Bitcoin Records 2nd Consecutive Week of Cash Inflows: Is a Breakout Rally Coming?

The post Bitcoin Records 2nd Consecutive Week of Cash Inflows: Is a Breakout Rally Coming? appeared first on Coinpedia Fintech News

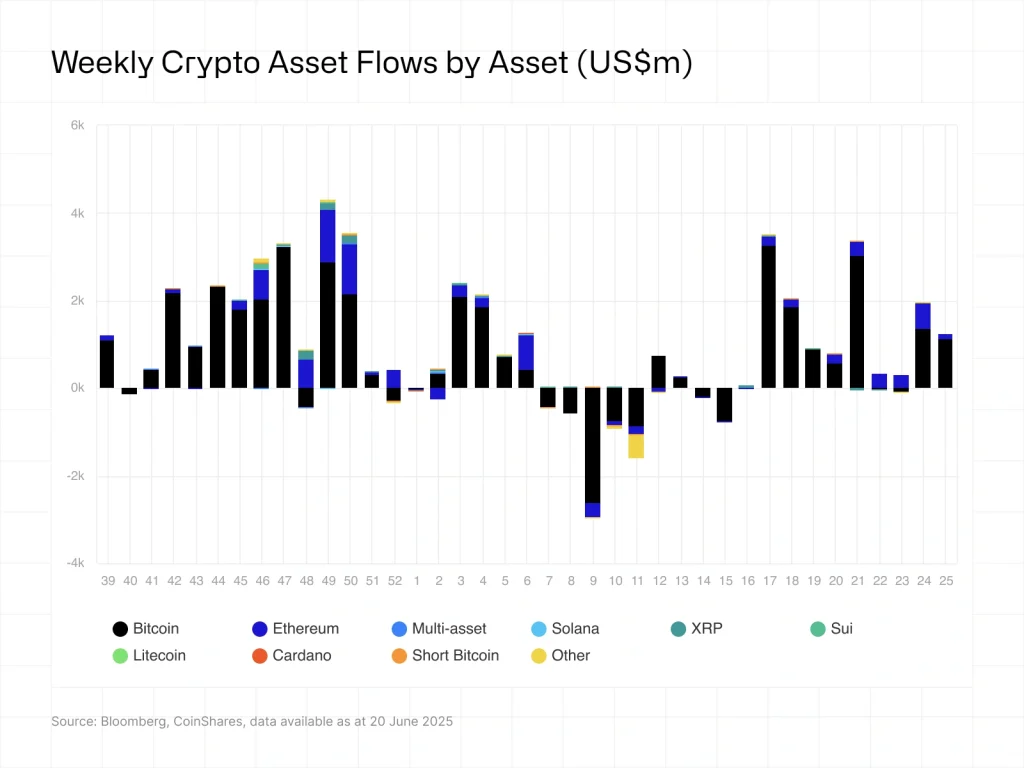

Bitcoin (BTC) demand by institutional investors has remained high amid rising fears of short-term crypto market capitulation. According to market data from CoinShares, Bitcoin’s investment product recorded the second consecutive week of cash inflow last week of about $1.1B.

As a result, the BTC’s investment products have posted a net monthly flow of about $2.38 billion and a year-to-date cash inflow of around $12.7 billion. The United States led in net cash inflows of about $1.25 billion, while Hong Kong and Switzerland posted a net cash outflow of about $32.6M and $7.7M respectively.

Is Bitcoin Price Ready for a Bullish Breakout?

Bitcoin price has rebounded over 3 percent to trade about $104,100 on Monday, June 24, during the mid-North American trading session. The flagship coin, however, faces a significant resistance range between $110k and $112k.

In the weekly timeframe, BTC price has been forming a potential macro double top coupled with a bearish divergence of the Relative Strength Index (RSI) .

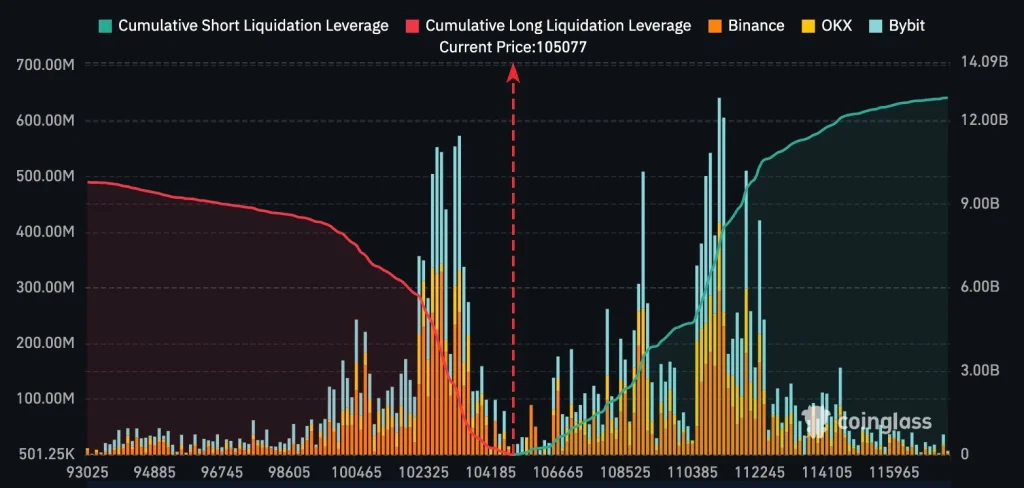

With the market data from Coinglass showing more than $12 billion in cumulative short liquidation leverage, BTC price faces further bearish sentiment in the coming weeks.

As Coinpedia reported , crypto analyst Benjamin Cowen thinks that the wider crypto market, led by BTC, will record lower lows in the coming months and potentially establish a local low in August or in September, 2025.

From a technical analysis standpoint, if BTC price consistently closes below $100k in the coming week, a selloff towards the support level around $96k will be inevitable.

Trump Media’s $2.3B Bitcoin Treasury Strategy Shocks Wall Street

The post Trump Media’s $2.3B Bitcoin Treasury Strategy Shocks Wall Street appeared first on Coinpedi...

Ripple Settlement Update: No, They’re Not Paying the SEC in XRP

The post Ripple Settlement Update: No, They’re Not Paying the SEC in XRP appeared first on Coinpedia...

Pro-XRP Lawyer Talks Ripple IPO Timing, Predicts $100B Valuation

The post Pro-XRP Lawyer Talks Ripple IPO Timing, Predicts $100B Valuation appeared first on Coinpedi...