Bitcoin, Ethereum, Solana To Hit Wild New Highs In October: Placeholder Co-Founder

Chris Burniske, the cofounder and partner at crypto venture firm Placeholder, laid out a time-boxed set of cycle targets for the market’s three bellwethers, arguing that the “crazier” price action gets through early autumn, the higher his conviction becomes that this cycle culminates in October. “Aiming for an October top in BTC, if I were to pick numbers, which we all know is a grade above guessing, I’d say BTC $142,690, ETH 6,900–8K, $SOL ~ $420. NFA, it’s a meme world we live in,” Burniske posted on X late on August 13.

Predictions For Bitcoin, Ethereum And Solana

The Placeholder co-founder expanded on the logic in follow-ups, saying he prefers the implied cross-asset relationships against Bitcoin at those levels. He suggested that if the run accelerates into August–September–October, his “conviction” in an October top rises; conversely, “if we pull back hard soon, and get more muted, then perhaps we can extend this bull for longer.” He also emphasized that once Bitcoin’s tide turns, lower-liquidity assets typically “drain out” faster—an admonition that aligns with past cycle behavior even if timing the inflection is, as he put it, “a grade above guessing.”

By construction, Burniske’s slate of targets bakes in a meaningful repricing of the crypto complex’s internal ratios. At a $142,690 Bitcoin, an Ethereum band of $6,900–$8,000 implies an ETH/BTC ratio in roughly the 0.048–0.056 range, while $420 Solana would imply an SOL/BTC ratio near 0.003. That positioning squares with his aside that he “likes the implied ETHBTC and SOLBTC ratios,” and with a broader market dynamic he and others point to: sustained capital rotation out of Bitcoin into higher-beta assets as the cycle matures.

On that rotation, Burniske amplified a dashboard from analytics firm Glassnode—shared via Swissblock—showing that market-cap-weighted seven-day returns across top altcoins have breached the +1σ band three times since April. Statistically, that constitutes significant outperformance relative to Bitcoin and is consistent with capital flowing from BTC into ETH and the long-tail. “It’s not that crypto inflows are drying up. Capital is rotating into ETH and altcoins, draining from BTC and fueling a torrent into the altcoin market,” Swissblock summarized alongside Glassnode’s chart.

Burniske also floated a tongue-in-cheek “meme world” extension to his Bitcoin call a few hours later—“BTC looking juicy, maybe $169,420 is a better meme world”—underscoring both the self-aware tone of the thread and the reality that upside blow-offs, if they occur, rarely stop on tidy round numbers.

The thread was not purely about price targets. It doubled as risk management guidance for a market that has already pushed to new all-time highs this year. “Selling some isn’t the same as selling it all, and it’s best to ‘sell some’ in bits and pieces on the way up,” Burniske wrote in a separate post he referenced again on Wednesday. “I see too many people who want to do it all in one go. Buy it all in one go, sell it all in one go, full port into one thing—those are gambling techniques, not investing techniques.”

Context for the Solana leg of the call arrived a day earlier. On August 12, Burniske suggested SOL “could be gearing up for a monster monthly” if capital rotation gives it “time in the sun” after Ethereum’s push—an argument that maps to the altcoin outperformance signals above and to his preference for the ETH/BTC and SOL/BTC skews into an October denouement.

None of this is novel as far as cycle anatomy goes—lead asset first, majors second, long-tail last. Whether the market prints Burniske’s “meme world” or settles for the initial $142,690/$6,900–8,000/$420 matrix, the thread’s two practical takeaways are unequivocal: autumn is the window he’s watching , and process discipline matters more than clairvoyance when the tape gets euphoric.

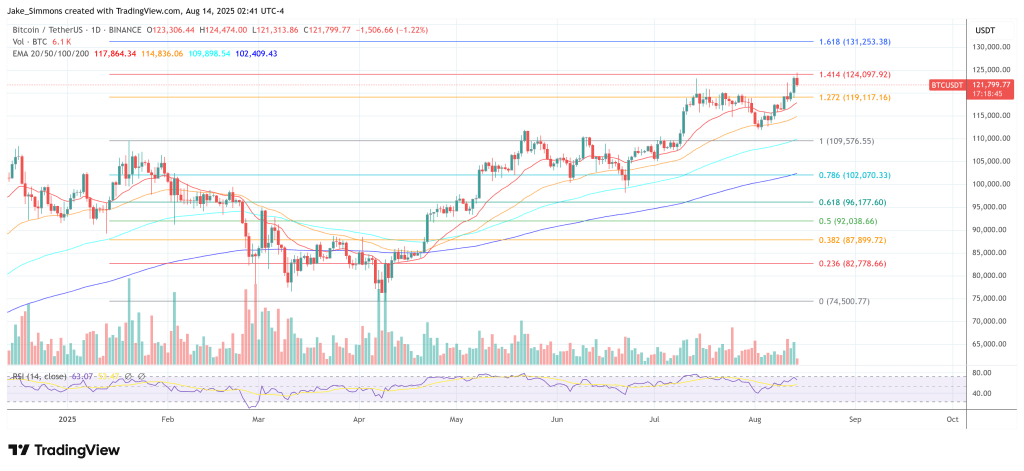

At press time, BTC traded at $121,799.

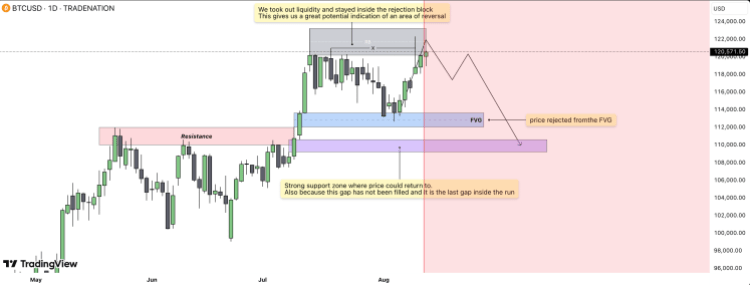

Brace For Impact: Bitcoin Price Could Crash To $110,000 Amid Signs Of Exhaustion

Despite recovering above $120,000 again, Bitcoin has not been able to completely shake off the beari...

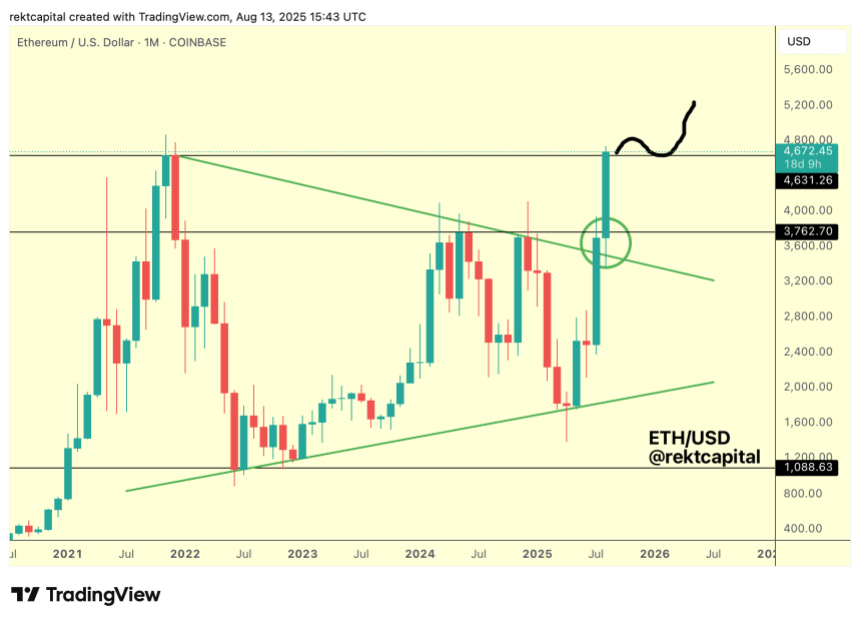

Ethereum Eyes ‘Final Boss’ Level, But Analyst Says Weekly Close Is Key For Price Discovery Run

Ethereum (ETH) is attempting to reclaim a crucial area as price nears its 2021 all-time high (ATH). ...

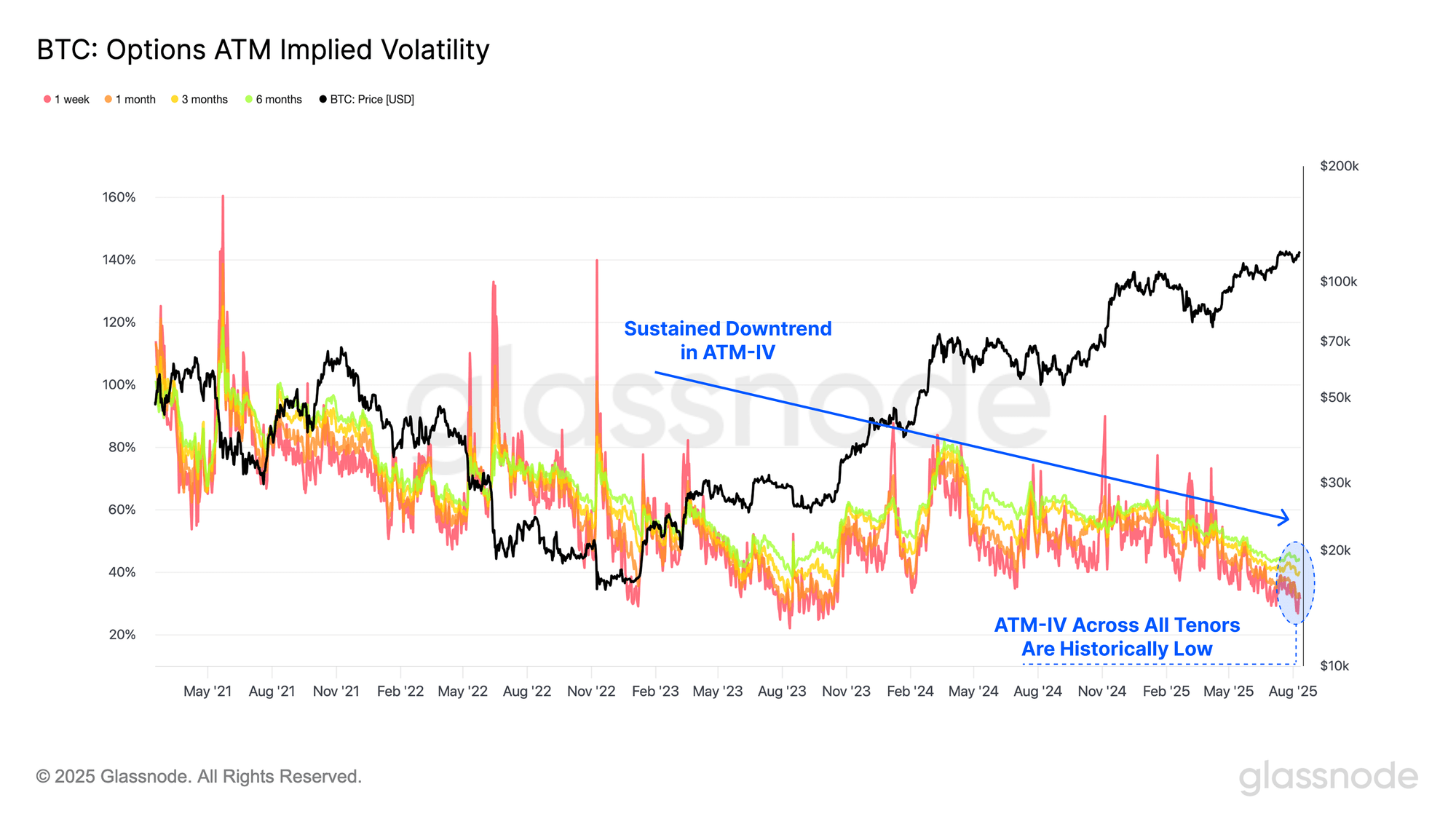

Bitcoin Options Traders Don’t Expect Volatility: Contrarian Signal Brewing?

Bitcoin options markets are showing a low volatility expectation, something that has actually preced...