Tron DeFi Activity Expands: SunSwap Hits $3B+ Monthly Swaps In 2025

Tron (TRX) is currently navigating a prolonged consolidation phase that began in December 2024, with prices oscillating between key levels and no clear breakout direction in sight. Despite this range-bound action, Tron remains firmly in the spotlight as fundamental developments capture market attention.

The most significant news came two weeks ago, when reports revealed that Tron is preparing to go public via a reverse merger with Nasdaq-listed SRM Entertainment. This potential listing could mark a major milestone for the blockchain platform, potentially making it the first major crypto network to enter US public markets directly.

At the same time, on-chain data signals growing momentum beneath the surface. According to insights from CryptoQuant, DeFi activity on the Tron network has been steadily expanding. Rising transaction volumes, increasing deposits in JustLend, and record swap activity on SunSwap point to deepening liquidity and user engagement.

These developments highlight a maturing ecosystem, but the market has yet to price in a breakout move. As consolidation continues, traders and investors are closely watching for the next major catalyst. Whether Tron’s public listing or accelerating DeFi traction triggers it remains to be seen, but momentum is quietly building.

Tron DeFi Growth Signals Underlying Strength

Tron is testing critical price levels after months of sideways movement, consolidating between $0.211 and $0.295. This range has acted as a structural base since late 2024, and a clean break in either direction could determine Tron’s next major trend. A breakout above $0.295 would likely trigger fresh momentum toward new local highs, while failure to hold support could expose the asset to deeper corrections.

While the broader crypto market anticipates upward expansion—supported by the rally in US equities and a more stable macro backdrop—Tron remains trapped in this tight band. Volatility persists, and without a decisive breakout, market participants remain cautious. Still, underlying fundamentals suggest TRX may be quietly gathering strength.

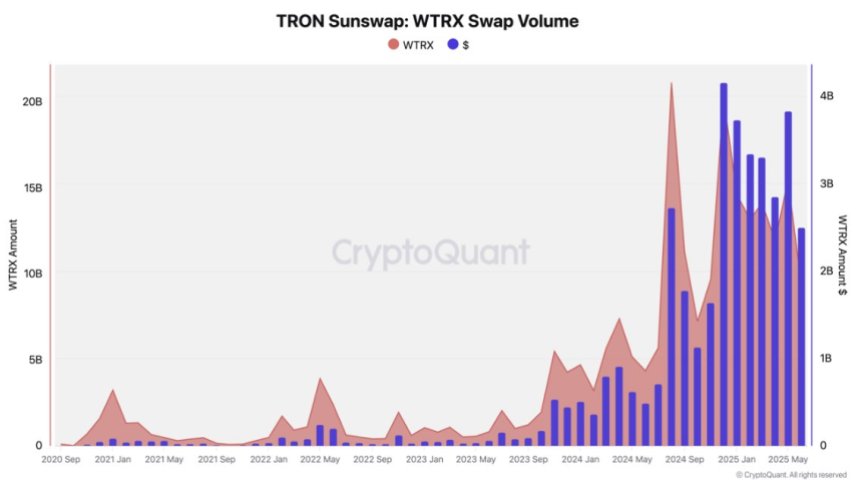

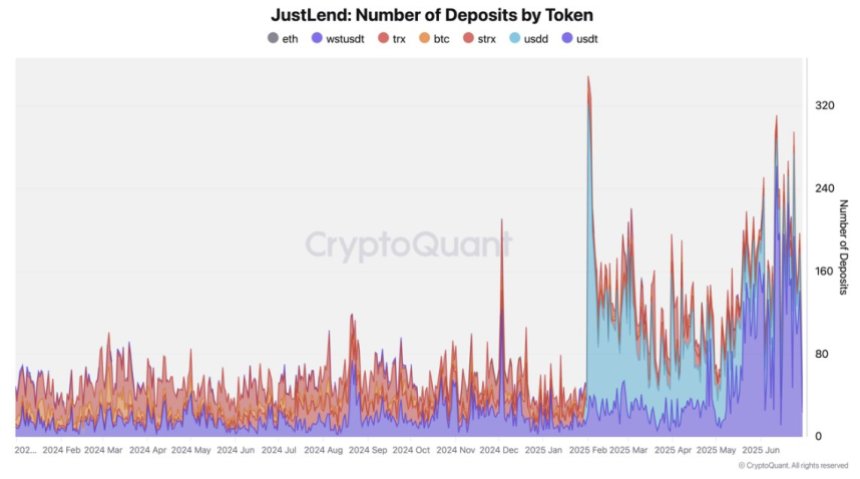

According to CryptoQuant data , DeFi activity on the Tron network is rising rapidly. SunSwap has surpassed $3 billion in monthly swap volume consistently throughout 2025, with May setting a record at $3.8 billion. Meanwhile, JustLend deposits have more than tripled year-to-date, peaking at $740 million. These developments point to deepening liquidity and growing demand across Tron’s DeFi ecosystem.

Stablecoin inflows and increasing borrowing activity further reinforce Tron’s expanding utility, suggesting the network is becoming a robust settlement layer. While the price remains range-bound for now, the fundamentals hint at a strong foundation for future upside, once the technical breakout finally materializes.

TRX Price Consolidates Near Resistance

TRX is currently trading around $0.2813, maintaining its position near the upper boundary of the long-standing consolidation range that began in December 2024. The asset has shown resilience above the 50-day, 100-day, and 200-day moving averages, all of which are trending upward, supporting the bullish outlook. The 50-day SMA at $0.2508 and the 100-day SMA at $0.2289 are providing dynamic support, indicating strong buyer interest on dips.

Price action throughout June remained sideways, with low volatility and volume consistent with a classic consolidation phase. Despite multiple rejections below the $0.295 resistance, TRX has not shown any signs of structural weakness, holding firmly above $0.26–$0.27 and gradually building pressure toward a breakout.

Volume has remained stable, though not yet signaling the kind of breakout momentum that would confirm a move into higher price discovery. Traders are watching closely for a clean candle close above $0.295 to validate a bullish continuation. If successful, TRX could rally toward the $0.32–$0.35 zone, with minimal overhead resistance.

Featured image from Dall-E, chart from TradingView

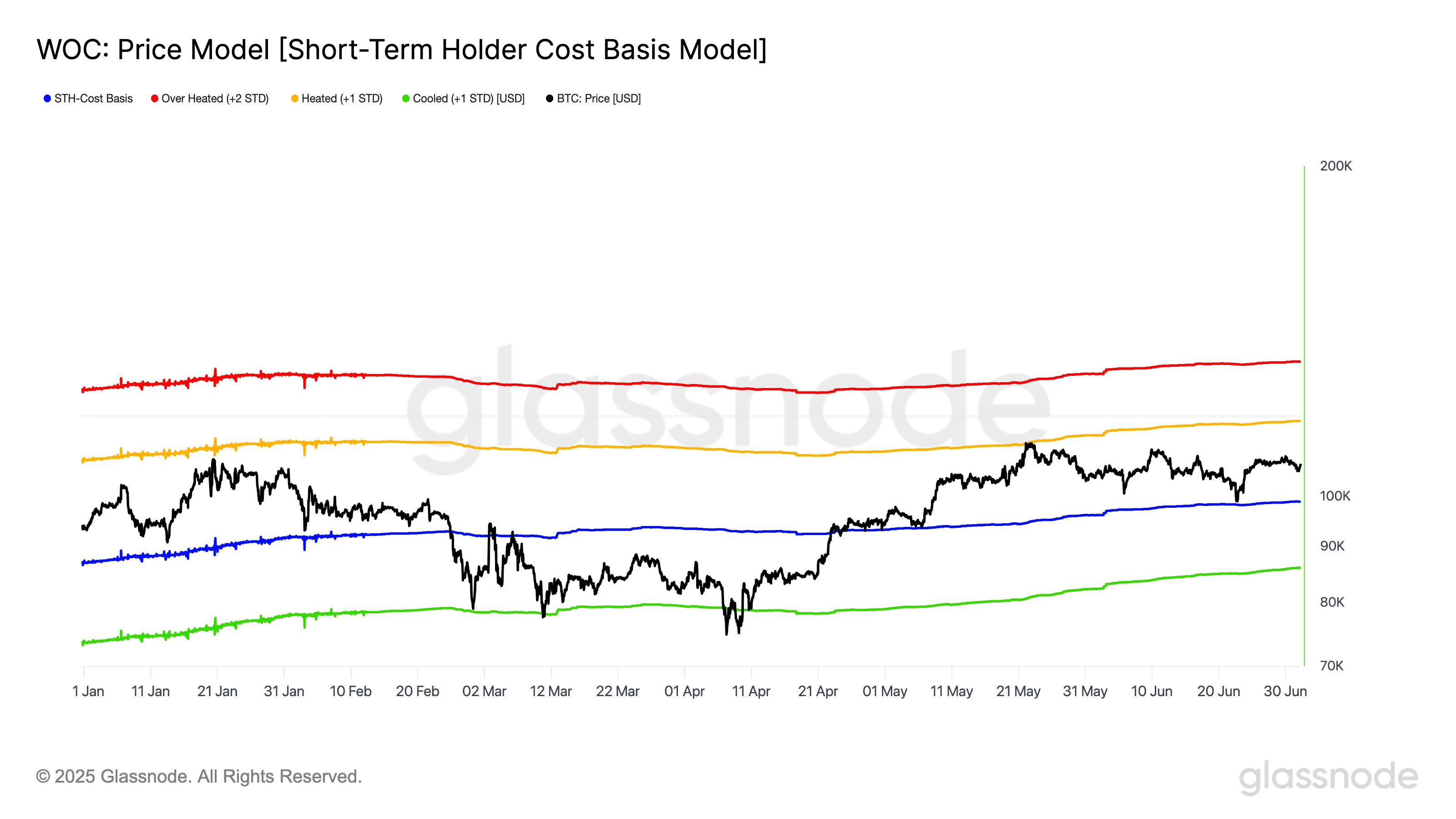

Bitcoin Short-Term Upper Bound Is $117,000, Glassnode Says

The on-chain analytics firm Glassnode has revealed Bitcoin has recently been trading within a short-...

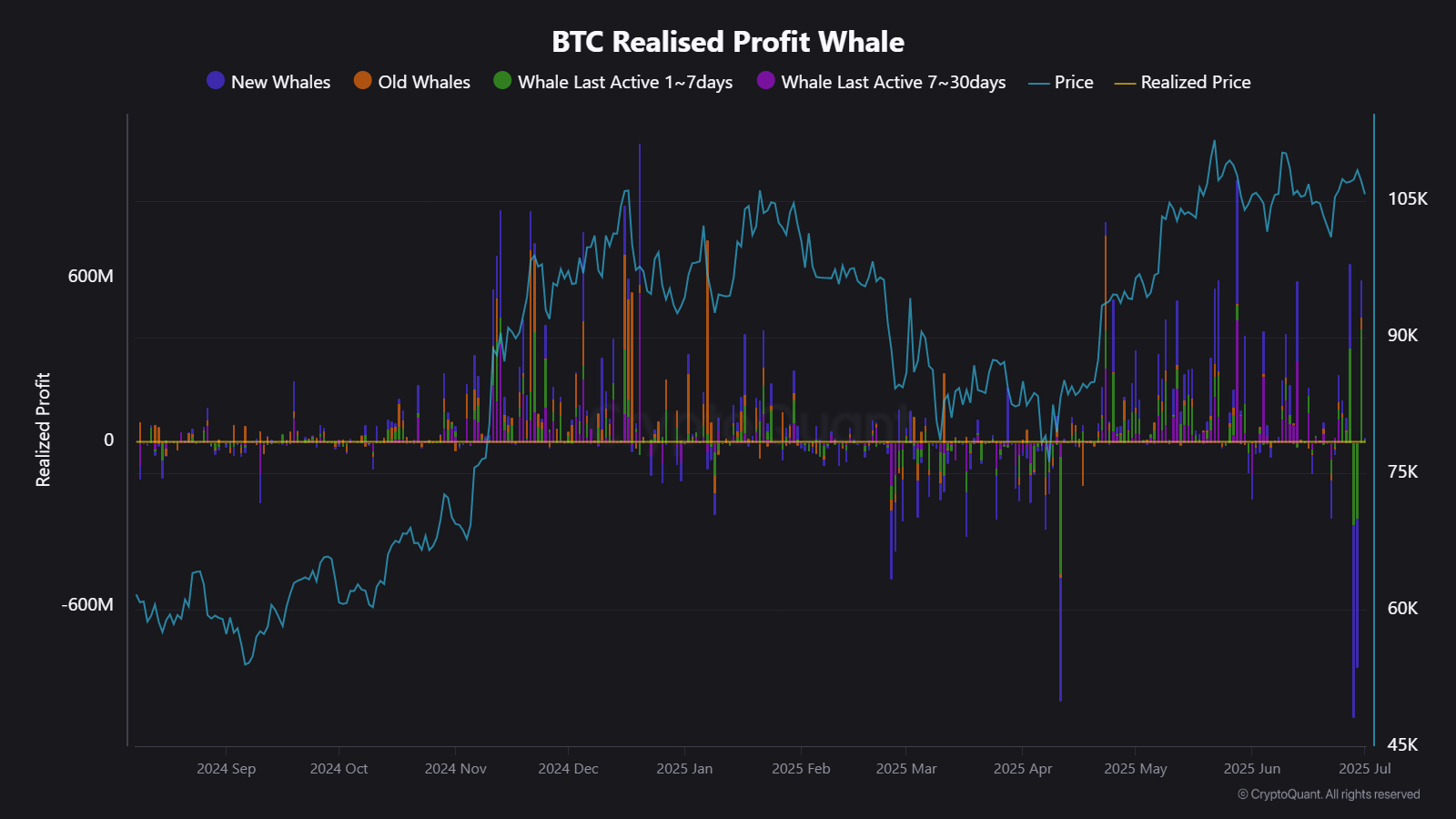

Whales Are Quietly Repositioning, Here’s What Bitcoin’s $107K Price Isn’t Telling You

Bitcoin continues to show little upward momentum as it trades below the $110,000 mark. As of the tim...

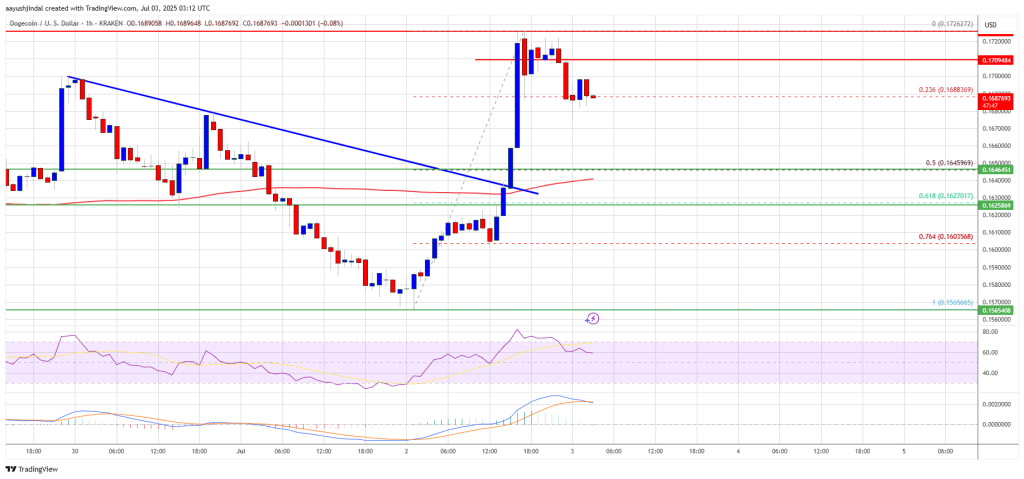

Dogecoin (DOGE) Bounces Off Lows, But $0.180 Cap Remains A Challenge

Dogecoin started a fresh increase above the $0.1650 zone against the US Dollar. DOGE is now consolid...