$57B in Bitcoin and Ethereum Options Signals Big Moves Could Be Coming

The cryptocurrency market has seen a notable rebound in the lead-up to Tuesday’s US Consumer Price Index (CPI) release, with Bitcoin climbing above $122,000 over the weekend and Ethereum rising by nearly 20% in the past week to more than $4,300.

The gains have coincided with improved sentiment in US equity markets, with QCP Capital noting that the correlation between Bitcoin and equity performance has strengthened since mid-July. Total market capitalization for digital assets also surged above $4.1 trillion, reflecting an increase on Monday.

The upcoming CPI report is being closely monitored for signs of inflationary trends. Consensus expectations point to a year-over-year increase of 10 basis points in headline inflation, bringing it to 2.8%.

QCP Capital stated that a softer reading could reinforce expectations for a Federal Reserve rate cut in September, while a higher-than-expected figure might disrupt the rally in risk assets, including cryptocurrencies.

Analysts suggest that the market is preparing for both outcomes, with positioning in derivatives markets indicating hedging on the downside while still leaving room for upward momentum.

Bitcoin and ETH Derivatives Data Signals Market Caution

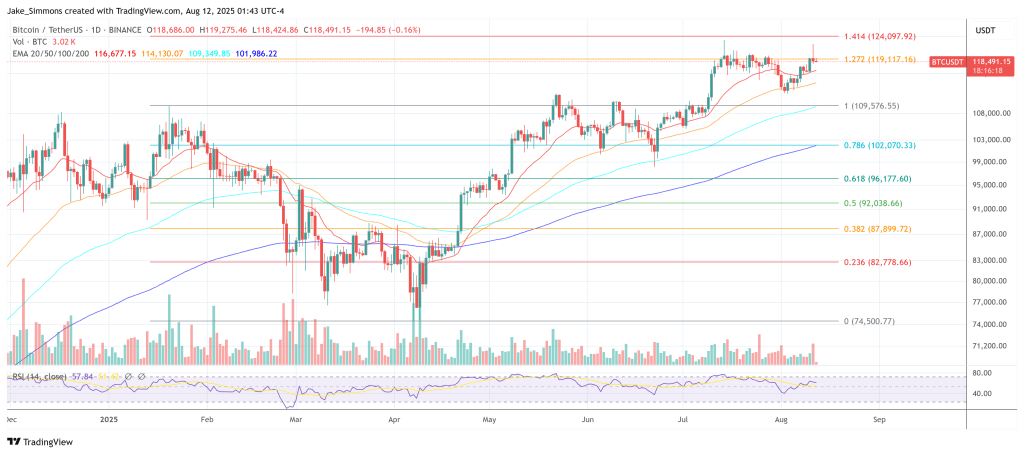

Options market activity shows that traders are actively preparing for volatility around the CPI release. QCP Capital highlighted demand for short-dated Bitcoin puts in the $115,000–$118,000 range, suggesting that some market participants are protecting against a potential price drop.

At the same time, there has been continued short-call covering, indicating reduced willingness to bet against further gains. Aggregated Bitcoin options open interest stands at $43 billion, close to the $49 billion peak recorded in July.

The firm expects implied volatility to remain elevated until the CPI release, after which it could compress if Bitcoin fails to break through resistance levels.

Ethereum options activity is similarly strong, with open interest at $13.9 billion, the highest level so far in 2025 and approaching the all-time high of $14.6 billion set in March 2024.

Elevated open interest in both BTC and ETH suggests that traders are heavily engaged in positioning around macroeconomic events, with the CPI print seen as a key catalyst for short-term price action.

Institutional Flows and Longer-Term Outlook

Beyond derivatives markets, institutional activity and flows into spot ETFs remain a focal point for analysts. CoinShares data shows that digital asset investment products saw $571 million in net inflows last week, driven by gains in both Bitcoin and Ethereum.

QCP Capital noted that the market has absorbed recent large-scale sales from long-term holders without a breakdown in price trends, indicating resilience in market structure.

Despite short-term uncertainty, some analysts maintain a bullish view for the remainder of the year. Paul Howard, Senior Director at Wincent, reiterated his forecast of $150,000 for Bitcoin before year-end, citing historical post-halving cycle trends.

Howard noted that historically, post-halving years have seen significant rallies, adding that while there may be periods of consolidation, the overall market structure suggests higher prices are achievable in 2025.

Featured image created with DALL-E, Chart from TradingView

Jeff Bezos’ Blue Origin Now Takes Bitcoin, ETH, SOL For Spaceflights

Blue Origin will now sell New Shepard spaceflight seats in Bitcoin, Ethereum, Solana and selected do...

Pundit Predicts ‘Near Term’ Bitcoin And Ethereum Prices, There’s Still Room To Run

Bitcoin and Ethereum prices began to rally over the weekend, and interestingly, ETH was able to beat...

ZORA Hits New ATH Amid 50% Daily Surge – What’s Behind The Breakout?

Social Network Zora has seen its native token, ZORA, record a massive rally following a spike in use...