Investors Sue MicroStrategy Over Misleading Bitcoin Financial Disclosures

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Pomerantz LLP has filed a class action against Strategy (formerly MicroStrategy) and its executives over the company’s Bitcoin investments and related financial disclosures.

The New York law firm recently

filed

the class action in the U.S. District Court for the Eastern District of Virginia. Notably, the plaintiffs include investors who acquired Strategy stock between April 30, 2024, and April 4, 2025.

The class action alleged that Strategy violated federal securities laws and hopes to pursue remedies on behalf of investors under Sections 10 (b) and 20 (a) of the Securities and Exchange Act.

Allegations Against Strategy

According to the complaint, Strategy misled investors during the class period by changing its accounting practices without adequately disclosing the implications. It noted the company has

accumulated

and held Bitcoin since 2020 as part of its long-term strategy.

The complaint states that Strategy financed its Bitcoin purchases using cash reserves, as well as proceeds from equity and debt financing. It also notes that the company has referred to itself as a "Bitcoin Treasury Company."

In support of this strategy, Strategy introduced new key performance indicators (KPIs), including BTC Gain, BTC Yield, and BTC $ Gain, to help investors evaluate the performance of its Bitcoin holdings.

Change in Accounting Model

Meanwhile, on January 1, 2025, Strategy adopted the FASB’s Accounting Standards Update (ASU 2023-08), which requires companies to record their cryptocurrency holdings at fair value in financial statements.

Previously, Strategy used a cost-less-impairment accounting model, under which Bitcoin impairments were recorded only when the asset’s price fell. Unrealized gains were not recognized unless the assets were sold.

The plaintiffs argue that Strategy failed to adequately warn investors about the new accounting model's risks and overstated its profitability under the fair-value approach.

In addition, the complaint alleged that Strategy understated the potential losses it might record on its Bitcoin holdings under fair-value accounting. According to the plaintiffs, investors suffered significant losses after Strategy announced an unrealized loss of $5.91 billion in Q1 2025.

As a result, the price of its common A stock crashed 8.67%, or $25.47 per share, to $268.14 on April 7. According to the complaint, the company later admitted in a public statement that the $5.9 billion net loss stemmed directly from applying the fair-value accounting standard on its Bitcoin holdings.

Consequently, Pomerantz is seeking to recover damages on behalf of affected investors.

Strategy Buys More Bitcoin

Meanwhile, Strategy seems unbothered by the class action as it announces the acquisition of 7,390 BTC worth $764.9 million. The company made the disclosure today in a filing

submitted

with the U.S. SEC.

At press time, the company holds 576,230 BTC acquired for $40.18 billion, each costing $69,726. With Bitcoin currently trading at $103,745, Strategy's Bitcoin stash is valued at $59.78 billion.

https://twitter.com/Strategy/status/1924435820947058877

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/506795.html

Related Reading

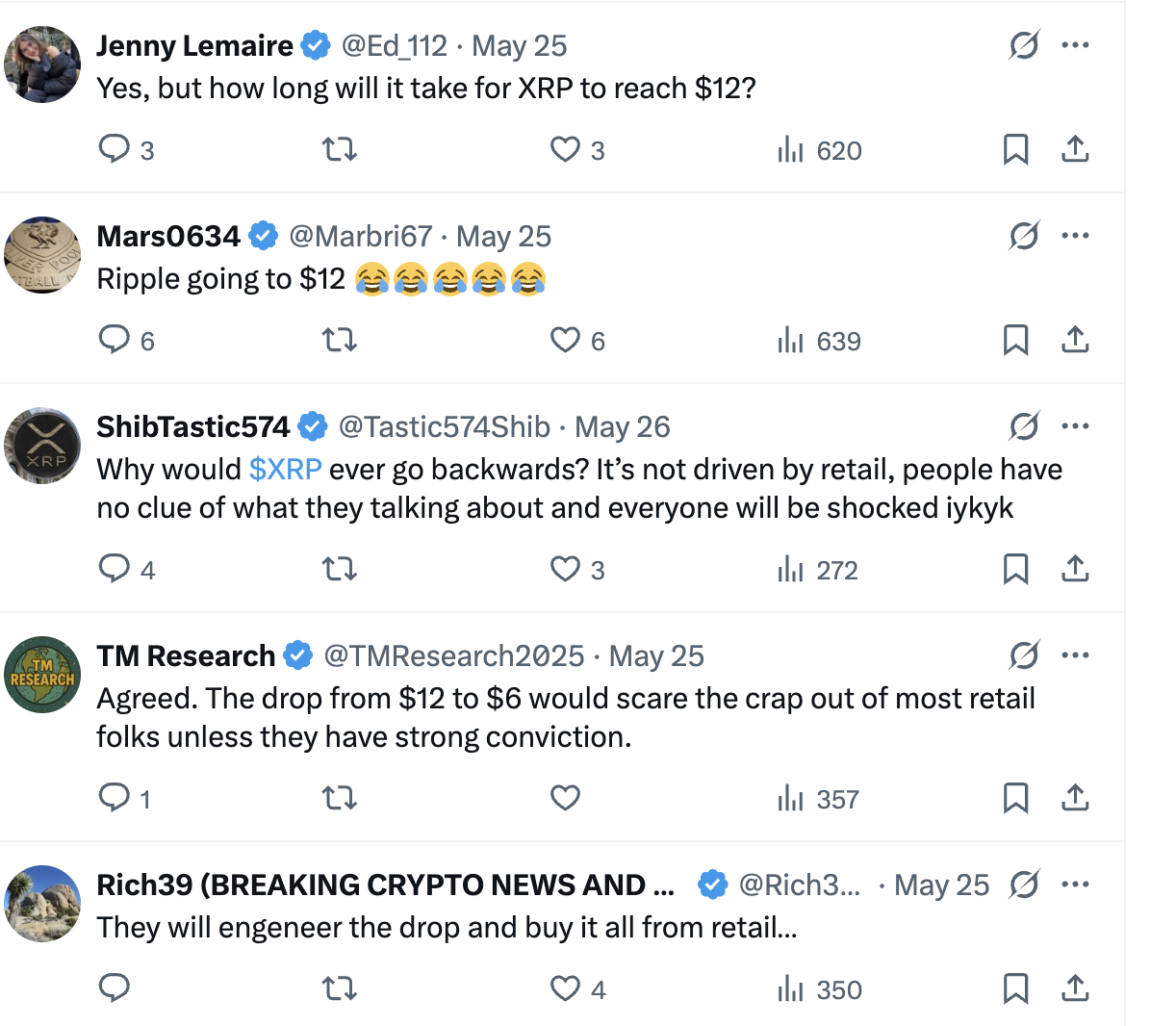

XRP Drop Zone: Expert Sees a 1,500% “Crash” That Could Push XRP to $27

Market analyst EGRAG is expecting a massive XRP price "crash," citing its historical performance, bu...

Pundit Says $8 XRP This Year Is Big, But Don’t Get Too Excited

XRP investors eyeing an $8 price target this year may be celebrating too soon, according to Xena, a ...

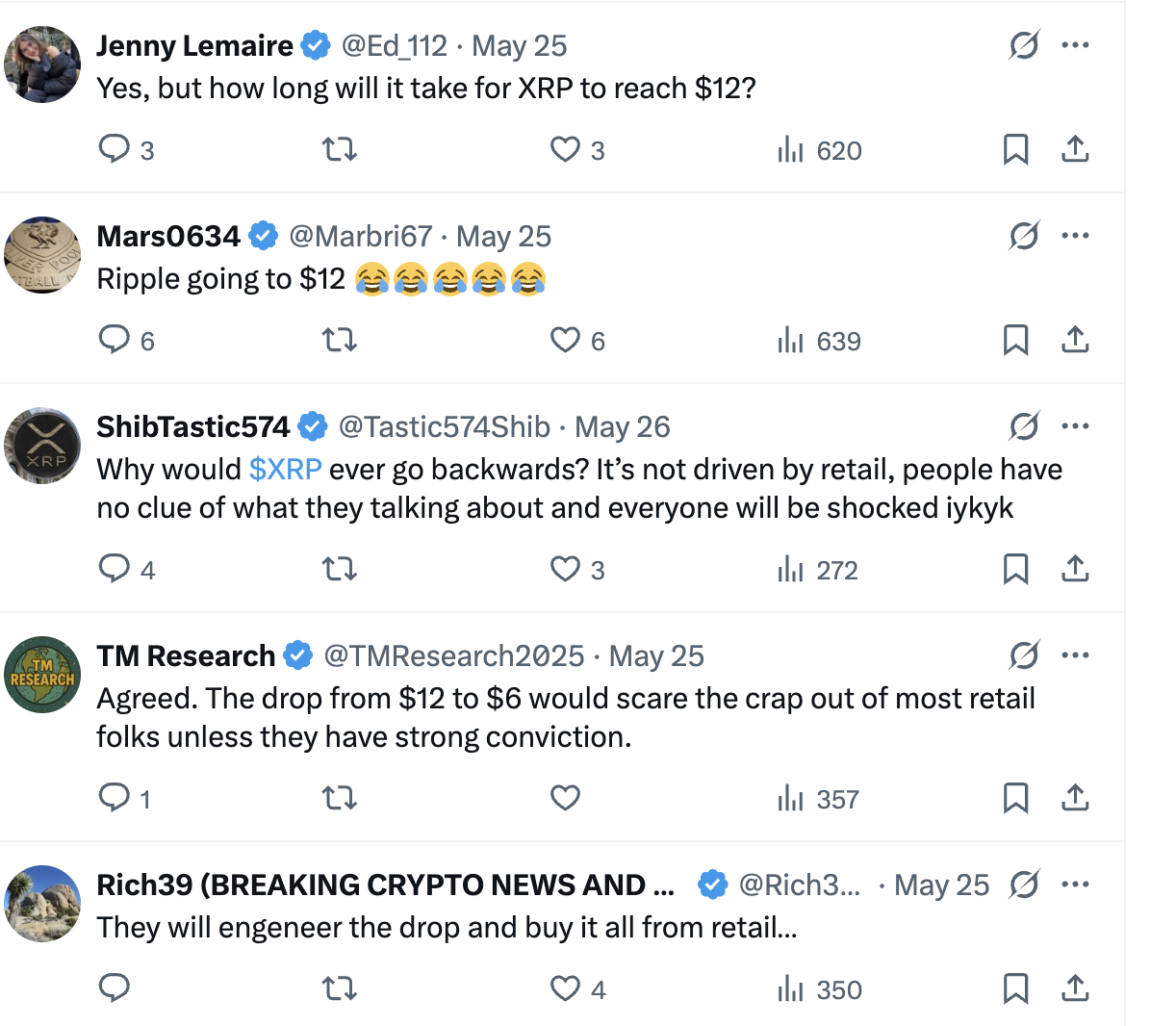

Pundit Says Smart Money Won’t Flinch When XRP Dips from $12 to $6

Although XRP lingers around $2, speculators in the community are constantly pondering the potential ...