Bitcoin’s Technical Correction Sparks $200K Price Speculation for 2025

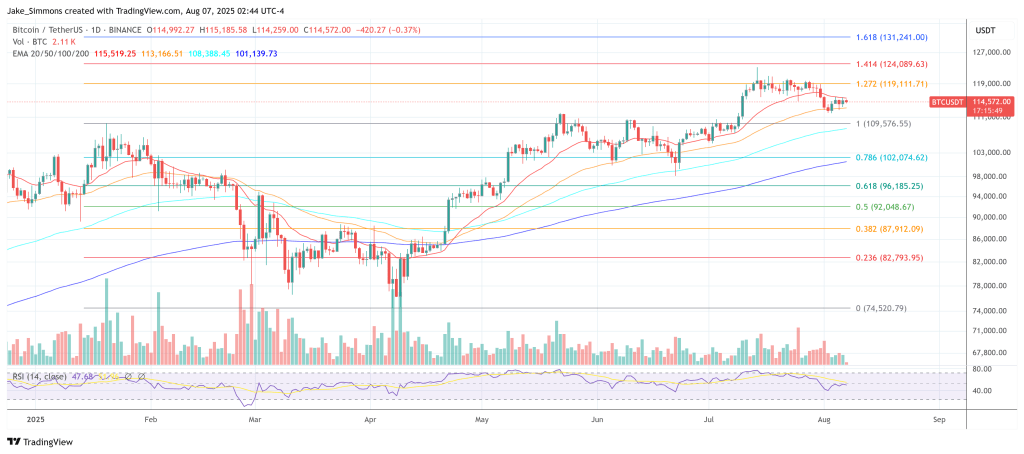

Bitcoin is currently undergoing a period of downward movement after briefly setting a new all-time high earlier last month. Over the past week, the world’s largest cryptocurrency has declined by nearly 4%, trading at $113,993 at the time of writing.

This represents a drop of approximately 7.2% from the peak price of above $123,000 reached in July. The decline has sparked renewed discussion among analysts about the asset’s current price discovery phase and what it could mean for the remainder of 2025.

Bitcoin Price Discovery and the Potential for Q4 Gains

CryptoQuant analyst Oinonen shared his latest assessment of Bitcoin’s market performance, noting that while the recent pullback appears significant, it primarily reflects technical market conditions.

In his post on the QuickTake platform, he explained that a combination of macroeconomic uncertainty, technical indicators turning bearish, and liquidation events has contributed to the decline. However, he described the ongoing situation as a “technical correction” within Bitcoin’s longer-term bullish structure.

Despite the short-term weakness, analysts remain focused on Bitcoin’s price discovery process. This phase, according to Oinonen, is essential in establishing the asset’s fair market value as supply and demand interact in the market.

Following the all-time high of $123,400 on July 14, Bitcoin appears to be consolidating, potentially setting the stage for further upward movement later in the year.

“Bitcoin has historically performed well in the fourth quarter,” Oinonen noted, suggesting that a return to its previous peak and even a potential move toward $200,000 could be on the horizon if historical patterns hold.

Additionally, the analyst pointed to Binance’s high stablecoin reserves as a factor that may influence Bitcoin’s trajectory. These reserves represent capital that could flow into Bitcoin and other digital assets if market sentiment improves.

A positive shift in buying activity, combined with Bitcoin’s reflexive market behavior, could support further gains, although the extent to which this would benefit altcoins remains uncertain.

Caution Over Negative Coinbase Premium Signals

While some market participants anticipate a possible rebound later this year, other analysts are urging caution. Another CryptoQuant contributor, known as BQYoutube, highlighted a recent change in the Coinbase Premium Index, a metric comparing prices on Coinbase versus other exchanges.

Since June 30, the premium has shifted to negative, indicating weaker buying pressure from US-based investors. “Historically, stronger Bitcoin rallies have coincided with a positive Coinbase Premium,” BQYouTube wrote, suggesting that traders may want to wait for signs of renewed spot demand before expecting a sustainable uptrend.

Featured image created with DALL-E, Chart from TradingView

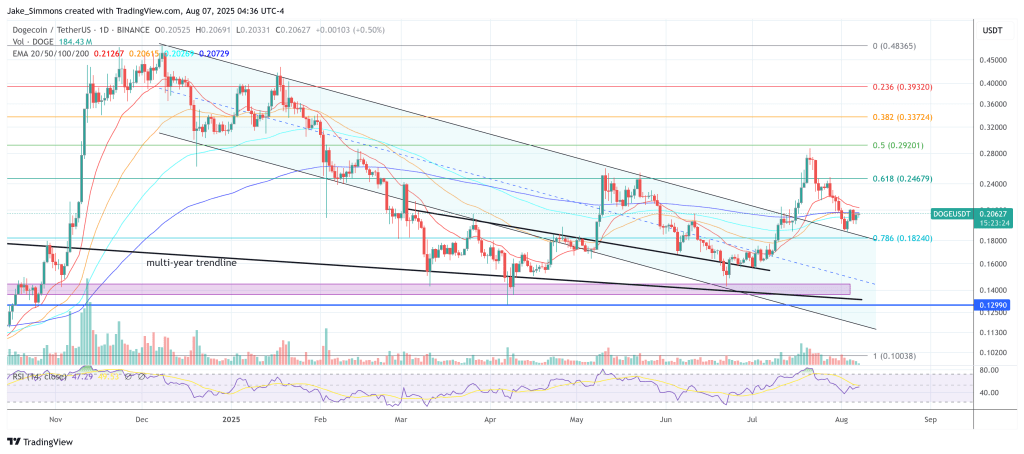

Dogecoin Doomed To Chop? Analyst Sees $0.90–$1.50 Top—But Not Anytime Soon

Dogecoin has now entered the longest period below its all-time high in its history—over 1,550 days a...

Bitcoin Remains ‘Undefeatable’, Tether Chief Says

Paolo Ardoino, chief executive officer of stablecoin issuer Tether, has called Bitcoin “undefeatable...

US Delay On Bitcoin Audit Is A Bullish Red Flag, Says Strike CEO

Jack Mallers, founder and CEO of Strike, ignited fresh debate over Washington’s still-undisclosed Bi...