Senate Fast-Tracks GENIUS Act That Could Spark a U.S. Stablecoin Boom

- The U.S. Senate recently moved forward with the GENIUS Act to control stablecoins and facilitate digital dollar developments.

- The proposed bill has strong support from lawmakers and crypto companies, which boosts its likelihood of becoming an official law.

- If passed, it could build trust, promote institutional adoption, and push the use of stablecoins in daily transfers.

Senate Majority Leader John Thune kicked off a fast-track process for the GENIUS Act, which would signal the first federal regulatory framework for U.S. dollar-backed stablecoins. The legislation, sponsored by Senator Bill Hagerty and co-sponsored by Senators Tim Scott and Cynthia Lummis, has passed through committee review and sits waiting for a full Senate vote that may occur before the end of April.

The GENIUS Act comes in response to calls for regulatory clarity after years of legal ambiguity surrounding stablecoins. It is also in line with the political agenda pushed by President Donald Trump to subject digital assets to a structured regime of oversight.

The measure was described by National Republican Senatorial Committee chair Scott as a ‘critical first step’ in restoring confidence in the US financial system through digital innovation. The bill’s core is intended to set minimum standards for stablecoin issuers and require assets to be fully backed with the pledge of transparency.

The TerraUSD failure in 2022 exposed severe concerns with algorithmic stablecoins, leading to new security standards needing establishment. According to lawmakers, the GENIUS Act would have stopped the unfortunate botched operation from happening.

Wall Street, Crypto Giants Back Bill Amid Trust Deficit

Major financial and crypto companies are joining forces to help the GENIUS Act advance. Stablecoin companies Circle and others are pushing for U.S. regulatory oversight because they want consumers to trust their business. Stablecoin adoption by traditional institutions remains limited because they want more clarity on compliance standards.

A passed bill will permit assets like USDC to move beyond niches and encroach on traditional finance. Following JP Morgan’s Kinexys Digital Payments platforms road, banks could start issuing stablecoins for cross-border transfers and settlements. Analysts believe the GENIUS Act could mark a turning point in including stablecoins into mainstream banking infrastructure.

The bill also could help boost public perception by addressing security and consumer protection. Regulatory approval would help users confirm that their digital currency funds are protected through reliable projects that are managed properly.

Mass Adoption May Follow as Rules Open New Avenues

GENIUS Act has greater benefits that extend beyond banking systems. U.S. corporations can now start issuing stablecoins thanks to well-defined laws. PayPal has launched PYUSD, and rumors suggest that Amazon is developing a blockchain-based payment system with dollar-backed tokens.

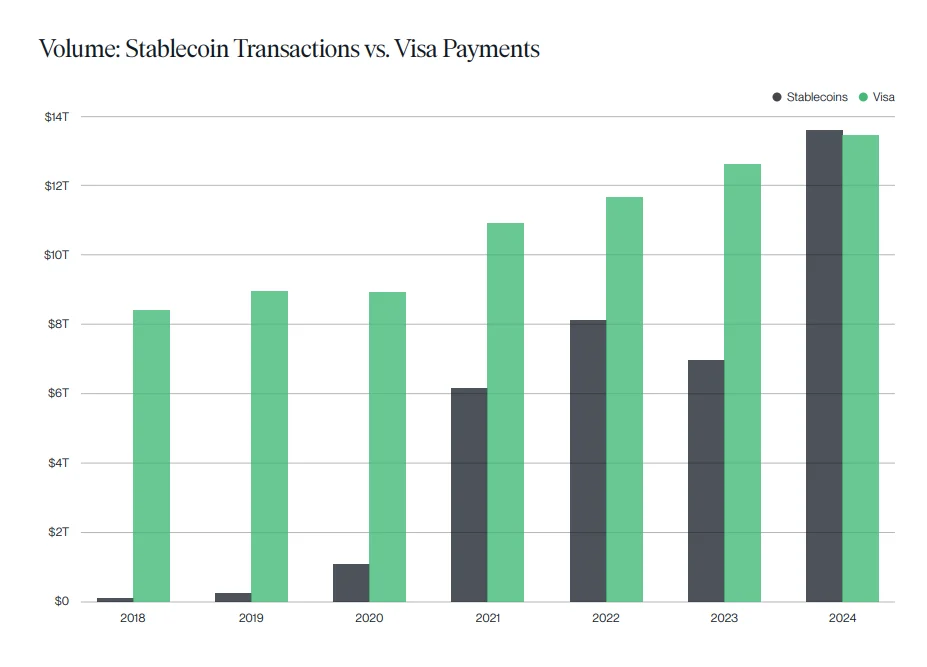

The adoption of stablecoin is exceeding expectations. In the first quarter, the stablecoin transaction volume surpassed that of Visa, claims Bitwise’s Q1 2025 Crypto Market Review. These represent a shift towards programmable and settlement for digital assets for everyday payments.

Visa and Bridge also recently launched a Visa card that allows users to spend stablecoins for everyday purchases. Over 150 million Visa-accepting merchants worldwide accept the card for stablecoin payments. In the announcements, this partnership seeks to make digital asset transactions transactional as traditional money.

PumpFun Offloads More than $16.8M in $SOL

As per Onchain Lens, 4 newly developed wallets associated to PumpFun have recently extracted up to 1...

Bitcoin Nears $100 While Facing Key Resistance at $98K Amid Bullish Sentiment

Bitcoin ($BTC) moves near $100K as bullish sentiment builds, facing key resistance at $98K amid risi...

PEPE’s Successor? Why Codename:Pepe Could Deliver the Next 1,000x Surge

Codename:Pepe merges real AI with meme coin hype, aiming to be the next 1,000x crypto like PEPE. Dis...