Ripple Partners with Oldest U.S. Bank for RLUSD Custody

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Ripple has announced that The Bank of New York Mellon (BNY)

will be the primary custodian of the reserves backing the RLUSD stablecoin.

In the

announcement

, Ripple emphasized that the move would drive institutional adoption of digital assets and bridge the worlds of traditional and decentralized finance.

Given BNY's reputation in the financial sector, its selection as the primary custodian of RLUSD reserves could boost institutional credibility for the stablecoin. As the oldest bank in the United States, BNY serves as a custodian for institutional and corporate assets.

Launched

in December 2024, RLUSD is backed by high-quality liquid assets, including cash equivalents, money market funds, and U.S. Treasuries. These reserves will be safely held in BNY, ensuring that the stablecoin maintains its dollar peg.

https://twitter.com/Ripple/status/1942901627234508829?t=7SvK-xbCGNPlHb7Vj_uxyA&s=19

Ripple and BNY Execs React

Jack McDonald, Ripple’s SVP of Stablecoins, stated that BNY was chosen as RLUSD’s ideal partner due to its unique blend of financial innovation, custody expertise, and forward‑thinking digital‑asset strategy.

BNY’s Global Head of Digital Services, Emily Portney, expressed enthusiasm in supporting the growth of the digital asset ecosystem. According to Portney, BNY achieves this vision by providing a differentiated platform that meets the institutional needs of the industry.

“We intend to provide secure, innovative, and streamlined solutions that empower financial ecosystems worldwide. BNY is proud to partner with Ripple as we propel the future of the financial system and digital asset adoption at institutional scale,”

Portney remarked.

Ripple Set to Leverage BNY Transaction Banking Services

In addition to selecting BNY as the primary custodian of RLUSD’s reserves, Ripple confirmed that it will also leverage the bank’s transaction banking services to enhance its operations.

The development comes months after the U.S. Federal Reserve rolled back its anti-crypto policies, which had prohibited banks from engaging in crypto activities without authorization.

In April, the Fed

rescinded

the 2022 and 2023 supervisory letters, allowing banks to engage with cryptocurrencies, including stablecoins, without seeking advance permission.

Meanwhile, Ripple has been making significant efforts to drive institutional adoption of RLUSD in recent times. Earlier this month, the company

applied

for a banking license with the Office of the Comptroller of the Currency (OCC).

The national bank charter, if granted, would subject RLUSD to full federal oversight. Since Ripple has already secured a banking license for the stablecoin in New York, RLUSD will operate with state and federal banking licenses if the OCC approves the company’s national bank charter request.

Notably, Ripple also applied for a Fed master account for the stablecoin through its custodian unit, Standard Custody.

RLUSD Now 8th Biggest Stablecoin

In the meantime, RLUSD’s market cap has crossed $500 million. RLUSD’s valuation, which stood at $469 million on July 3, has increased by 6.85% to $501.17 million in less than a week.

Following the surge, RLUSD flipped TrueUSD (TUSD) and became the eighth-largest stablecoin in the market. At the moment, TUSD is valued at $493.23 million.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/516115.html

Related Reading

Here’s Why This XRP Pump Is Nothing Serious

Discussions around the market-wide run triggered by Bitcoin have led to suggestions that XRP boasts ...

Bitcoin Expert Confirms XRP Forces Its Way into the BTC Conversations as Demand for XRP Is Real

Tim Kotzman, host of The Bitcoin Treasuries Podcast, recently shared an unexpected observation that ...

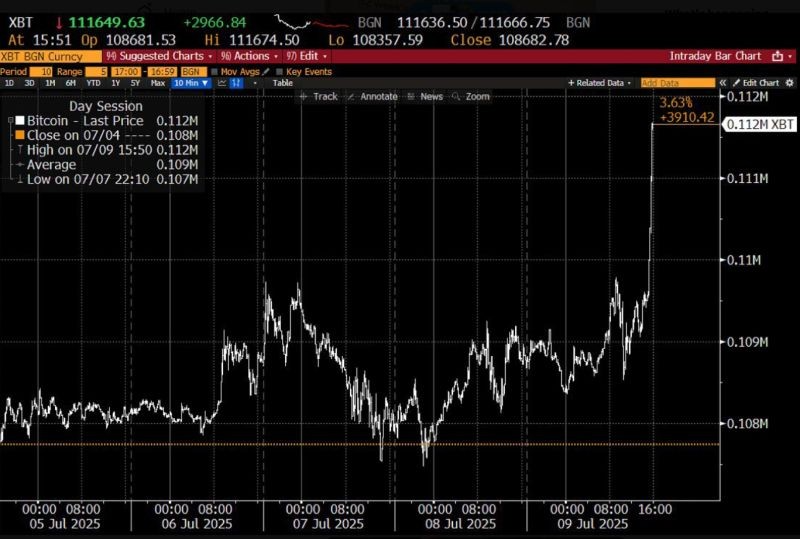

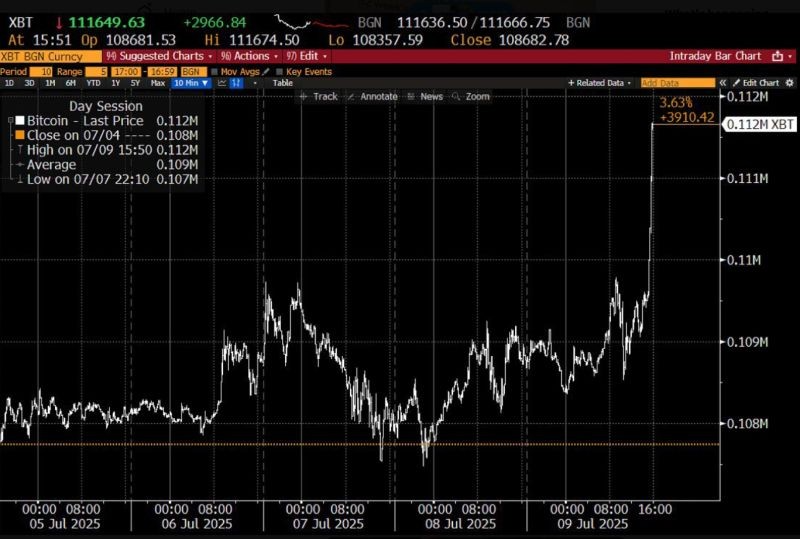

Bloomberg Terminal Switches Bitcoin Price Scale to Show BTC in Millions, Is Something Brewing?

Discussions around Bitcoin reaching million-dollar valuations are becoming more predominant, and eve...