Cardano Sees Largest ADA Exchange Outflow Since 2021

- Since January, close to 980 million ADA tokens have left exchanges.

- Daily active addresses on the Cardano network and its DEX volume are decreasing.

- ADA is at $0.72 and might drop if it does not maintain support or move past important resistance levels.

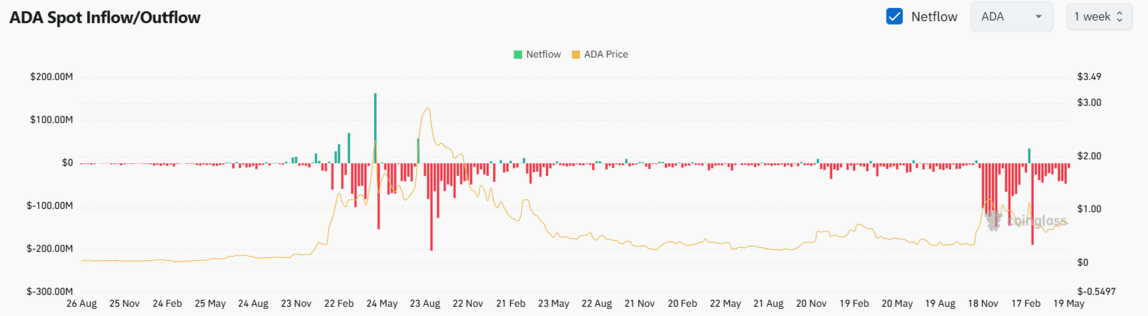

In the first quarter of the year, 980 million ADA were taken out of exchanges. At the moment, around $680 million is leaving exchanges, marking the greatest outflow since the 2021 rally. More investors going for self-custody could make a difference in how the ADA price changes.

As reported by CoinGlass, there hasn’t been a single positive netflow for ADA in 2022, which is much the same as what happened in mid-2021 before ADA reached its record high of $3. Alternatively, the price now stands at $0.72 and market signs suggest it could drop if it loses its support.

Outflows are commonly viewed as bullish, meaning individuals are holding assets instead of preparing to sell. However, on-chain and exchange data illustrate a different and more complicated state of events.

On-Chain Metrics Show Weakening Demand

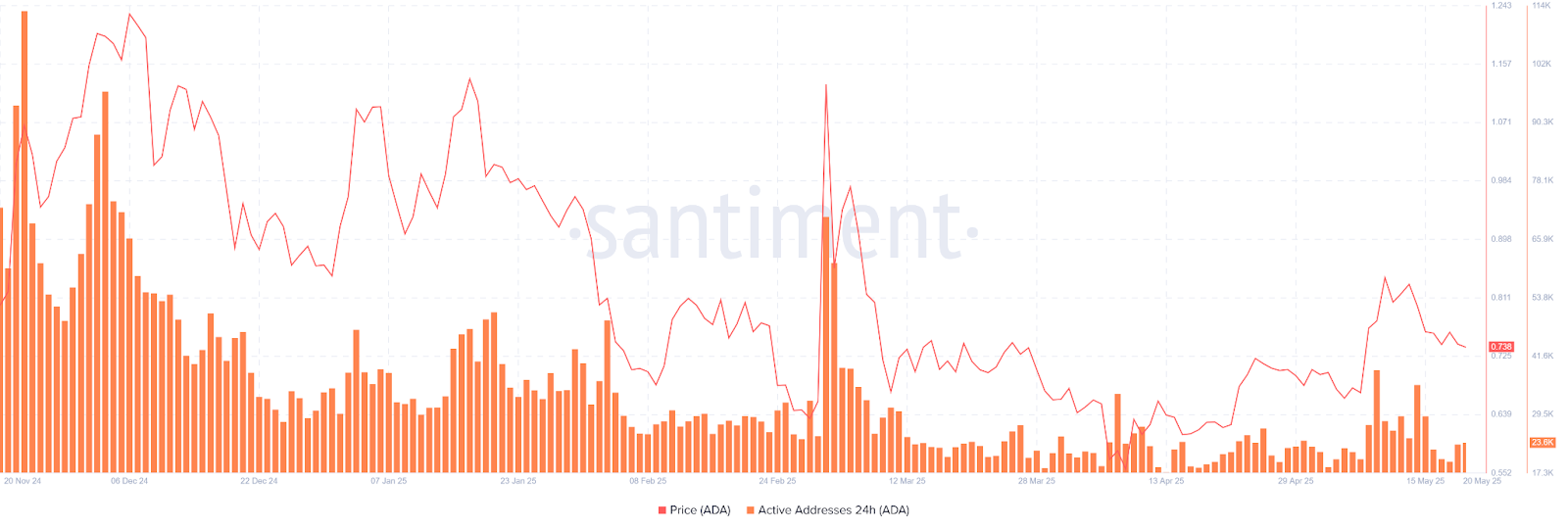

Exchange withdrawals indicate that investors expect to hold ADA in the long run, which is not the same as the current activity on Cardano’s blockchain. According to Santiment, daily active addresses have declined greatly, going from more than 35,000 users on May 14 to just 23,644 users on Tuesday. There has been a constant drop in users on the network ever since early March, highlighting less interaction.

At the same time, Cardano’s DEX trading volume is decreasing. According to DefiLlama, the daily volume is now just $3.06 million, much less than reported in December. Reduced trading activity in Cardano means fewer users and less liquidity in the ecosystem.

The decline in using blockchain supports the belief that the market is headed down. ADA’s strength is declining, and experts predict that a closing price below $0.72 could lead to more downside. Adding to the bearish sentiment are less active networks and muted market enthusiasm.

Analysts Weigh In with Diverging Views

Even as activity and prices fall, some analysts feel positive about ADA’s prospects. According to Ali Martinez, a popular market watcher, ADA might trade at $1 if it breaks the $0.81 barrier. Another expert, Henry, said that Cardano is “calm, deep, and often misunderstood,” as it generally moves slowly before big shifts in price.

Another Cardano advocate, Dan Gambardello, said that he believes the current drop is normal. He thinks the ongoing price movement is a sign of a larger bullish trend that will develop gradually.

Nevertheless, the market is still pessimistic until the ADA supports these levels. The last time Cardano experienced this kind of outflow for a while, it suddenly broke its record high, but the wider market was already moving up by then.

While there is an outflow trend, some are speculating that Cardano and Litecoin could join forces in the DeFi industry. In a recent exchange on social media, Charles Hoskinson, the founder of Cardano, acknowledged his ongoing connection with Litecoin’s leadership. The exchange has once again sparked interest in the possibility of DeFi activities across different chains with the upcoming release of Cardano’s privacy project, Midnight.

CodexField Shakes Hands with UPay for Crypto Asset Management

CodexField integrates UPay to streamline crypto payments at a global level by linking digital assets...

Bitcoin’s Fall Due to US Economic Concerns Has Prompted Investors to Turn to Cloud Mining Platforms to Earn Up to $27,000 a Day in Passive Income

As Bitcoin dips on US fears, investors flock to XRP Mining cloud platform, earning up to $27K daily ...

BitMart Launches “Elite Trader Program”: Building a Creator-Centric Social Trading Ecosystem

BitMart launches Elite Trader Program to empower financial creators with tools, exposure, and profit...