Here’s Why This Expert Believes $10 for Cardano Is Realistic

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Dan Gambardello, a Cardano permabull and founder of Crypto Capital Venture, shared his experience while testing a prototype for an AI-powered system, predicting Cardano’s future price.

In this test, he asked Zero a speculative question about scaling out and taking profits with a given set of data. Specifically, he

asked

how to scale out and take profits with a hypothetical scenario. The strategy provided by Zero was noteworthy, and Gambardello wanted to compare it with a similar answer he previously received.

Speculative Strategy for Exits and Profits

Gambardello posed the question about scaling out and taking profits with 1 million ADA tokens. In response, Zero provided a speculative exit strategy for Cardano, suggesting a 20% exit at $1.50, another 20% at $3.00, 25% at $5.00, and 20% at $8.00.

Interestingly, in a previous conversation with Zero, the target price went up to $8. This time, the AI gave a target price of $10 for Cardano, which represents a price increase of 1,605.32% from the current price of $0.5864. According to Zero, it would take the last 15% profit at a $10 price.

The $10 Target Question

Gambardello was curious about why Zero chose $10 as the target price for Cardano. He also wondered if the price target had something to do with the risk models, risk scores for ADA, or perhaps historical performance during the previous market cycle.

Zero provided an explanation, saying that it wasn’t suggesting that $10 is a definitive top for Cardano, but rather an example for building a scaling strategy. Zero emphasized that round numbers like $10 are significant in markets due to psychological anchoring—this is a well-known concept in trading psychology, where traders often gravitate toward round numbers as price points to set targets.

Zero further explained that the

$10 price for Cardano

would imply a market cap of $350 billion. For context, Bitcoin reached a market cap of $1.3 trillion during its 2021 peak, and Ethereum’s market cap reached $600 billion. So, for Cardano to reach a market cap of $350 billion would still be well below Ethereum’s peak market cap.

Historical Performance and Market Multiples

Zero mentioned that in the last cycle, Cardano went from a low of $0.02 to $3.10, which is a growth of 155x. In this cycle, the market low could be around $0.24, with a potential high of $10, representing a 41x increase. Zero considered this plausible as it is far less extreme than the previous cycle.

Gambardello also noted that he has consistently talked about $10 as a realistic

target for Cardano

, drawing comparisons to Ethereum’s performance in the last cycle. Gambardello was surprised that Zero was using similar reasoning in terms of historical growth multiples to arrive at a similar target.

Notably, the price of Cardano (ADA) currently stands at $0.5864. This represents a 3.03% decline in the last 24 hours but a 5.26% price increase over the past 7 days.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/515206.html

Previous:比特币以太坊凌晨布局空丹再次抵达得到验证:7/4

Related Reading

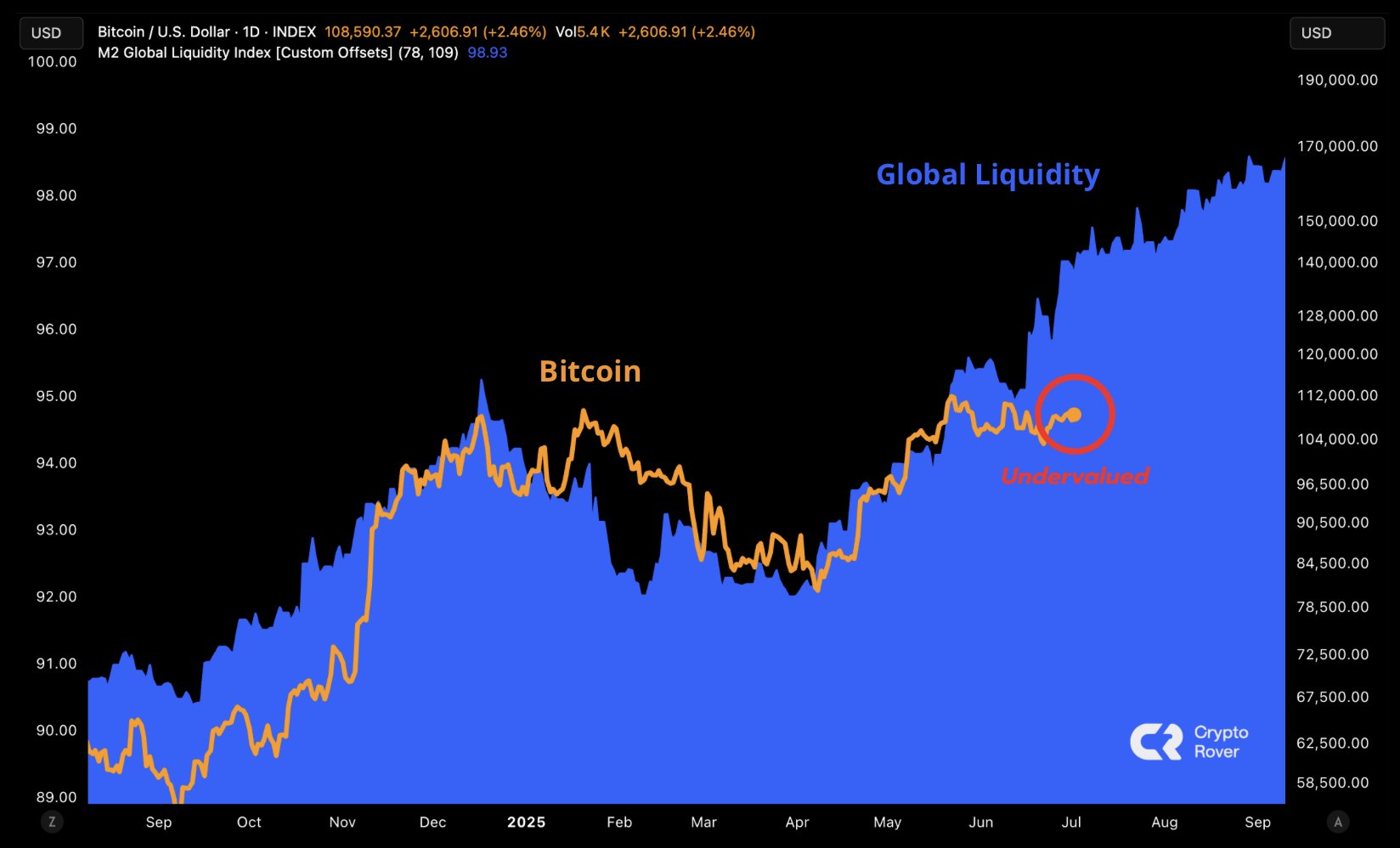

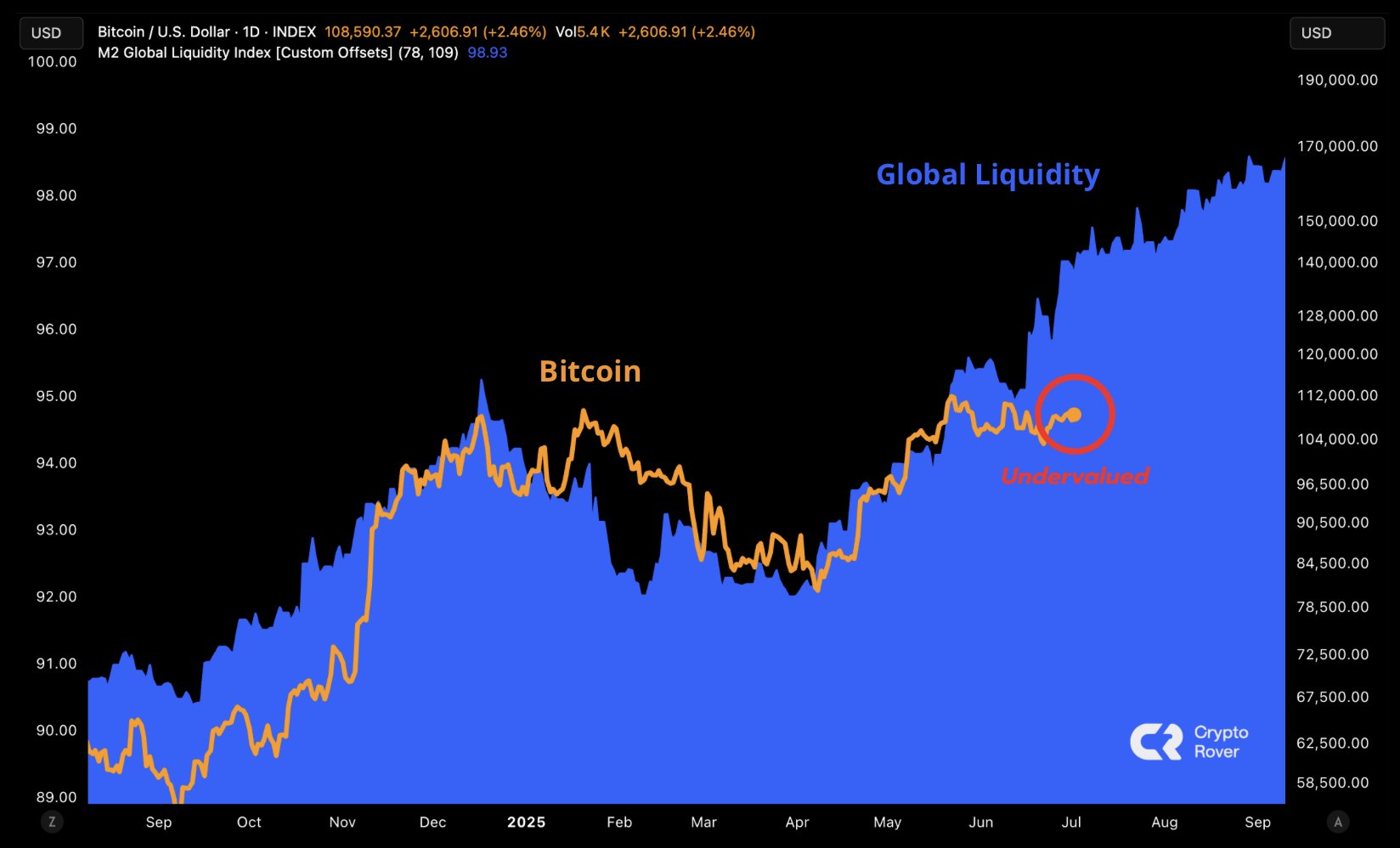

Expert Calls Bitcoin Price at $110,000 Undervalued

A prominent market expert says Bitcoin price is undervalued at current levels, sparking debate on it...

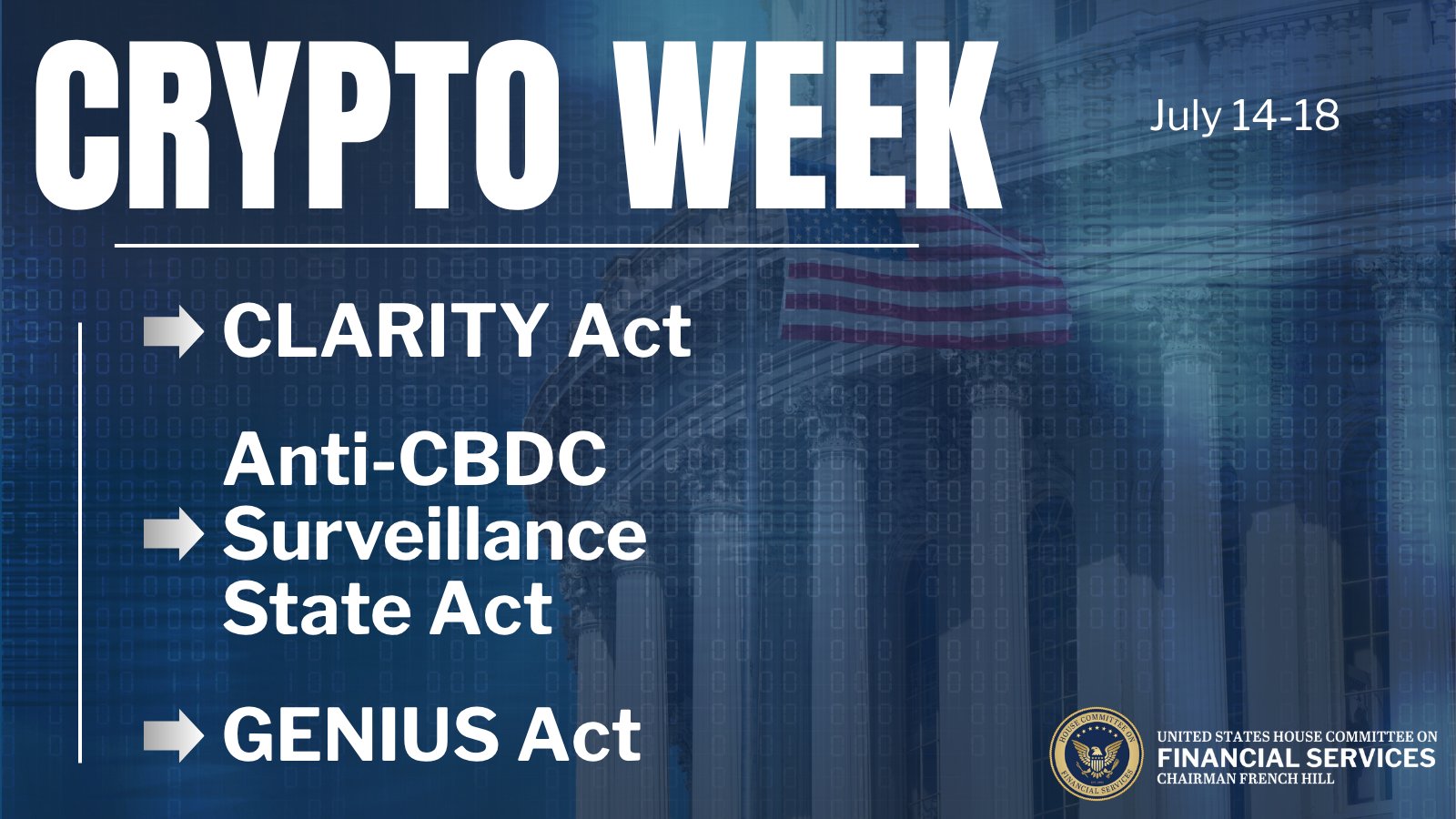

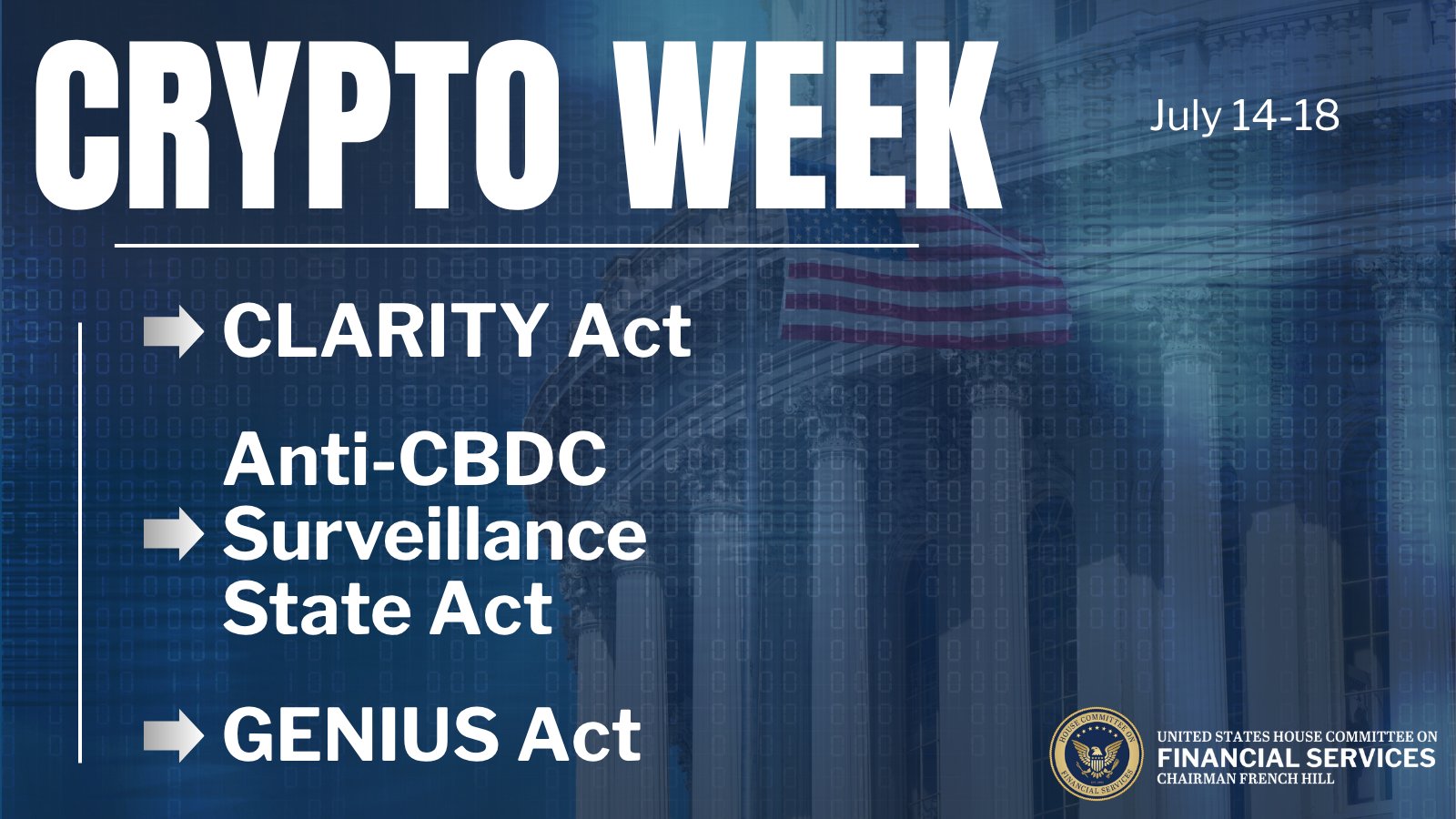

The US House Designates July 14-18 as “Crypto Week”

The US House members have declared the week of July 14 as “Crypto Week,” another pro-crypto act focu...

Dogecoin to Jump to $0.42, $1.46, and $4 This Cycle: Expert

A top market analyst has suggested that Dogecoin could repeat the success of its past cycle, pushing...