Ethereum Stalls at $2,500, But Is a $4,000 Breakout Closer Than You Think?

Ethereum has struggled to maintain upward momentum following a brief rally that pushed its price above $2,800 last week . Currently, ETH is trading at $2,511, reflecting a 9.4% decline over the past week.

This retreat comes amid a broader period of consolidation across the digital asset market, with Ethereum seeing both technical resistance levels and on-chain trends that could shape its price action in the coming weeks.

Ethereum Faces Technical Resistance

The latest analysis from İbrahim COŞAR, a contributor to CryptoQuant’s QuickTake platform, highlights the significance of the 50-week exponential moving average (EMA) as a resistance level for ETH. Historically, successful breakouts above this technical marker have been followed by substantial price gains.

COŞAR notes that in prior cycles, once ETH crossed above the 50-week EMA, price increases ranged from 25% to 135%. Averaging those moves suggests a breakout could see Ethereum targeting the $4,000 range.

The EMA is a trend-following indicator that places more weight on recent price action, often used to identify potential breakout or breakdown zones in asset movements .

Staking and Accumulation Metrics Show Investor Conviction

In parallel to price action, Ethereum’s staking metrics continue to show steady growth. On-chain analyst OnChainSchool reported that more than 500,000 ETH were staked in the first half of June, bringing the total staked to over 35 million ETH.

This milestone represents the highest amount ever locked in Ethereum’s proof-of-stake contract and reflects a growing trend toward network participation and supply reduction.

Staking, in ETH’s case, involves locking ETH to help secure the network and validate transactions in return for staking rewards. As the amount of ETH staked rises, the liquid circulating supply shrinks, potentially tightening available supply on exchanges.

Additionally, accumulation wallets, or addresses with no history of selling, have also reached an all-time high, now holding 22.8 million ETH. Combined, these metrics point toward long-term holding behavior, rather than speculative trading.

Ethereum Hits ATH in Staking: Over 35 Million ETH Locked

“Alongside this, Accumulation Addresses (holders with no history of selling) have also reached an all-time high, now holding 22.8 million ETH.” – By @onchainschool

Read more

https://t.co/WYoX9qpODZ pic.twitter.com/6MAlK0sCfJ

— CryptoQuant.com (@cryptoquant_com) June 17, 2025

These on-chain developments coincide with ongoing interest in Ethereum-based financial products. The Ethereum ecosystem has seen renewed institutional and retail engagement, particularly after the US Securities and Exchange Commission approved the first spot ETH ETFs.

Just recently, SharpLink Gaming, a Nasdaq-listed firm, also a marketing partner to sportsbooks and online casino gaming operators, unveiled a $425M Ethereum reserve strategy led by ConsenSys.

Featured image created with DALL-E, Chart from TradingView

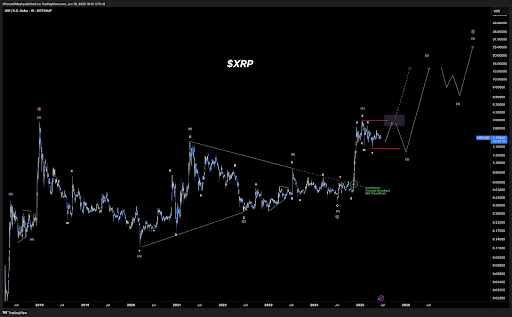

XRP 5-Wave Count Shows When The Price Will Hit All-Time Highs Above $5

Crypto analyst XForce has again alluded to the 5-Wave count to show when the XRP Price is likely to ...

Bitcoin Is The Purest AI Trade, Says Wall Street Veteran

Macro investor Jordi Visser has published a Substack essay arguing that Bitcoin is “the purest AI tr...

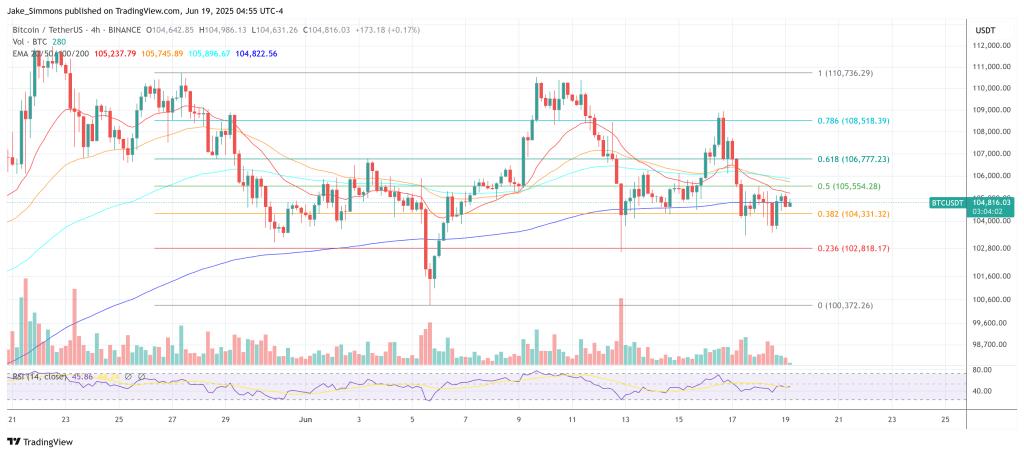

Bitcoin’s Momentum Wobbles—Analyst Predicts Correction Below $94K

Bitcoin’s recent climb to $105,000 has done little to shake off the worries piling up around its mom...