Bitcoin Could Break The Dollar — $250K Prediction Still In Play, Billionaire Says

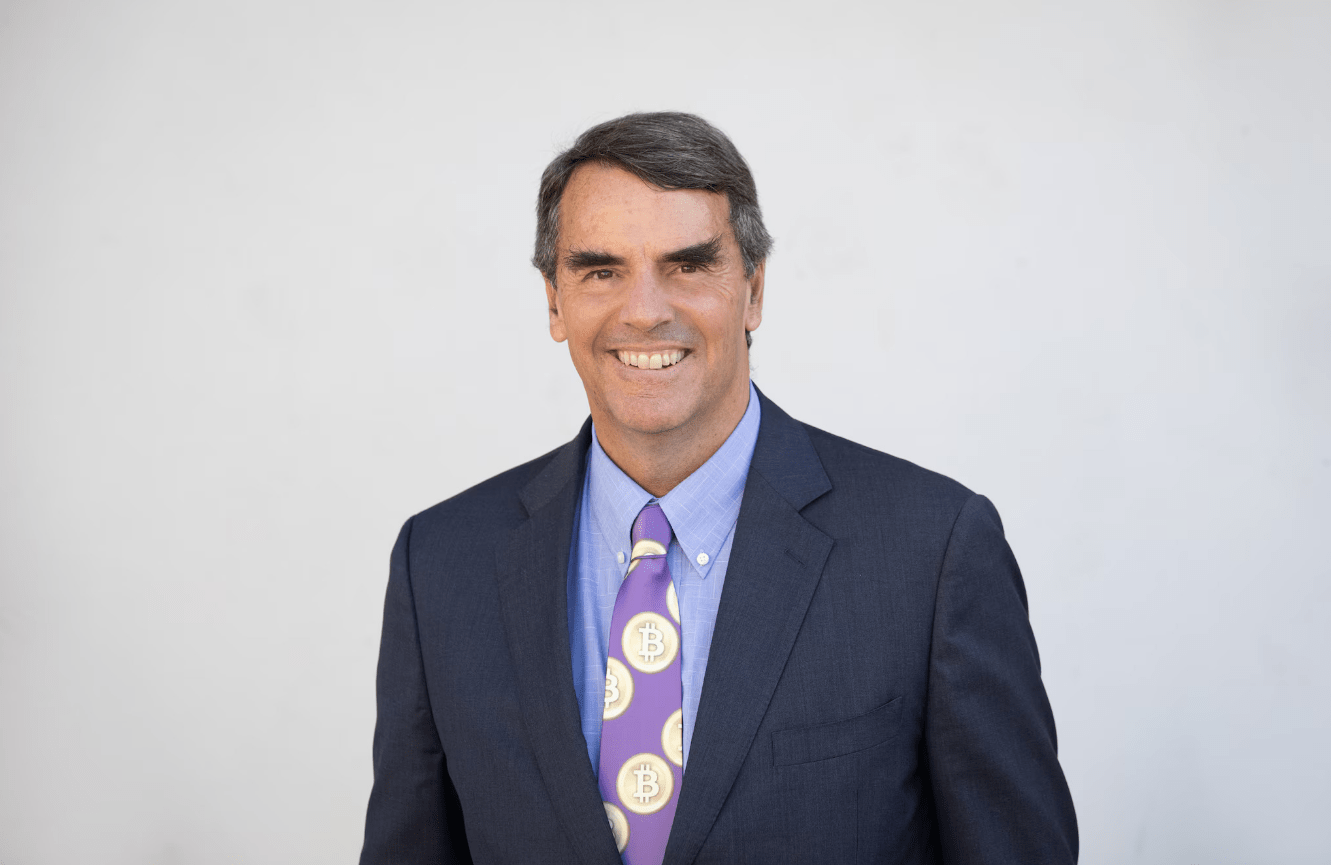

Tim Draper , a Silicon Valley venture capitalist, has doubled down on his call for Bitcoin to hit $250,000 by the end of 2025. He shared this on X, renewing a prediction he first made in 2018 when he set his sights on reaching that mark by 2022.

Back then, the crypto market took a sharp downturn in 2022—thanks in part to FTX’s collapse—and the timeline slipped. Still, Draper believes today’s drivers are strong enough to push prices higher. He even suggested that the US dollar might vanish in a decade as Bitcoin takes its place.

Tim Draper’s Bold Timeline

According to Draper, the $250,000 target isn’t just wishful thinking. In 2018, he said Bitcoin would reach that level by 2022. It didn’t happen—2022 saw many digital assets tumble in value. This year, though, he repeated his forecast after seeing a “recent surge” in the crypto.

Bitcoin might go infinite against the dollar.

On the heels of the recent surge, I’m still expecting Bitcoin to reach $250,000 this year.

Whether Bitcoin will keep gaining ground that fast, who knows.

But the main factors pushing it forward right now are:

→ General optimism… pic.twitter.com/EiD36iYbRy

— Tim Draper (@TimDraper) June 4, 2025

He also claimed Bitcoin could become “infinite against the dollar,” arguing that in 10 years the US dollar wouldn’t exist. His confident tone suggests he’s sticking with the same numbers—$250,000 by December 31, 2025.

Political And Regulatory Drivers

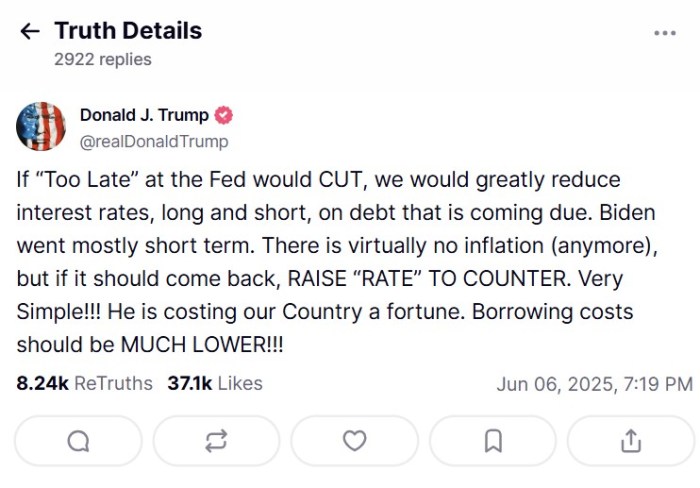

Based on reports, Draper points to politics as a big catalyst. He highlighted moves by US President Donald Trump, who is working on new trade deals. One sign of this push is the Media & Technology Group’s filing on June 5, 2025, for a Truth Social Bitcoin ETF.

That application is headed to the NYSE Arca, with Crypto.com lined up as custodian, and it aims to bring more mainstream money into Bitcoin. On the regulatory front, the US Senate voted 66–32 on May 19 to advance the GENIUS Act , which would set rules for stablecoins.

Plus, the Digital Asset Market Clarity Act of 2025 is under debate. It has bipartisan support and is meant to spell out clear rules for crypto.

Financial Institutions And AdoptionDraper also sees banks and big companies stepping in. He mentioned that JP Morgan plans to let its clients buy Bitcoin and use spot-BTC ETFs—like BlackRock’s IBIT—as collateral. That shift could open doors to a flood of institutional cash.

Meanwhile, according to Bitcoin Treasuries data, Michael Saylor’s Strategy leads the pack, holding over 580,000 BTC. At current prices, that stash is worth about $61 billion. These moves, Draper argues, point to people treating Bitcoin more like gold than a risky token.

Technological Advances On BitcoinIn his view, the tech upgrades on Bitcoin matter too. He talked about Web3 apps built on Bitcoin and said “Layer 2 solutions give Bitcoin the flexibility of Ethereum .” Right now, Lightning Network handles many Bitcoin transactions, making payments faster and cheaper.

Featured image from Imagen, chart from TradingView

Ethereum Holds Key Range Support After Pullback – Bulls Eye $3,000 Level

Ethereum has faced a sharp pullback, dropping over 10% in the last 24 hours as global tensions and m...

Best Altcoins to Buy as Trump Urges Fed to Cut Interest Rates in Favor of Crypto

Bitcoin made a new all-time high on May 22 when it crossed $112K. Although it dipped below $100K soo...

The Return Of Altcoin Season: Why Bitcoin Dominance Must Fall To 62%

One of the reasons that the altcoin season seemed to not have begun until now is the fact that Bitco...