Ethereum Whales Ramp Up Accumulation By 1.50 Million ETH — Incoming Price Boom?

In line with the crypto market, Ethereum prices briefly crashed below $2,500 on Friday due to escalating geopolitical tensions between Israel and Iran. The prominent altcoin currently trades around $2,567 following a slight recovery but remains some distance off the week’s high of $2,871.

Amidst all these recent developments, prominent blockchain analytics company Santiment has shared a positive report hinting at a bullish ETH future.

ETH Whale Holdings Grow By 3.72% In 30 Days

In an X post on June 14, Santiment provides valuable insights into Ethereum whales’ behaviors. The credible analytics firm reports that all 6,392 of such investors holding between 1,000 and 100,000 ETH have significantly increased their holdings over the past month compared to retail investors.

In adding data to this claim, Santiment further shares that ETH whales have acquired 1.49 million ETH, worth $38.26 million, in the past 30 days, boosting their total holdings by a significant 3.72%.

Generally, whale accumulations are bullish signals that indicate an asset’s strong potential for long-term price appreciation. Therefore, ETH’s recent whale activity is likely to encourage significant levels of retail investment that could incite a price rally.

Interestingly, CoinMarketCap data shows the altcoin has recorded a 2.38% decline over the past month. The token’s price has largely oscillated within a range of $2,400 to $2,800, reflecting indecision in the market amidst external pressures and a lack of clear bullish catalysts.

Ethereum whales have conducted this accumulation spree during a period of market uncertainty, indicating strong investor confidence regardless of the present market situation.

Ethereum Price Overview

At the time of writing, Ethereum trades at $2,536 following a price gain of 1.18% in the past day. Meanwhile, the altcoin is up by 3.82% on its weekly chart after a notable brief price ascent above $2,800.

According to data from CoinCodex , the general ETH market sentiment is bullish while the Greed & Fear Index stands at 61 (Greed). This report is well reflected in the reported accumulation trend.

Related Reading: Ethereum Faces Stress As Israel-Iran Conflict Shakes Sentiment – ETH/BTC Support In Focus

The CoinCodex team predicts Ethereum will maintain its range-bound movement in the short term, as indicated by projections of $2,825.11 in five days and $2,767 in a month.

Meanwhile, their long-term forecasts paint a strong bullish future of $4,269.40 in the next three months.

With a market cap of $309.46, Ethereum continues to rank as the second-largest cryptocurrency with a market dominance of 9.4%.

Amid Bitcoin Hype, Seasoned Trader Predicts Sudden Drop To This Level

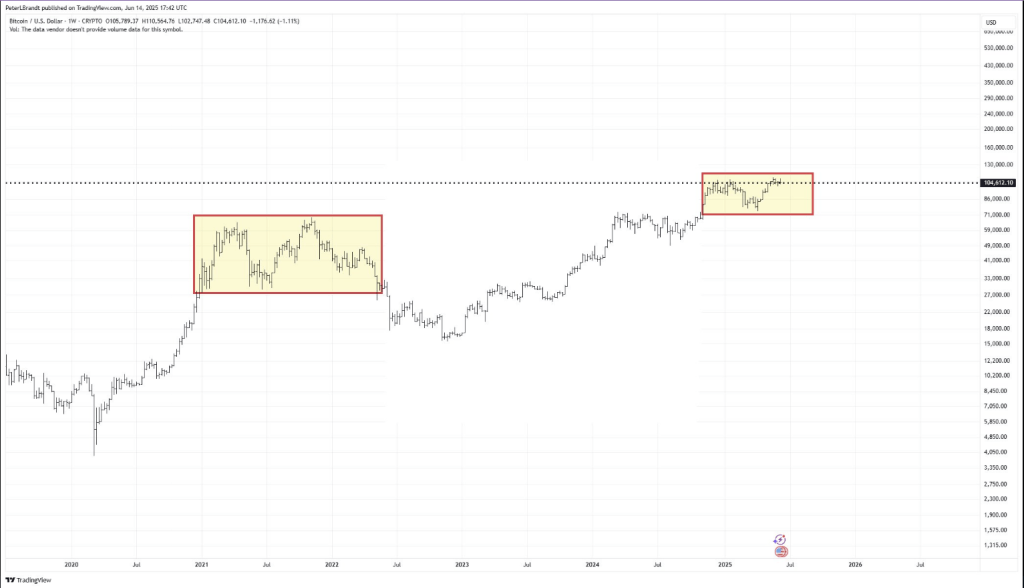

Bitcoin is at a crossroads again. Prices have been bouncing between $61,000 and $104,000 for about s...

Dormant Ethereum Wallet Awakens After 10 Years With Millions Worth Of ETH

Ethereum has been consolidating around the $2,500 price level over the past few days, showing little...

If Patience Had Value, XRP Holders Would Own The Market—Expert

In a recent market twist, XRP surged almost 600% between November 2024 and January 2025. Based on la...