.

Traders are eyeing $0.27 as the nearest floor. A dip that far would mean another 20% fall from $0.34. If bears push harder, $0.20 comes into view, a slide of roughly 40%. On the upside, $0.40 caps the range. A clean break above it would mark an 18% jump. Beyond that, $0.46 stands as the next barrier, implying a 35% climb from current levels.

The mixed data suggests a coil before the next move. Short-term sentiment leans cautious, but the positive 6-month chart keeps bulls interested. A bounce toward $0.40 looks possible if buyers appear near $0.31. Closing above $0.40 could ignite a run to $0.46. Failure to hold $0.31 puts $0.27 in play and risks deeper losses toward $0.20.

Conclusion

ENA, BONK, RAY, and SEI remain solid accumulations, yet XYZVerse’s first all-sport meme coin, eyeing 20,000% upside, positions early entrants for outsized gains as the 2025 bull run unfolds.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/ , https://t.me/xyzverse , https://x.com/xyz_verse

This article is not intended as financial advice. Educational purposes only.

Top Blockchains by NFT Sales Volume: Ethereum Rules With $56.57M Sales, Solana and Polygon Compete

The NFT market was highly active during the week. Ethereum sustained its long-established majority a...

Ethereum Price Eyes $4,260 Support Zone; Break Could Trigger Drop to $3,700

Ethereum ($ETH) trades near $4,260 support with 690K ETH accumulated, top analyst warns a breakdown ...

Cardano Whales Scoop Up 150M ADA, What Happened?

Analyst Ali Martinez says whales accumulated 150 million ADA in two weeks as Cardano price holds nea...