Strategy Partners Barclays and TD Securities to Raise $2.1B for Additional Bitcoin Purchases

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Leading business intelligence company Strategy (formerly MicroStrategy) announces plans to raise an additional $2.1 billion to grow its Bitcoin holdings.

In a

press release

today, Strategy unveiled plans to raise $2.1 billion by selling shares of its 10% Series A Perpetual Strife Preferred Stock (STRF). The Crypto Basic also confirmed the development in an X post today.

https://twitter.com/thecryptobasic/status/1925543917212021007

Strategy Enters New Sales Agreement

Consequently, on May 22, Strategy entered into a sales agreement with Barclays Capital, The Benchmark Company, and TD Securities. These financial institutions will be the sales agents for Strategy’s STRF offering.

According to a prospectus

filing

, these agents will execute the sale on behalf of Strategy in a disciplined manner over an extended period. This indicates that they will closely watch the stock’s price and trading volume and only issue it under favorable conditions.

STRF, which trades on the Nasdaq exchange, was worth $100.65 per share as of yesterday, May 21. While the agents are not required to meet any minimum sales goals, the Strategy aims to raise $2.1 billion via the offering.

Plans to Buy More Bitcoins

2% of the gross proceeds will be paid to the sales agents–TD Securities, Barclays, and the Benchmark Company. The remaining proceeds will be channeled to general corporate purposes, including acquiring additional Bitcoins and other routine expenses.

It has become common for Strategy to fund its Bitcoin purchases using proceeds raised through the sales of its stocks. Through this effort, Strategy has grown its Bitcoin holdings to 576,230 BTC. Strategy’s Bitcoin holdings represent 2.9% of BTC’s circulating supply, which currently stands at 19.86 million coins.

Strategy has been buying Bitcoin since August 2020 and is still poised to acquire more through the issuance of its STRF shares. The company has remained resilient in growing its Bitcoin stash despite reporting a Q1 2025 loss of $4.2 billion after adopting a new accounting method.

Notably, the STRF offering is part of Strategy's latest

fundraising plan

, which was recently unveiled. Strategy aims to raise $42 billion to fund more Bitcoin buys by issuing $21 billion worth of fixed income and another $21 billion in common shares.

Bitcoin Soars to New ATH

Meanwhile, the timing of the latest offering comes hours after Bitcoin registered a new all-time high (ATH). The premier cryptocurrency set an ATH of $111,861 in the early hours of today.

Although Bitcoin has retraced slightly to around $110,000, the firstborn crypto is still up 3.68% in the past 24 hours, 8.9% in the past week, and 22.72% in 30 days.

At the moment, Bitcoin is changing hands at $110,859, boasting a market cap of $2.2 billion.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/507542.html

Related Reading

Pundit Says XRP Today’s Prices Are a Generational Entry, Compares XRP to Bitcoin at $0.05

Crypto commentator Dustin Layton is urging XRP holders not to underestimate the potential of their h...

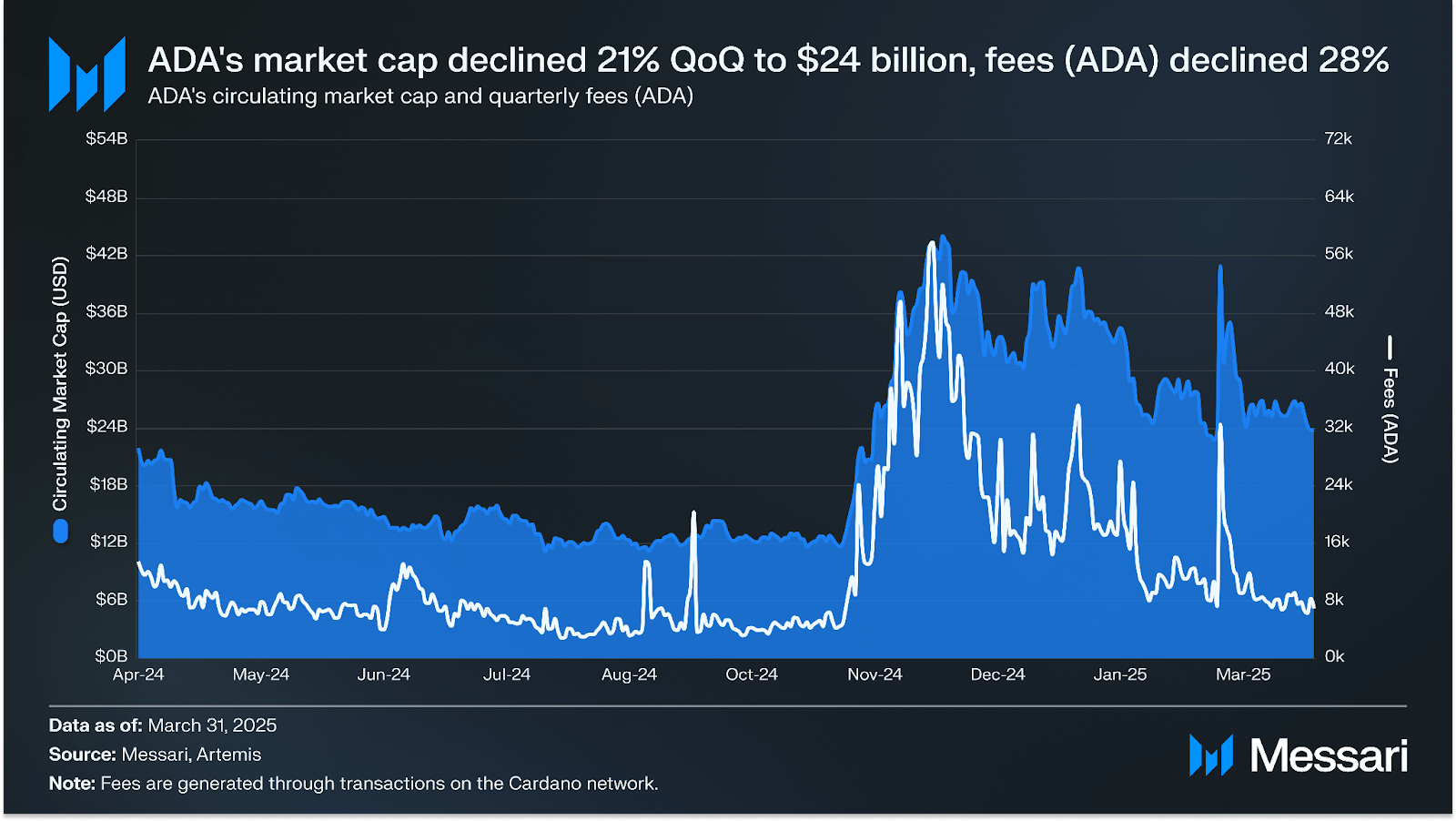

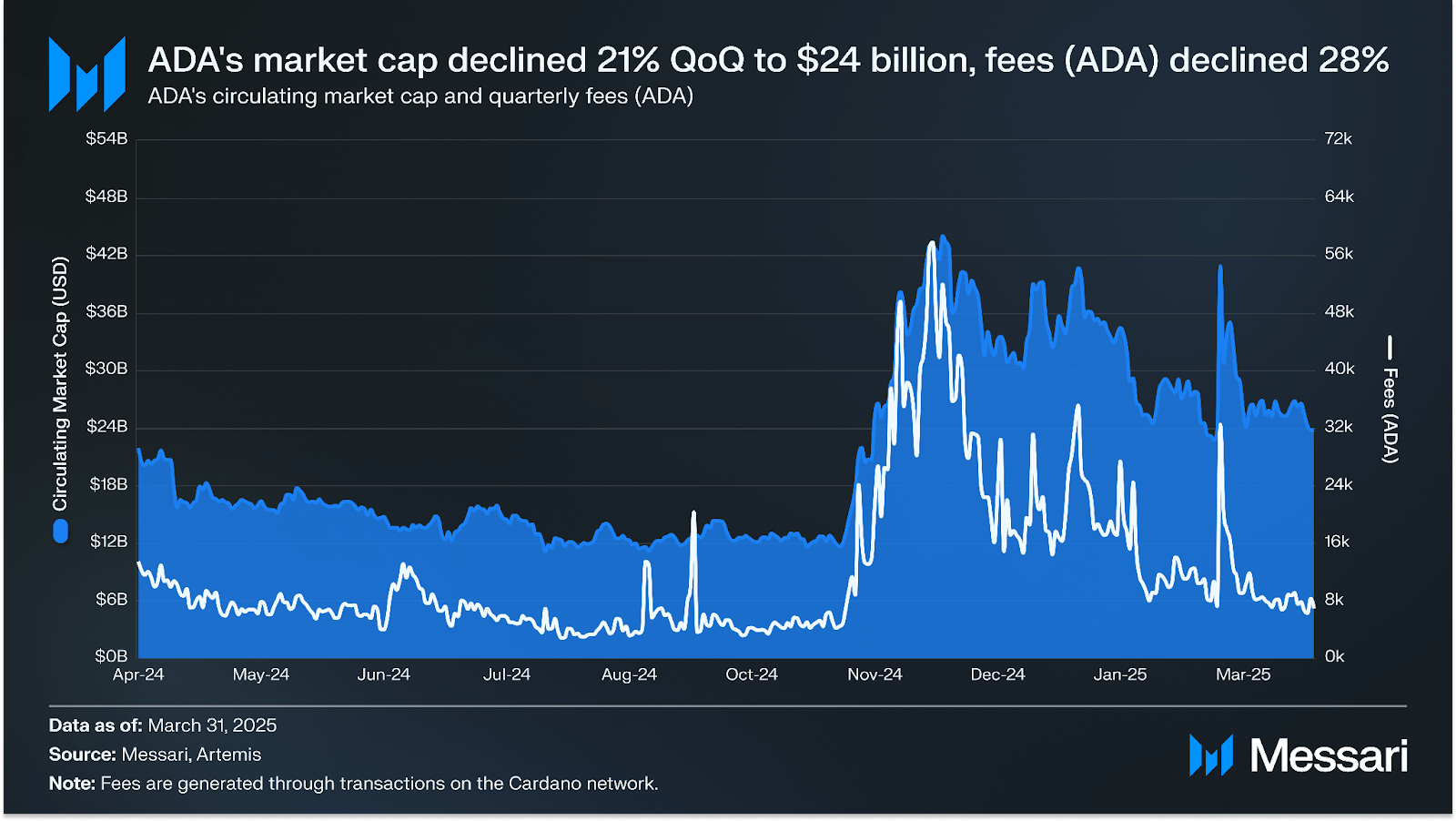

Cardano Ends Q1 2025 with $1.1B Treasury, Rising Governance Participation, and Mixed On-Chain Metrics

Leading analytics platform Messari has released a new report on Cardano, highlighting key developmen...

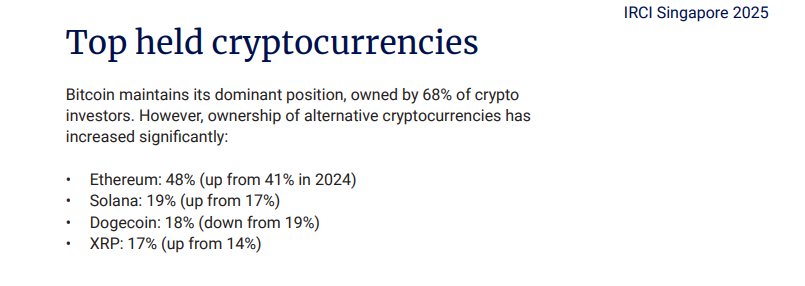

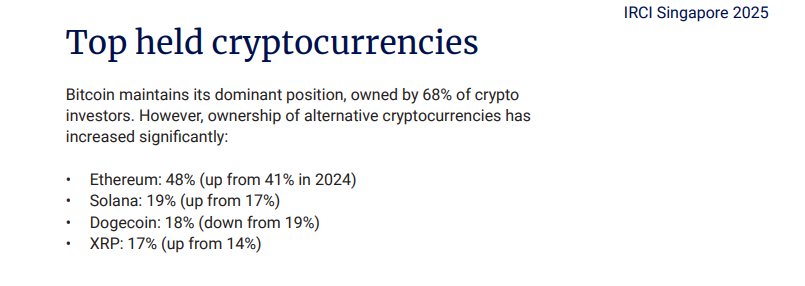

XRP Now One of the Top Holdings Among Singaporeans: Independent Reserve Report

Singaporeans are increasingly buying altcoins like XRP as the asset’s adoption spreads across the na...