Peter Brandt Warns Bitcoin Could Face 75% Drop Similar to 2022 Crash

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Peter Brandt, a respected figure in the trading community, recently warned that Bitcoin could face a dramatic price drop, drawing comparisons to its 2022 chart setup.

His remarks come at a time when. Bitcoin has seen a notable 1.87% price increase in the last 24 hours and a 3.61% rise over the past week, now priced at $109,192.

Despite the positive momentum, Brandt’s technical analysis suggests the market could be gearing up for a major reversal.

Bearish Reversal Concerns

According to Brandt, the current setup mirrors the 2022 scenario, where Bitcoin underwent a substantial decline. He points out the presence of a Double Top pattern, a bearish technical formation that indicates potential price reversal.

https://twitter.com/PeterLBrandt/status/1932391437636641256

In addition, the Exponential Moving Averages (EMA) are also signaling a downward trend, further suggesting that the market may be heading for a correction.

Technical Indicators Reflect Bearish Sentiment

The chart provided by Brandt highlights the emergence of a Double Top pattern, which typically signals a bearish reversal in price action. For context, the first top formed when BTC claimed highs above $108,000 in December 2024 and January 2025.

However, the asset faced a considerable decline below $100,000 after this peak. Interestingly, following the recovery that began in April, Bitcoin soared to a new all-time high near $112,000 last month, forming the second top.

Notably, this Double Top pattern mirrors a similar setup seen in 2022. For context, Bitcoin hit an initial top of $65K in April 2021. After this, it dropped and then recovered to a second top of $69K in November 2021, marking its ATH. After the $69K peak, Bitcoin collapsed considerably, leading to the bear market. Brandt's chart suggests another drop could be looming again.

Moreover, the 9-period EMA crossing below the 21-period EMA has historically marked the beginning of a downward trend, further reinforcing Brandt’s concerns. These technical indicators have led some traders to anticipate a potential 75% crash, should history repeat itself. A 75% decline from $109,192 would indeed bring Bitcoin’s price to around $27,298.

Derivatives Data Shows Diverging Trends

Amid Brandt’s warnings, Bitcoin’s derivatives data paints a more complex picture. Bitcoin’s volume has surged by nearly 30%, now at $100.33 billion, indicating heightened market activity. This rise in volume typically precedes significant price movements. Moreover, open interest in Bitcoin has also increased by 1%.

The Binance BTC/USDT Long/Short ratio of 0.5501 and the OKX BTC Long/Short ratio of 0.53 both indicate that more traders are holding short positions than long positions, suggesting a bearish sentiment in the market on these exchanges.

Bitcoin Investment Products See Outflows

Meanwhile, Bitcoin’s investment products

have seen

modest outflows. Over the past week, Bitcoin faced $56.5 million in outflows, signaling a potential shift in investor sentiment. This comes as Ethereum has experienced strong inflows, leading the way with $296.4 million.

The continued outflows from Bitcoin investment products, along with short-Bitcoin products, may further suggest that market participants are adjusting their expectations amid ongoing uncertainty.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/510808.html

Related Reading

If Patience Were a Token, XRP Holders Would Already Be Billionaires: Pundit

A crypto pundit and market commentator has commended the patience of XRP holders amid years of exten...

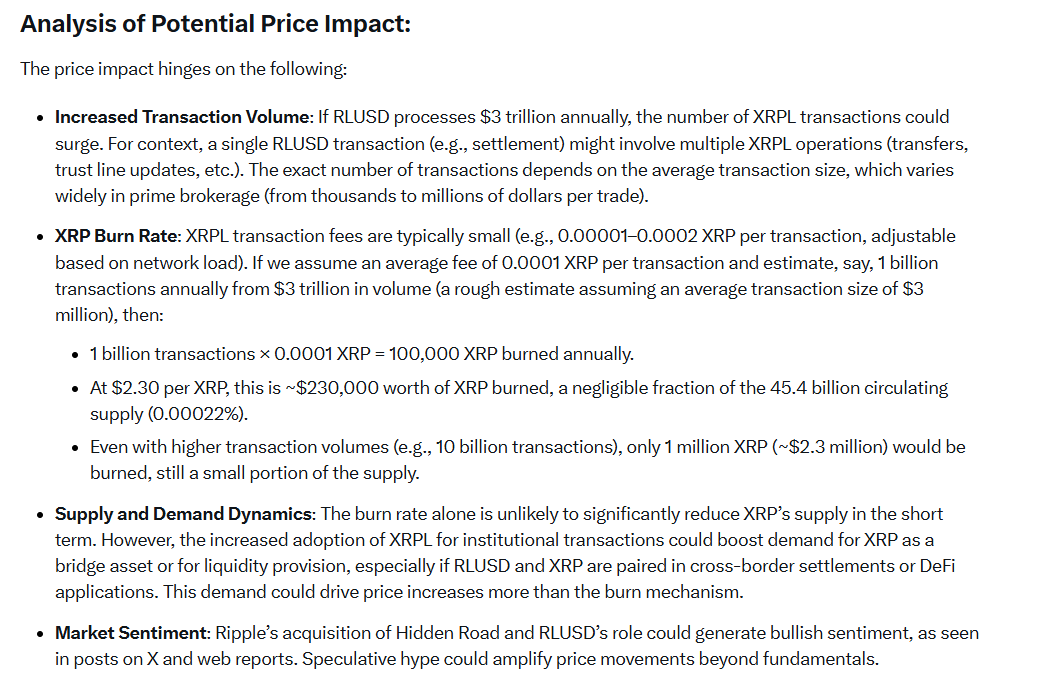

Here’s Predicted XRP Price If XRPL Handles 100% of Hidden Road’s Volume

XRP price could witness a massive boost if the XRP Ledger handles 100% of the transaction volume pro...

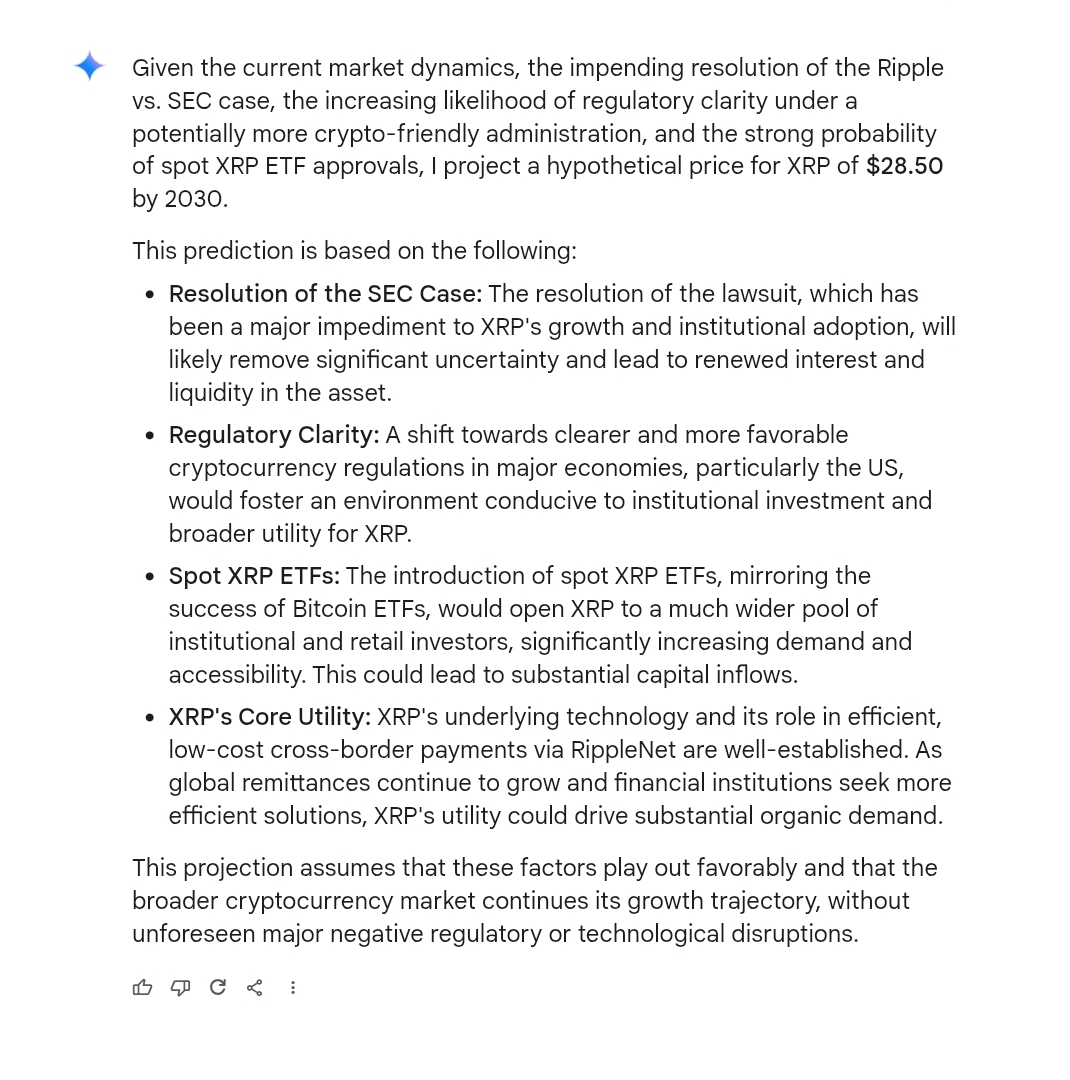

Here’s How Much $10,000 Investment in XRP Can be Worth in 5 Years

A $10,000 investment in XRP could grow to impressive heights by 2030, depending on how XRP's price a...