SEC Chair Paul Atkins Lays Out New Crypto Oversight Plan

Favorite

Share

Scan with WeChat

Share with Friends or Moments

New U.S. SEC Chair Paul Atkins has outlined a strategic vision for reshaping regulatory oversight of crypto assets and on-chain securities.

This development came in a keynote speech delivered at the Tokenization Roundtable on Monday. As digital ledgers increasingly replace traditional off-chain systems, the SEC is prioritizing three core areas: crypto issuance, asset custody, and trading infrastructure.

Atkins

emphasized

the importance of evolving the Commission’s regulatory approach to support innovation while maintaining investor protections. He highlighted the need to build a regulatory framework matching blockchain-based financial products' decentralized nature.

Notably, this latest summit marked Paul Atkins' second appearance at a crypto roundtable since

taking over

leadership at the SEC. In his speech, Atkins also criticized prior regulatory approaches that prioritized enforcement actions over formal rulemaking. He emphasized returning to Congressional intent in securities law enforcement.

Issuance Guidelines Under Review

Atkins noted that regulatory clarity around crypto asset issuance remains insufficient. The SEC has so far only seen four issuers conduct registered offerings or use Regulation A to distribute crypto assets. According to Atkins, this is largely due to regulatory uncertainty and disclosure requirements that are poorly aligned with decentralized technologies.

For instance, forms like S-1 still require traditional disclosures such as executive compensation, which may not apply to many crypto projects.

To address these challenges, the Commission has begun issuing staff guidance to clarify its current view that certain distributions and assets may not implicate federal securities laws. However, Atkins confirmed that more formal Commission action is necessary.

Staff have been tasked with evaluating whether additional exemptions or adjustments to registration requirements are needed to support new issuance models.

SEC to Expand Custodial Options for Crypto Assets

Turning to custody, Atkins detailed plans to enhance flexibility for registrants managing crypto assets. He noted that the recent rescission of Staff Accounting Bulletin No. 121 removed a significant barrier to crypto custodial services. Atkins criticized the bulletin’s broad impact and lack of public input, saying it created confusion across the market.

In addition, the SEC is assessing how to define “qualified custodian” under existing laws. The aim is to clarify eligibility and potentially allow for secure self-custodial solutions using advanced technologies.

Atkins also signaled that the Commission may revise or replace the current “special purpose broker-dealer” framework. With only two such broker-dealers active today, he indicated that the limitations placed on them have deterred broader participation.

Integrated Trading Platforms

Finally,

Atkins

addressed crypto asset trading, supporting broader product access across trading platforms. He noted that current rules do not prohibit registered broker-dealers from facilitating trades involving securities and non-securities.

To solve this issue, the SEC is reviewing the Alternative Trading System (ATS) framework to improve its compatibility with crypto markets. Staff have been directed to consider guidance or new rulemaking to enable the listing and trading of crypto assets on national securities exchanges.

Atkins also expressed interest in exploring conditional exemptive relief to firms bringing blockchain-enabled products to market, provided these efforts conflict with legacy rules.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/505658.html

Previous:分析师梁丘:5.13比特币/以太坊晚间行情分析

Related Reading

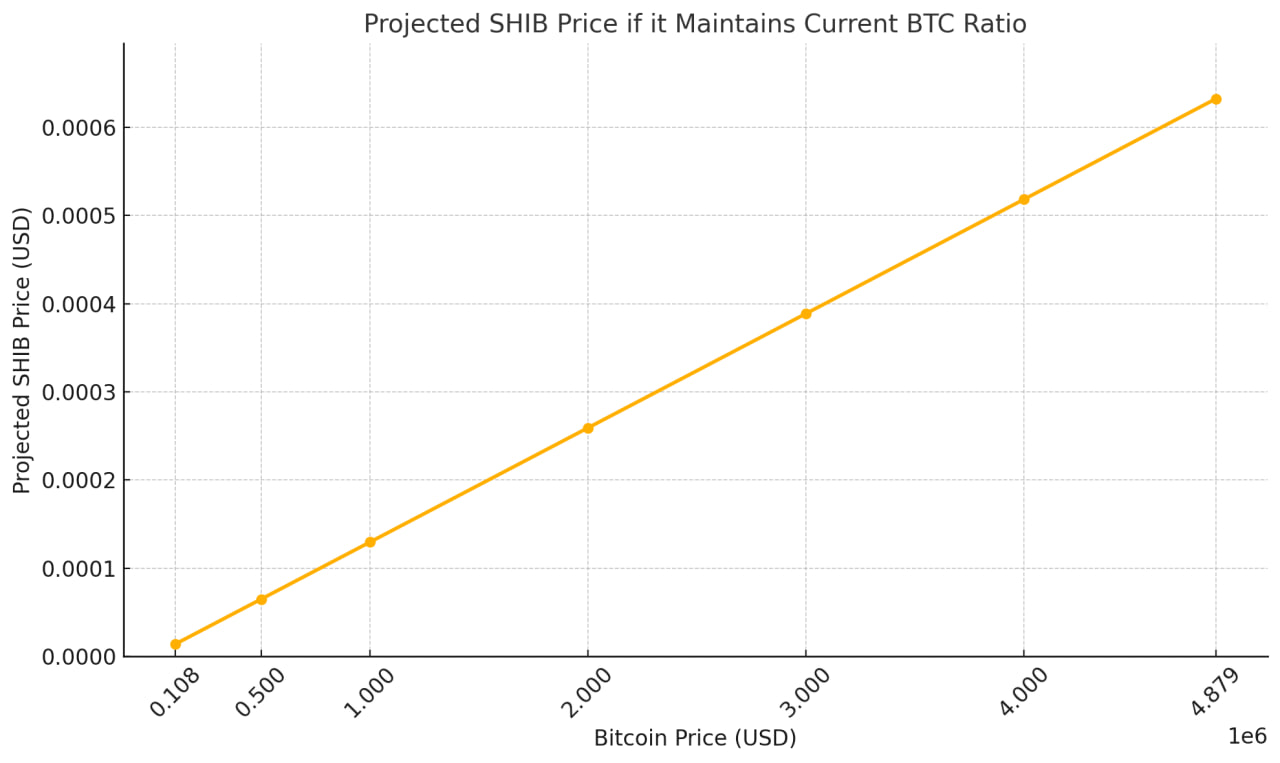

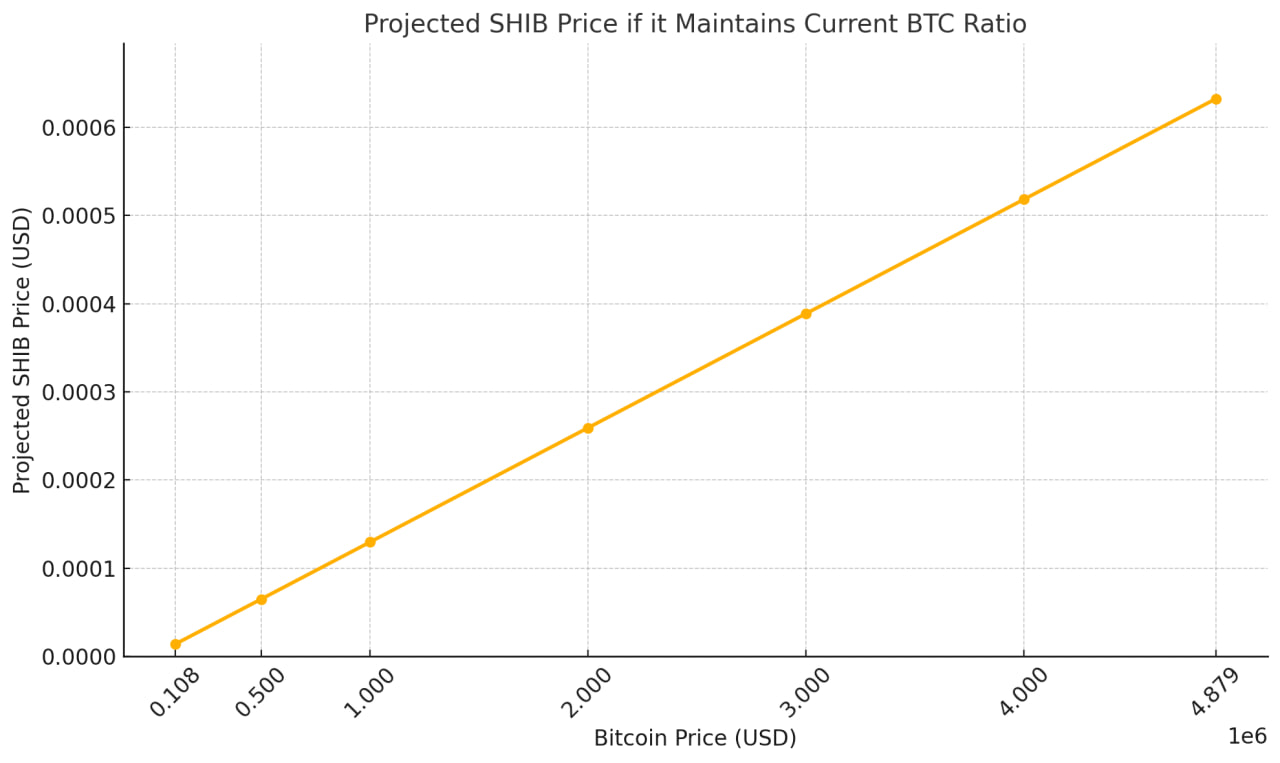

Here’s How High Shiba Inu Can Rise if Bitcoin hits $4,878,819 By 2040

Bitcoin’s projected rise to $4.87 million by 2040 could have a ripple effect on altcoin performance,...

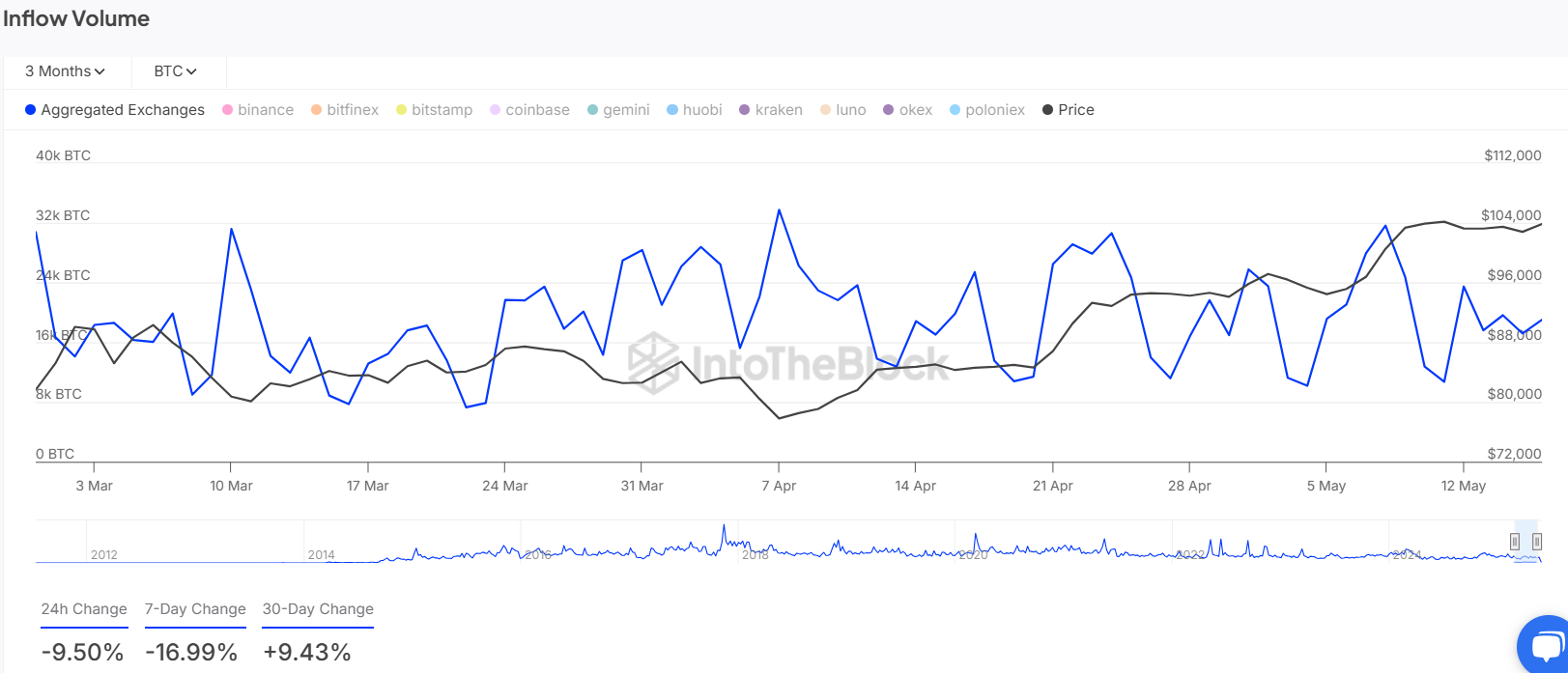

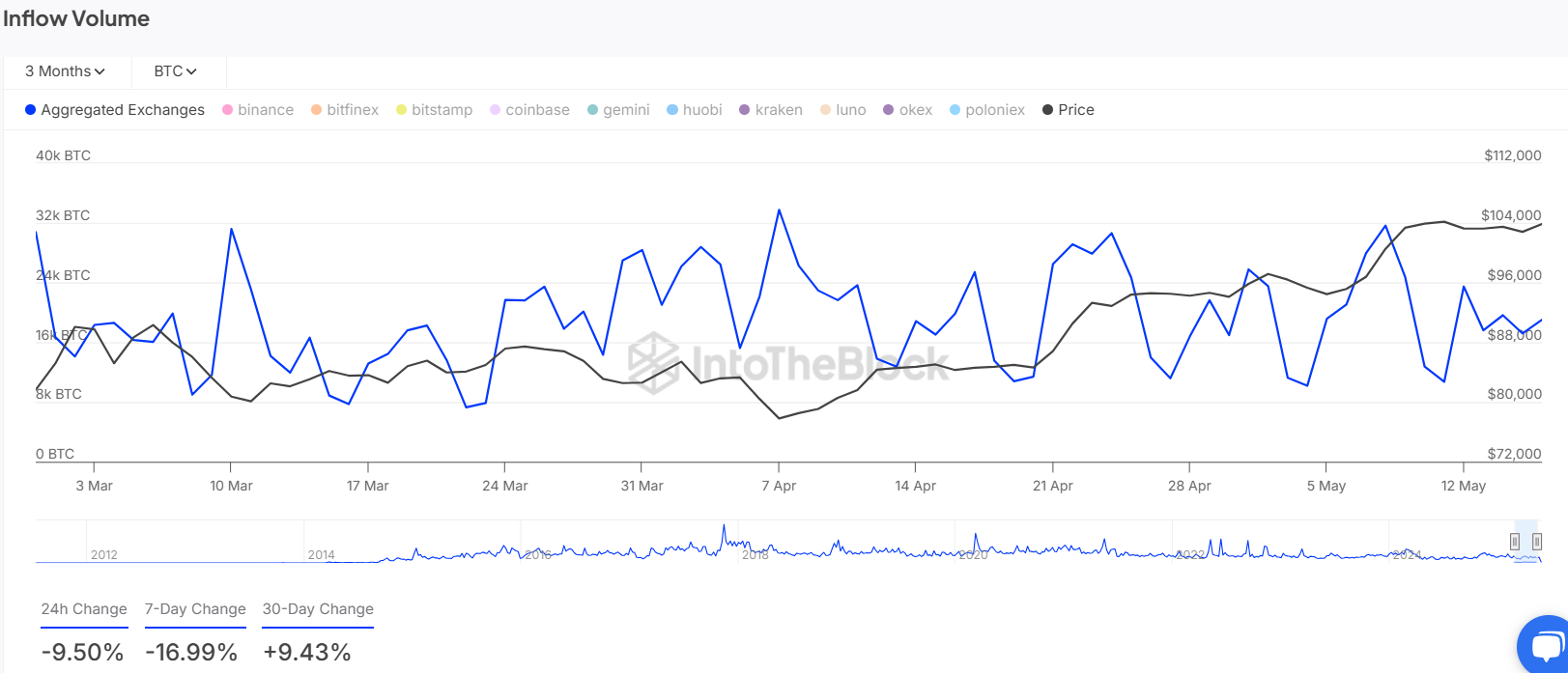

Two New Bitcoin Wallets Withdraw $84.2M in BTC From Binance, What’s Happening

Two new Bitcoin wallets recently withdrew large amounts from Binance’s hot wallet.This news comes ...

Stripe in Talks with Banks to Integrate Stablecoin Payments

Stripe Inc. is accelerating its exploration of stablecoins, engaging in talks with banks to integrat...