With the bond markets siding with the Fed and dissing Trump's rhetoric for lower rates, GDP versus jobs data has been putting cryptocurrencies under pressure. US

President Donald Trump took advantage of the unexpectedly strong job growth fifteen minutes after Friday's release of the April employment report to increase his pressure on Fed Chair Jerome Powell, claiming that there was no reason to defer interest rate cuts.

Traders in bonds came to a very different verdict. They reevaluated their projections of a rate cut in light of recent hiring trends and Thursday's manufacturing report, which outperformed expectations.

The uncertainty produced by Trump's trade war has had a major effect on financial markets and sparked fears of a US recession, prompting this change. After putting a lot of money into short-term Treasuries, they shifted tactics in the hopes that the Fed would start easing policy next month to lower the impact.

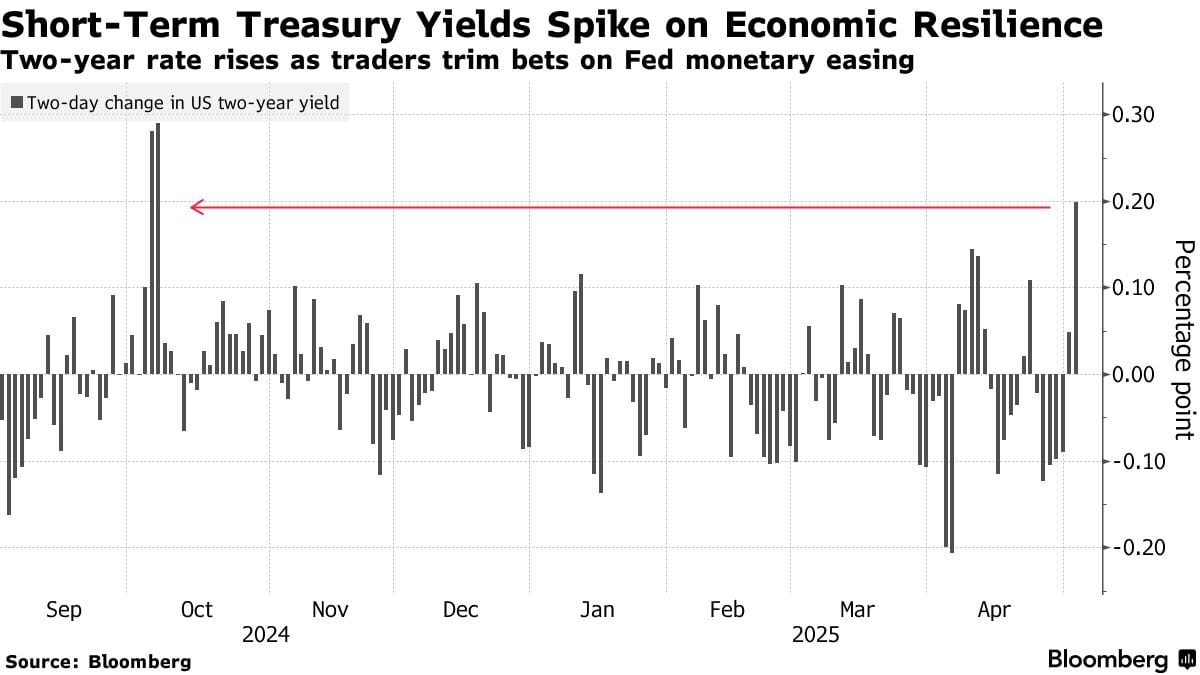

Futures traders started to take into account the message that Fed officials have been consistently sending — that they will be cautious until there are greater signs of an economic rebound — and two-year rates soared, marking the greatest two-day spike since October.

The latest numbers showed how difficult things are and how the markets have been very volatile since the US trade war escalated a month ago.

Due to the unpredictable nature of pauses, threats, and negotiating attempts, the conclusion is practically difficult to forecast, leading to a level of volatility similar to the pandemic and the 2008 financial crisis.

Traders seem obsessed with resilient jobs data and overlooked the contraction in US GDP in the March quarter and other activity and sentiment data flashing recession signs. The dollar has come under severe pressure again after a brief respite last week, suggesting that the sell-Trump trade is gaining traction.

But this time, cryptos are in the sell orders, too. Bitcoin launched a test of the six-figure mark last week, but fell back to just above the $94,100 level on Monday, and is currently 2.9% up since yesterday at $96,891. This comes after breaching a 10-week high of about $97,480 last week.

However, the top crypto has reversed that trend of haven-ride and is looking like a risk asset this week.

The trading pattern in the original crypto is similar to the deep rout in digital assets, which led to a 30% decline in Bitcoin from its lifetime peak of over $109,000 on Trump's inauguration day in January.

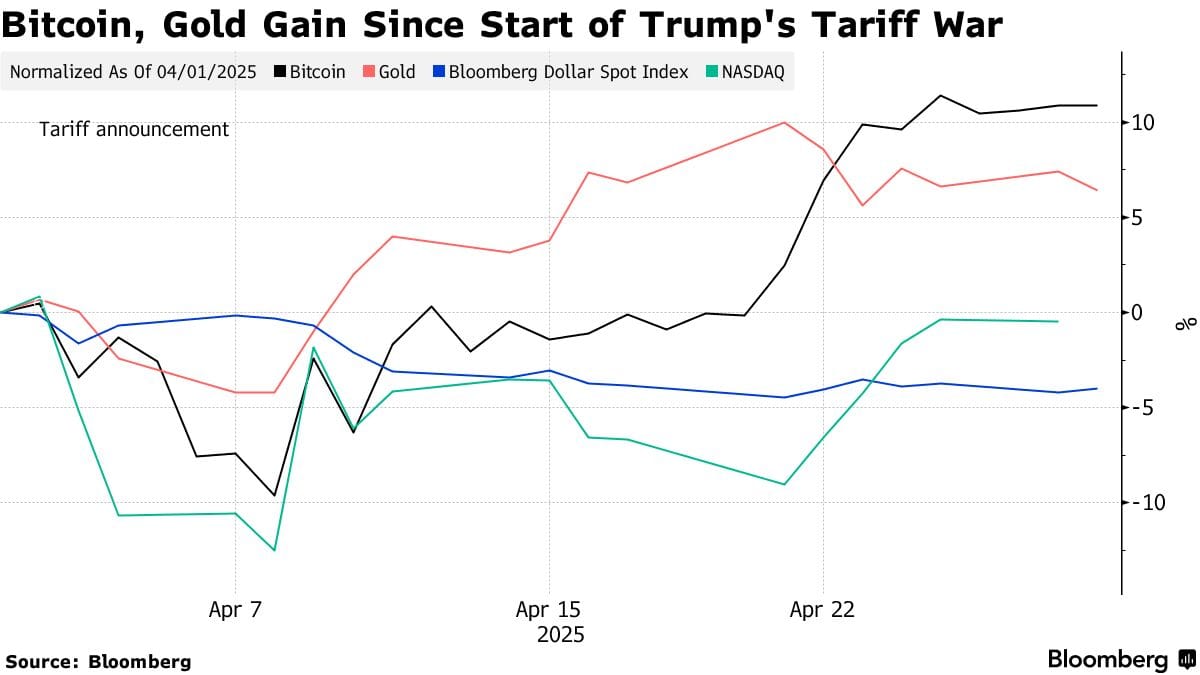

Still, despite Monday's ruse, Bitcoin outperformed almost every other asset, including the global safe-haven asset gold, in April.

The current discussion regarding the largest cryptocurrency's role as a refuge from market turmoil, particularly the fluctuations triggered by significant US tariffs, has gained new momentum as Bitcoin has outperformed both technology stocks and gold this April.

On April 2, referred to as "Liberation Day," President Trump declared reciprocal tariffs, leading to significant fluctuations in global markets.

The Bloomberg Dollar Index experienced a decline of more than 4% compared to the previous day, whereas the Nasdaq Composite saw a decrease of 0.2%. In the face of uncertainty, gold reached unprecedented levels, peaking at $3,500 per ounce before pulling back slightly, ultimately reflecting a 6.1% gain.

In contrast, Bitcoin's price has climbed by about 12% since April 1. Supporters of the cryptocurrency said it provided a hedge against rising worries about US fiscal policies and the soundness of financial institutions.

In response to the tariffs, Bitcoin and other risk assets experienced a decline, mirroring the significant downturn in US stocks. Nevertheless, investors flocked to the cryptocurrency amid escalating policy concerns and rising long-term Treasury yields, experiencing a surge in value.

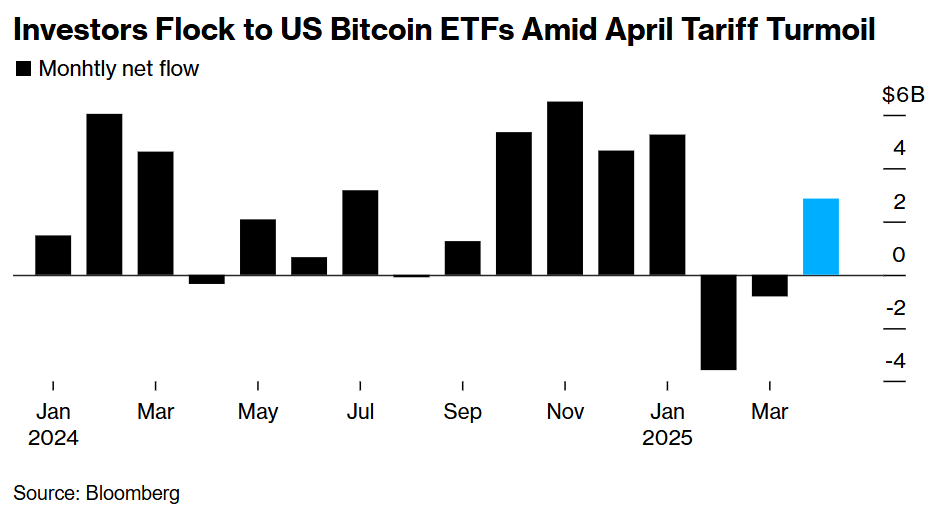

In April, there was a significant influx of approximately $2.9 billion into US-listed Bitcoin spot exchange-traded funds (ETFs), indicating a notable turnaround from March and February, during which the funds experienced net outflows of $811 million and $3.6 billion, respectively.

Fears regarding the US economy and the independence of the Federal Reserve have prompted investors to seek refuge in more secure assets such as the Swiss franc, the euro, gold, and increasingly, Bitcoin.

But the start of this week suggests a different tune for cryptos.

The Fed's dilemma is driving those doubts, as Bitcoin needs the US central bank to lower rates, but the latest labor market data suggests otherwise.

Nevertheless, investors flocked to the cryptocurrency amid escalating policy concerns and rising long-term Treasury yields, experiencing a surge in value. longest stretch of gains in two decades.

We observed a shift in the trend, with macroeconomic factors such as inflation and tariffs predominantly influencing Bitcoin prices.

Recently, there has been a notable increase in spot markets, while demand for derivatives, typically utilized for leveraging, remains subdued. This trend suggests a transition towards momentum trading strategies.

Bitcoin and Ether tracker exchange-traded funds attracted more than $3.2 billion last week. According to Bloomberg data, that is the greatest sum recorded this year, and it was about $1.5 billion for the iShares Bitcoin Trust ETF.

What the Technicals Are Telling Us?

There is currently a lack of liquidity for both bullish and bearish positions on cryptocurrency assets, but the options market is seeing an increase in interest for upside exposure even as the price shows some decline.

According to last week's data from Coinglass and the top cryptocurrency options exchange, Deribit, the top-performing tenor for open interest is $100,000 call options.

However, futures contracts show significant liquidations currently as investors redirected their funds from digital assets amid a cautious market environment.

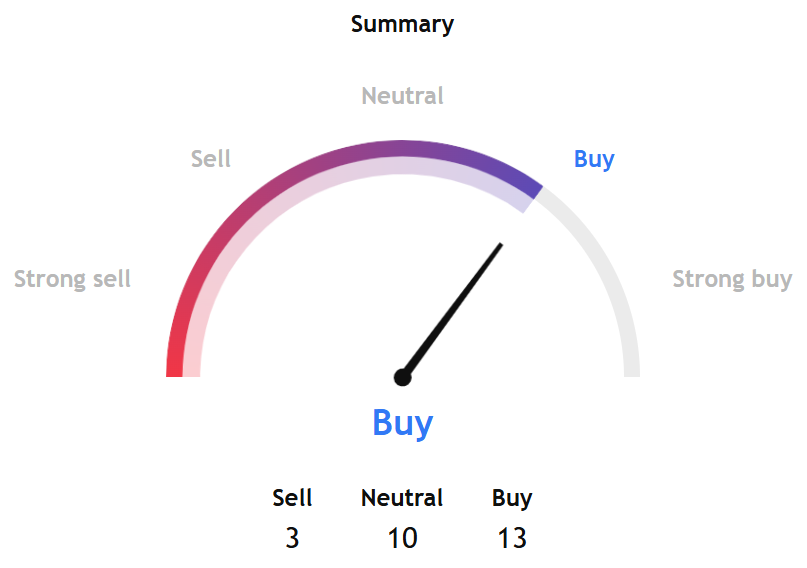

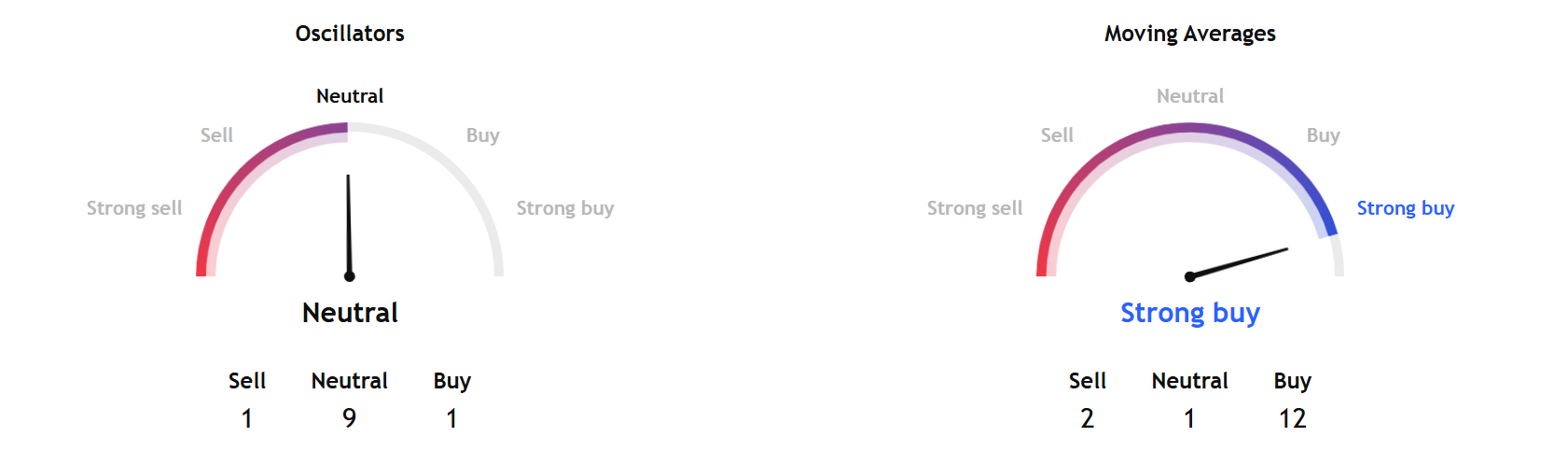

Still, overall technical analysis based on TradingView suggests a 'buy' for Bitcoin.

The oscillators point to a 'neutral' stance, while moving averages show a 'strong buy' signal.

Under Oscillators' technical indicators, the value of the MACD level (12, 26) shows 2,766, which is a buy signal.

On the other hand, the momentum indicator shows -297, which is a sell signal that is currently playing out in the price.

All other indicators suggest a neutral stance.

Under moving average indicators, exponential moving averages (10, 20, 30, 50, 100, and 200) and simple moving averages (20, 30, 50, 100, and 200) show a buy signal.

The Hull Moving Average (9) and Simple Moving Average (10) were the only technical flashings of a sell signal.

The SoSoValue data also shows an increase in open contracts for calls, suggesting that market makers need to buy more underlying assets to hedge their positions, which typically leads to the purchase of more ETFs.

So, despite the price action, the options markets suggest that the demand for ETFs will be at play.

Elsewhere

Blockcast

Coinbase's Ecosystem Play & Asia's Crypto Landscape

Tune in to hear Coinbase Singapore country director Hassan Ahmed's expert perspective on the trends shaping the industry and Coinbase's pivotal role in this transformation.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Consensus 2025, Toronto

We're a media partner for Consensus 2025, held in Toronto, Canada on 14-16 May. Coinbase, BlackRock, Google & The White House Will Be There – Will You? Use the code BLOCKHEAD20 for 20% off tickets!