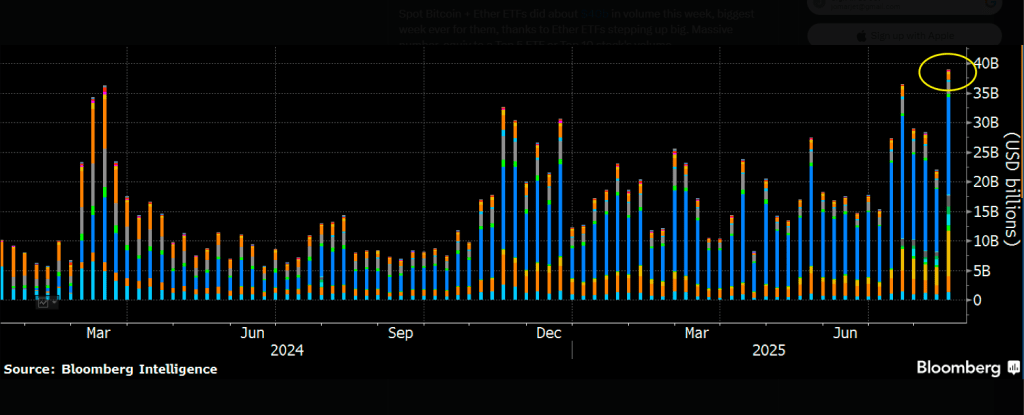

ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

This week saw record trading in US spot Bitcoin and Ether ETFs, driven largely by a sudden rush into Ether funds.

According to ETF analyst Eric Balchunas, Ether ETFs alone posted roughly $17 billion in weekly volume, a figure that surprised many after months of quiet. The spike has pushed trading desks to rethink how fast money can flow into these funds.

Ether ETFs Record Big Volume

Reports have disclosed that spot Ether ETFs not only logged about $17 billion in weekly trading volume, but also saw a record single-day net inflow of $1 billion.

Across the first two weeks of August, the funds pulled in more than $3 billion. According to Balchunas, it was almost as if the Ether ETFs were in hibernation mode for 11 months and then crammed one year’s worth of activity into six weeks. That phrase captured how suddenly demand arrived.

Spot Bitcoin + Ether ETFs did about $40b in volume this week, biggest week ever for them, thanks to Ether ETFs stepping up big. Massive number, equiv to a Top 5 ETF or Top 10 stock’s volume. pic.twitter.com/Z89uV63A3w

— Eric Balchunas (@EricBalchunas) August 15, 2025

Price Peaks And Quick Pullbacks

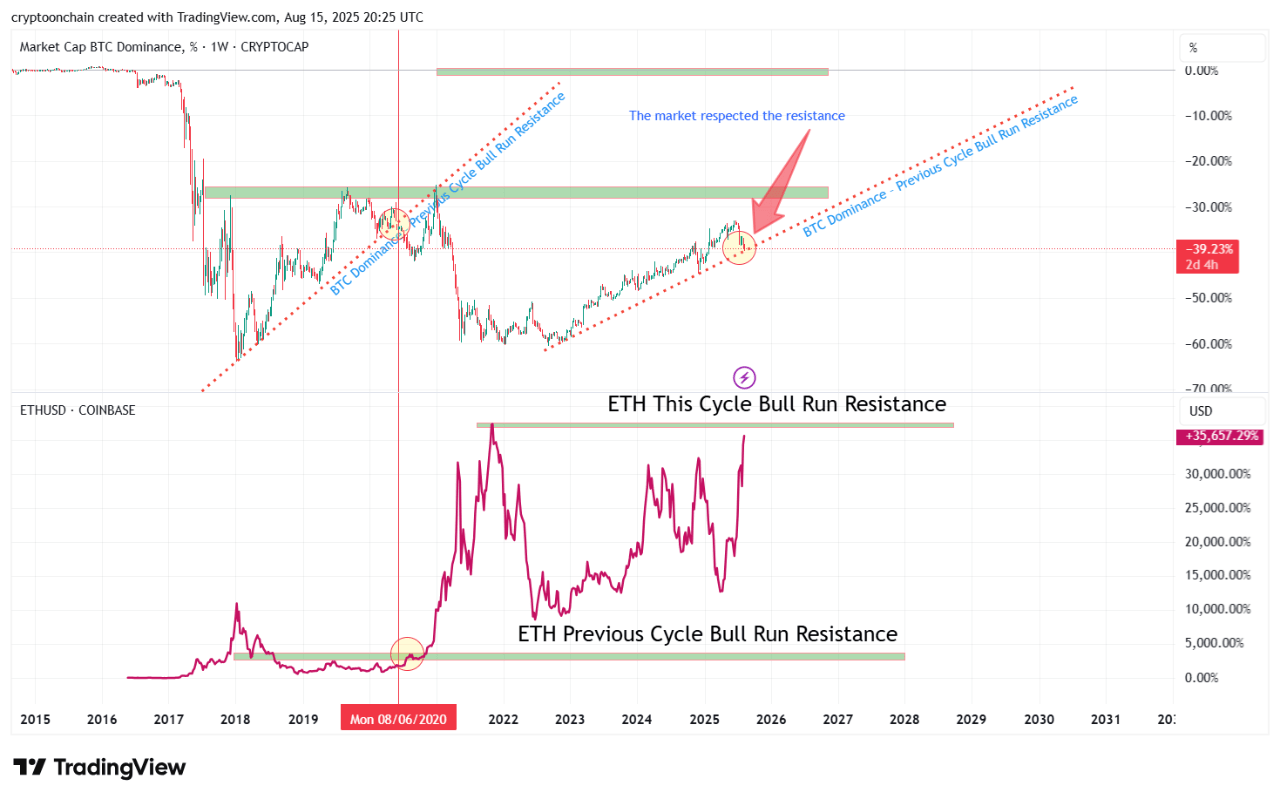

Based on market data, Bitcoin hit a headline-making high of $124,000 on Thursday, while Ether came within nearly 2.1% of its November 2021 high by reaching $4,787, CoinMarketCap data shows.

The highs did not stick. Since Thursday, Bitcoin has fallen over 5% from that peak and was trading around $117,648, while Ether dropped 6.15% and sat near $4,475. Short swings like these are common when excitement and fresh flows meet thin liquidity.

Comparisons To The Bitcoin ETF Run

Comparisons To The Bitcoin ETF Run

Analysts are drawing parallels to last year’s Bitcoin ETF rush. Reports point out that Bitcoin ETFs reached new highs of $73,680 just two months after launching in January 2024.

MN Trading Capital founder Michael van de Poppe said, “There’s way more to come for this cycle.” That view reflects optimism among some traders that ETFs can keep driving prices higher across crypto markets.

Caution From Market WatchersAt the same time, some market watchers warn that a fresh all-time high for Ether could still be weeks or months away. Flows can be volatile. Big one-day inflows can move markets quickly, but they can also reverse just as fast when traders take profits or shift strategies.

If Ether funds keep bringing in large sums beyond the first two weeks of August, the move looks more durable. If not, the big numbers could turn out to be a short-lived spike.

Based on reports and market behavior so far, ETFs are clearly a major near-term driver for both Bitcoin and Ether.

The story is still unfolding. Some expect more gains; others urge patience. Either way, the sudden rush into Ether ETFs has made this chapter one of the busiest in recent crypto trading history.

Featured image from Pexels, chart from TradingView

Bitcoin Makes A Modest Pullback As Market Eyes Post Trump-Putin Meeting Reaction

According to CRYPTOWZRD’s recent update, Bitcoin ended the last session on a bearish note, but the b...

XRP Price Could Be Headed To New All-Time Highs Due To These Factors

Recent price action has shown that XRP is establishing the $3 price level as a base, and an analysis...

Altcoins Takeover Incoming? These On-Chain Metrics Signal An Imminent Market Shift

The cryptocurrency market was impressive for most of the week, with Bitcoin and large-cap altcoins l...