Trump Media Registers $12 Billion in New Securities Amid Bitcoin Acquisition Plans

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Trump Media and Technology Group, the parent company of Truth Social, has filed to register up to $12 billion in new securities following Bitcoin acquisition plans.

This move, disclosed in a recent S-3 filing, marks another significant step for the company, which recently concluded a $2.3 billion Bitcoin treasury deal.

The

filing

reveals plans to issue up to 84.6 million shares of common stock. However, the offering will not take effect until the SEC grants approval.

Bitcoin Treasury Deal and Future Acquisitions

Trump Media’s decision to file for additional securities follows its recent involvement in acquiring Bitcoin. Last week, the company announced a Bitcoin treasury deal valued at $2.3 billion. This move aims to strengthen Trump Media’s capital position, as well as support its future expansion.

Notably, the company had previously denied reports suggesting it would raise a larger $3 billion fund for Bitcoin investments. Despite this, the current filing indicates the company’s intention to continue acquiring the cryptocurrency. With this, it positions itself alongside other firms like

Strategy

, which have adopted similar Bitcoin acquisition strategies.

Meanwhile, Trump Media’s growing interest in Bitcoin signals a broader trend among companies exploring ways to integrate the digital currency into their portfolios. Companies such as Marathon Digital and Metaplanet have also engaged in Bitcoin acquisitions.

Interestingly, new entrants have emerged. Specifically, KULR Technology entered the scene in December 2024 with $21 million worth of Bitcoin. Acurx Pharmaceuticals and Hoth Therapeutics also announced plans to acquire BTC this year. In addition, gold mining firm Bluebird recently

became

the latest entrant.

Expansion Plans and Capital Markets Access

Devin Nunes, the CEO and President of Trump Media,

emphasized

the company's focus on securing capital for rapid growth. He mentioned that the capital raised through these initiatives would provide the flexibility needed to acquire valuable assets and increase the company's customer base.

This, in turn, is expected to enable Trump Media to tap into capital markets when most advantageous. Nunes highlighted that the company's goal is to ensure financial independence while accelerating its growth trajectory, which is increasingly dependent on acquiring digital assets like Bitcoin.

Furthermore, Trump Media's involvement in crypto extends beyond just holding Bitcoin. The company is also exploring the

launch

of a Bitcoin exchange-traded fund, which could expand its presence in the crypto market. This is in line with other companies offering similar financial products related to Bitcoin.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/510181.html

Previous:分析师梁丘:6.7比特币/以太坊凌晨继续看冲高回落为主

Next:比特币以太坊凌晨最新行情走向分析:6/6

Related Reading

Experts Say in Just 5 Years Everyone Will Wish They Had Bought XRP Today

Social media influencer John Squire has warned market participants that those not holding XRP today ...

Cardano to Become a Top 5 Coin Amid Relationship with Bitcoin and XRP: Top Analyst

A top analyst has identified a recent relationship Cardano has with two of the top three cryptocurre...

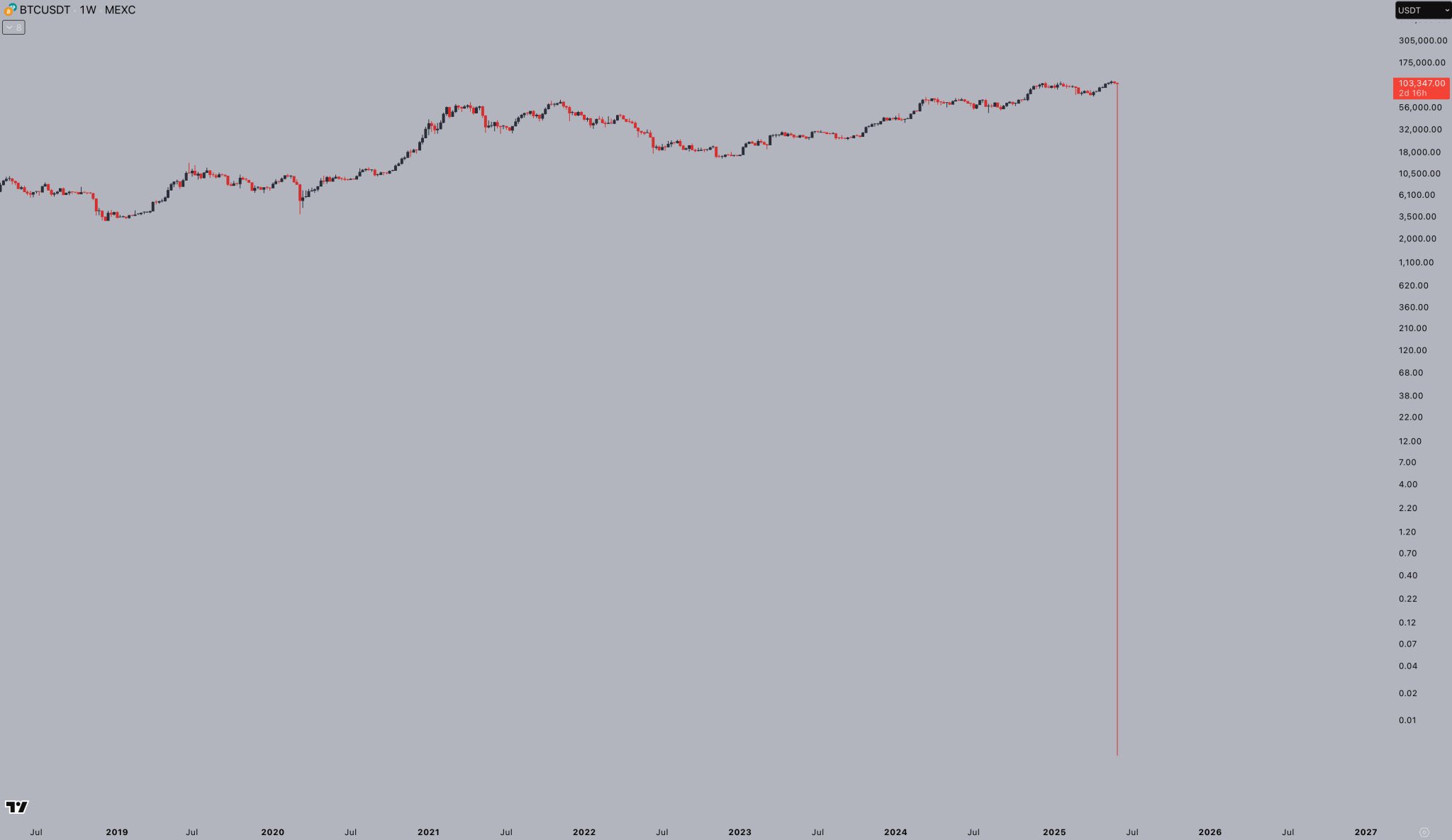

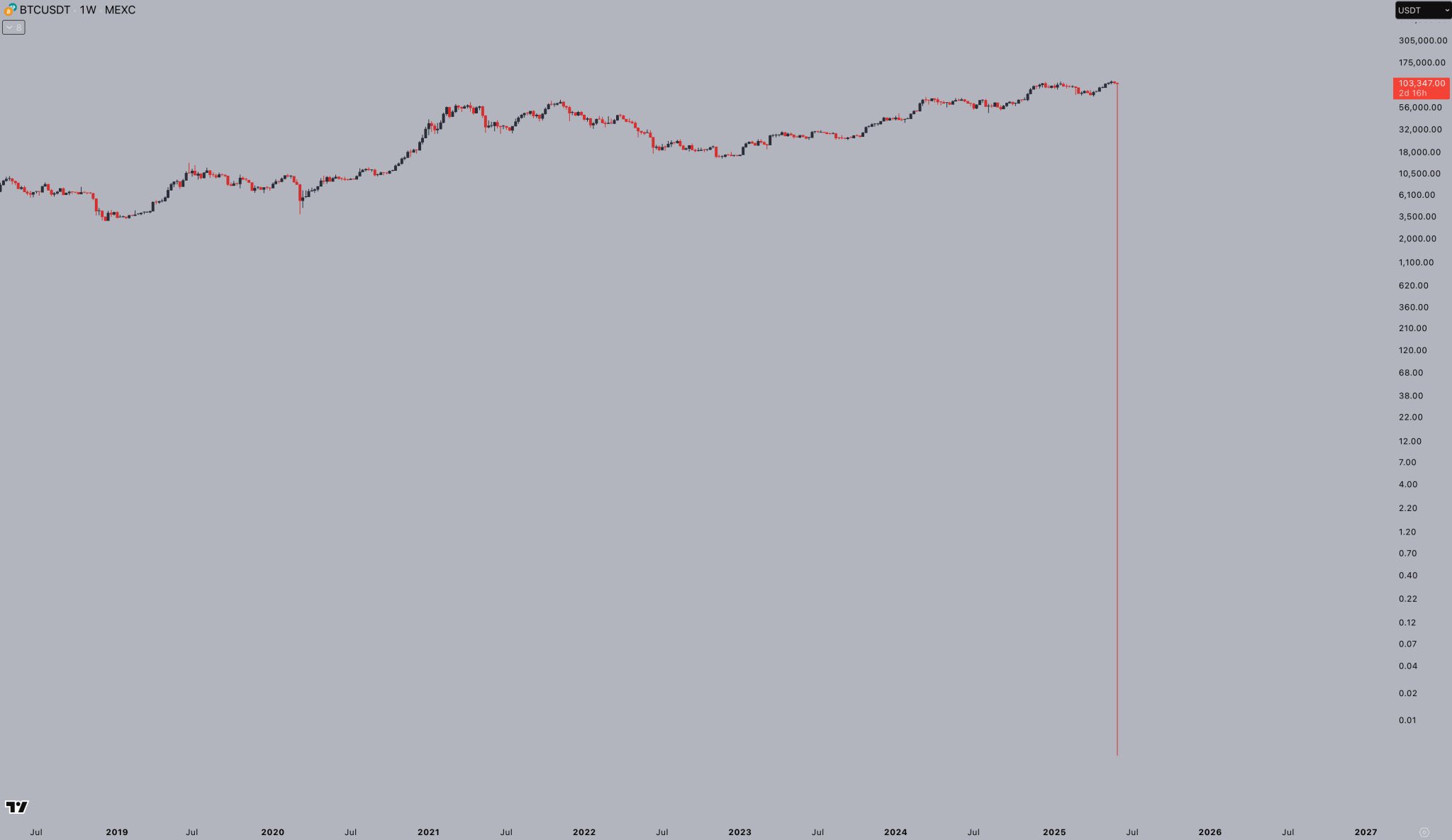

Bitcoin Drops 100% from $103,000 to $0 on MEXC Exchange: Here’s What Happened

A TradingView glitch caused Bitcoin to drop by 100% to $0 on the crypto exchange MEXC, sparking an u...