Crypto Pauses After Record Rally as Markets Await Powell at Jackson Hole

After a record-breaking rally last week, cryptocurrencies lost momentum, aligning with how risk assets performed. Wall Street stocks fell on Friday from record highs due to mixed economic data, giving traders different perceptions of the Federal Reserve's path.

Bitcoin fell and flatlined at around $118,000 after a new all-time high of above $124,000 on Thursday. It is currently trading at around $115,000 as of publication time. Broader crypto tokens showed a similar trend, with Ethereum down by around 10% from last week's highs to around $4,270.

The week ahead will also be about how the market perceives the next steps in the Russia-Ukraine talks.

On Monday, Trump will meet with Zelensky, the president of Ukraine, for the first time since their public disagreement in February. This is a major diplomatic engagement. This latest meeting follows a clandestine meeting on Friday with Russian President Vladimir Putin, during which Putin demanded that Kyiv give up territory, and Trump withdrew his demand for an immediate end to the fighting in Ukraine.

Nevertheless, the Fed chief at Jackson Hole will have a greater impact on cryptos with what he says about the rate path.

Last week, vehicle sales and large-scale internet promotional events were the main drivers of the recent uptick in retail sales in the United States, according to economic data. Separate data showed that consumer morale unexpectedly fell for the first time since April, at the same time inflation expectations rose.

Bets for stagflation are on the rise. While consumers are moving past the dire economic outlook that was anticipated in April after Trump announced reciprocal tariffs on the world, they expect inflation and the jobless rate to rise.

This week, Powell has the chance to offer his perspective on the economy, marking a pivotal moment for markets heavily wagering that the Fed is poised to lower rates next month.

Financial markets are bracing for a quarter-point rate cut next month and two more cuts by year's end, with a 50 basis point (bps) cut also being the top of a hot debate currently.

So Powell's speech at the central bank's annual conference in Jackson Hole, Wyoming, on Friday marks the beginning of a crucial time.

The Fed has a history of making big policy pronouncements at this event, and this time is no different. Even though certain economists express caution in light of unexpectedly high inflation figures, market participants are confident that a deteriorating job market has enabled the Fed chair to take on a more accommodating stance.

Market participants continue to place their bets on a potential reduction next month, expecting that Powell will adhere to his commitment that the policy decision on September 17 will be informed by indicators reflecting a softening labor market and stable inflation.

Jackson Hole Impact

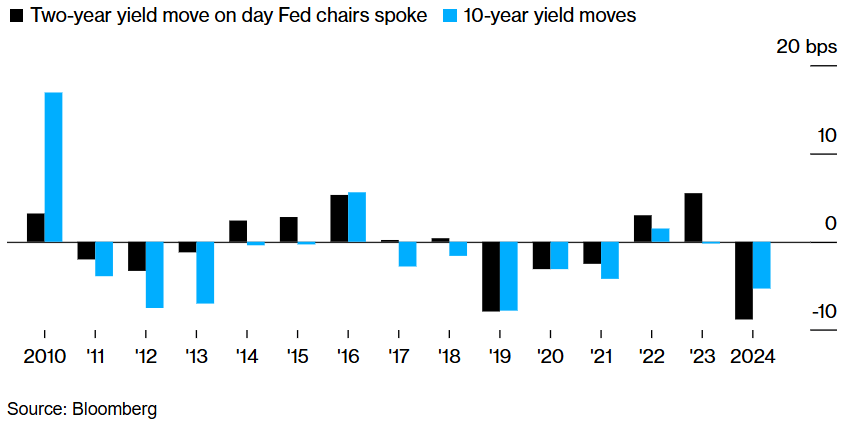

Following July's dismal job data, rising expectations of Fed easing led to a fall in rates across most maturities in August, with the two-year maturity leading the way. The yield curve has steepened this month, and the two-year rate is currently at about 3.75%, just slightly higher than its previous lows.

In this context, the Jackson Hole summit is attracting heightened scrutiny. Powell elevated short-term interest rates three years ago, highlighting the challenges of managing inflation for both individuals and enterprises.

At the previous year's symposium, he suggested that the central bank is prepared to lower borrowing costs from a two-decade peak. On the same day that the comments reinforced traders' expectations for a rate cut, two-year rates declined.

A significant half-point adjustment marked the initial reduction that September, implemented by the central bank. Market participants are closely monitoring if Powell decides to go that way again, with some traders betting on a 50 bps cut in the options market.

However, with producer prices starting to reflect tariffs, there is a clear divide. The boost for cryptos from a Fed rate cut is evident; however, it is crucial to scrutinize the words of the Fed chief to comprehend the reasoning behind any anticipated move, particularly with Trump exerting pressure on Powell.

Elsewhere

Blockcast

Institutional Stake-hodlers: stETH vs stVaults vs Sales Cycle

Lido Ecosystem Foundation's head of institutional relations Kean Gilbert hops on Blockcast to confirm that institutions are here, after a long journey of discovery and education. Discover what happens during the shift from traditional finance to the forefront of blockchain innovation, and explore the strategic moves shaping the future of Ethereum and liquid staking.

Access the episode from your preferred podcast platform here .

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Jeremy Tan (Singapore parliament candidate), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Samar Sen (Talos), Jason Choi (Tangent), , Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Figure, Gemini File for US IPOs as Crypto Companies Rush to Public Markets

Blockchain lender reports 22% revenue surge while Winklevoss exchange reveals widening losses ahead ...

ETF Outflows and Geopolitical Turbulence Shape a Cautious Market

Your daily access to the back room...

BitMine Surges Past $6.6 Billion in Holdings to Become 2nd-Largest Crypto Treasury

Company adds 373,000 ETH tokens in one week as institutional backing fuels aggressive accumulation s...