Circle Launches L1 Blockchain Arc Alongside Q2 Earnings

USDC issuer Circle Internet Group, Inc. (NYSE:CRCL) has announced the launch of Arc , a new, open Layer 1 blockchain specifically designed for stablecoin payments, foreign exchange, and capital markets applications. The announcement came alongside a strong second-quarter earnings report, highlighting significant growth after a successful $1.2 billion IPO.

Arc is engineered to be an "enterprise-grade foundation" for the future of finance, addressing some of the key challenges that have hindered the widespread adoption of stablecoins. By creating a dedicated blockchain, Circle aims to provide a faster, more affordable, and more secure environment for both businesses and consumers to transact with digital currencies.

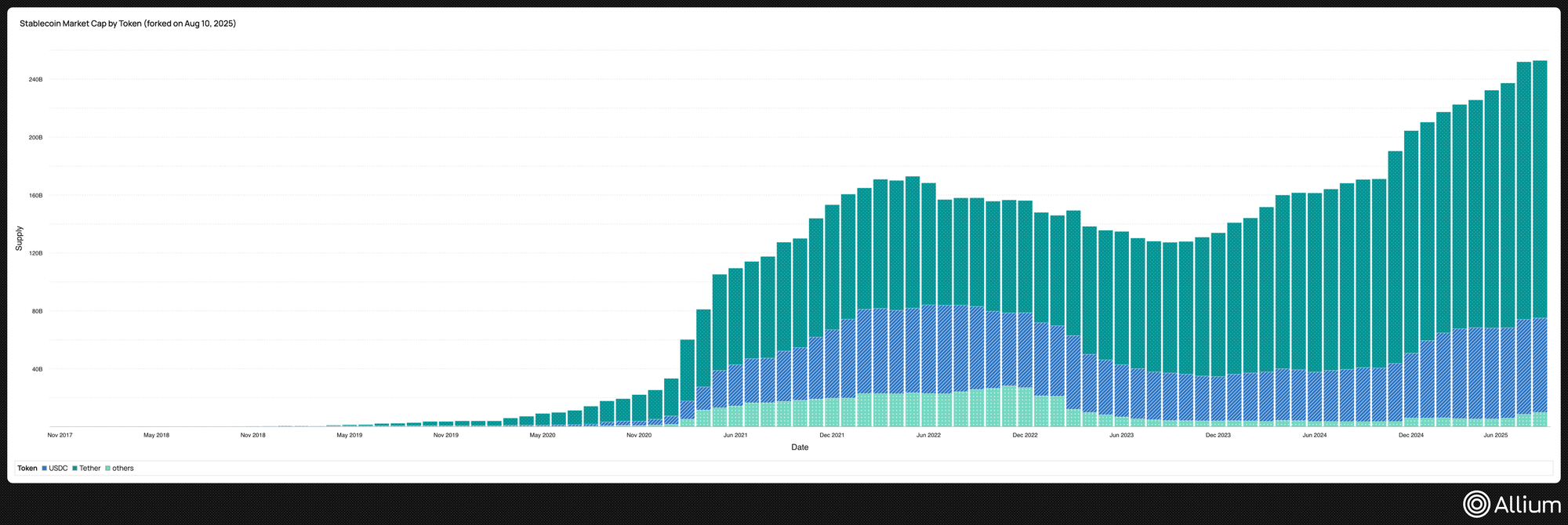

USDC is the second largest stablecoin, making up $65 billion of the roughly $250 billion in circulation, according to data compiled by Allium.

Jeremy Allaire, Co-Founder and CEO of Circle said, "We are seeing accelerating interest in building on stablecoins and partnering with Circle across every significant sector of the financial industry." According to the announcement, Arc is " a defining moment in [Circle's] journey to deliver a full-stack platform for the internet financial system."

On top of being seamlessly integrated with all of Circle's current products, Arc uses USDC as the native gas token, is EVM-compatible, and offers "sub-second settlement finality" with enterprise grade security, according to a press release .

Q2 Earnings

The launch of Arc comes at a time of significant growth for Circle. The company reported a 90% year-over-year increase in USDC in circulation, reaching $61.3 billion at the end of the second quarter. Total revenue and reserve income also saw a 53% year-over-year increase to $658 million, though the company posted a net loss of $482 million, driven largely by $591 million in IPO-related non-cash charges.

Adjusted EBITDA grew 52% year-over-year to $126 million.

"I’m proud of Circle’s performance in the second quarter, our first as a public company, where we demonstrated sustained growth and adoption of our platform across a multitude of use cases and with a diverse set of industry-defining partners,” said Allaire.

“Circle’s successful IPO in June marked a pivotal moment—not just for our company, but for the broader adoption of stablecoins and the growth of the new internet financial system," he added.

Circle has announced that a public testnet for Arc is expected to launch in the fall of 2025, providing the first opportunity for developers and the public to experience the new network. This will be a critical step before the full mainnet launch, and will be closely watched by the financial and cryptocurrency industries.

Bolivia's Crypto Revolution: A New Model for Crisis Economics

Cryptocurrencies may only make up a tiny part of Bolivia's economy, but their significant rise in po...

Crypto Exchange Bullish Increases IPO Size Ahead of Wednesday Trading Debut

Former NYSE president Tom Farley's company targets $4.8 billion valuation as investor demand surges...

Terraform Labs Co-Founder Admits to $40 Billion Fraud in Federal Court

South Korean entrepreneur faces up to 25 years in prison for misleading investors about TerraUSD sta...