Powell’s Jackson Hole Balancing Act Keeps Crypto Range-Bound

Key Takeaways

- BTC consolidating in the $115K–$117K range, with $115K as key support and $120K–$123K as immediate resistance. Fed Chair Powell expected to keep a neutral stance at Jackson Hole, avoiding firm dovish commitments.

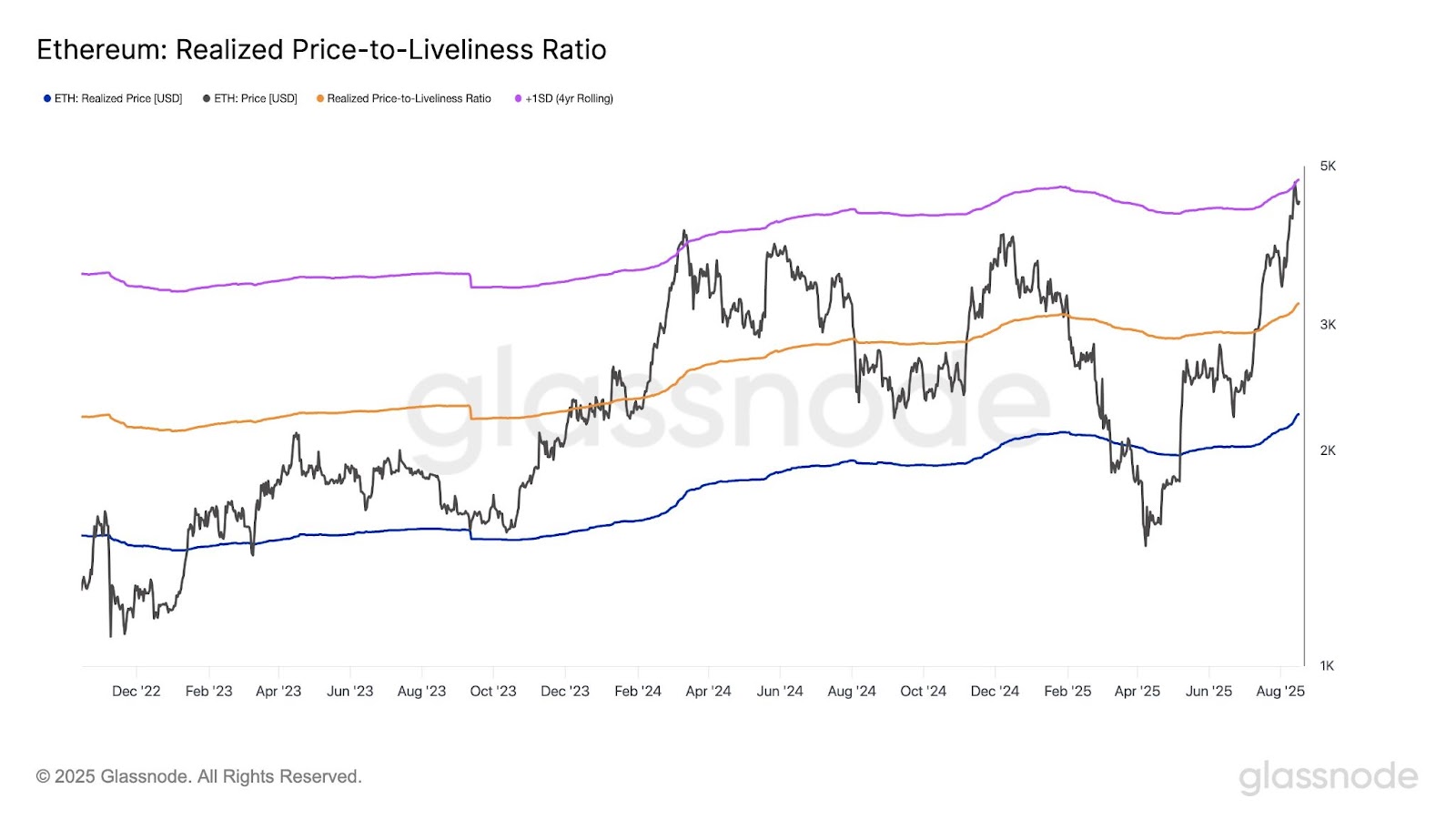

- ETH rally stalls again at +1σ Active Realized Price (~$4.7K), consistent with prior cycle resistance zones.

- ETF inflows remain resilient: BTC ETFs +$547M weekly, ETH ETFs +$2.85B weekly (record). Elevated medium-term implied volatility ratio signals rising structural/macro concern.

Macro Catalysts and Fed Impact

Markets enter the week focused on Powell’s keynote at the Jackson Hole symposium. Futures still price in ~85% odds of a September rate cut, but tariff-driven inflation and weaker labor market data complicate the narrative. Already, markets have seen a quick price flush with a 2% drop for BTC and 5% drop for ETH at the opening of Asian trading hours.

A hawkish tilt would function as a tightening trigger, with the likely effect of pulling risk assets lower. A neutral stance would leave BTC and ETH consolidating in recent ranges until further data (labor reports, PCE) clarifies the Fed’s path.

The macro context remains supportive on balance: equities remain near their highs, and crypto ETFs continue to attract net inflows, providing a demand cushion despite policy uncertainty.

Market Remains on Edge

Bitcoin Range Setup

BTC trades near $115K, defending its high-volume support zone. Resistance stands at $120K–$123K; a break opens the path toward $127K (+1σ). Alternatively, a breakdown below $115K risks exposing $112K. Short-term holder cost-basis remains firm, providing structural support.

Ethereum Resistance

ETH once again stalled at $4.7K (+1σ ARP), a repeated sell zone in prior cycles. Sustained ETF and treasury demand offset near-term profit taking, but breakout confirmation requires clean acceptance above this level.

Derivatives Positioning

BTC’s 6M/1M IV ratio is at extreme levels, higher than 96.8% of all observations, flagging medium-term concern around structural risks. Options skew remains modest, but elevated OI in both BTC ($39B) and ETH ($35.5B) suggests potential for sharp realized vol expansion if ranges break.

ETF Flows

- BTC ETFs : $547M net inflows last week, despite a small $14M outflow on Friday.

- ETH ETFs : $2.85B weekly inflows, including a record $1B single-day inflow on Monday, a new milestone.

- Flows signal robust institutional appetite, with ETH increasingly emerging as the speculative leader.

What Does the Market Setup Say?

Crypto enters the week in a holding pattern: BTC is pinned in the $115K–$120K range, with Powell’s remarks likely dictating the next breakout attempt.

ETH continues to attract record ETF flows but faces resistance at $4.7K, with breakouts requiring both macro alignment and sustained inflows.

With leverage rebuilt across majors and implied volatility at extremes, tight risk management is warranted.

Positioning

- Cash: 10% — Key funding held ahead of Powell’s speech; scope for vol spike.

- BTC: 35% — defended $115K support, but resistance at $120K–$123K likely sticky; add above $127K breakout.

- ETH: 40% — overweight; flows remain record-strong, but $4.7K resistance requires tactical caution.

- SOL: 10% — maintained for high-beta exposure in altcoin rotation.

- BNB/XRP: 5% each — stable beta allocations.

This sets the tone for Monday, August 18: crypto pinned by macro uncertainty, with ETF flows cushioning downside, but Powell’s message is the key directional trigger.

Figure, Gemini File for US IPOs as Crypto Companies Rush to Public Markets

Blockchain lender reports 22% revenue surge while Winklevoss exchange reveals widening losses ahead ...

ETF Outflows and Geopolitical Turbulence Shape a Cautious Market

Your daily access to the back room...

BitMine Surges Past $6.6 Billion in Holdings to Become 2nd-Largest Crypto Treasury

Company adds 373,000 ETH tokens in one week as institutional backing fuels aggressive accumulation s...