Visa, Mastercard, and Stripe Fuel Stablecoin Revolution in Global Finance

The post Visa, Mastercard, and Stripe Fuel Stablecoin Revolution in Global Finance appeared first on Coinpedia Fintech News

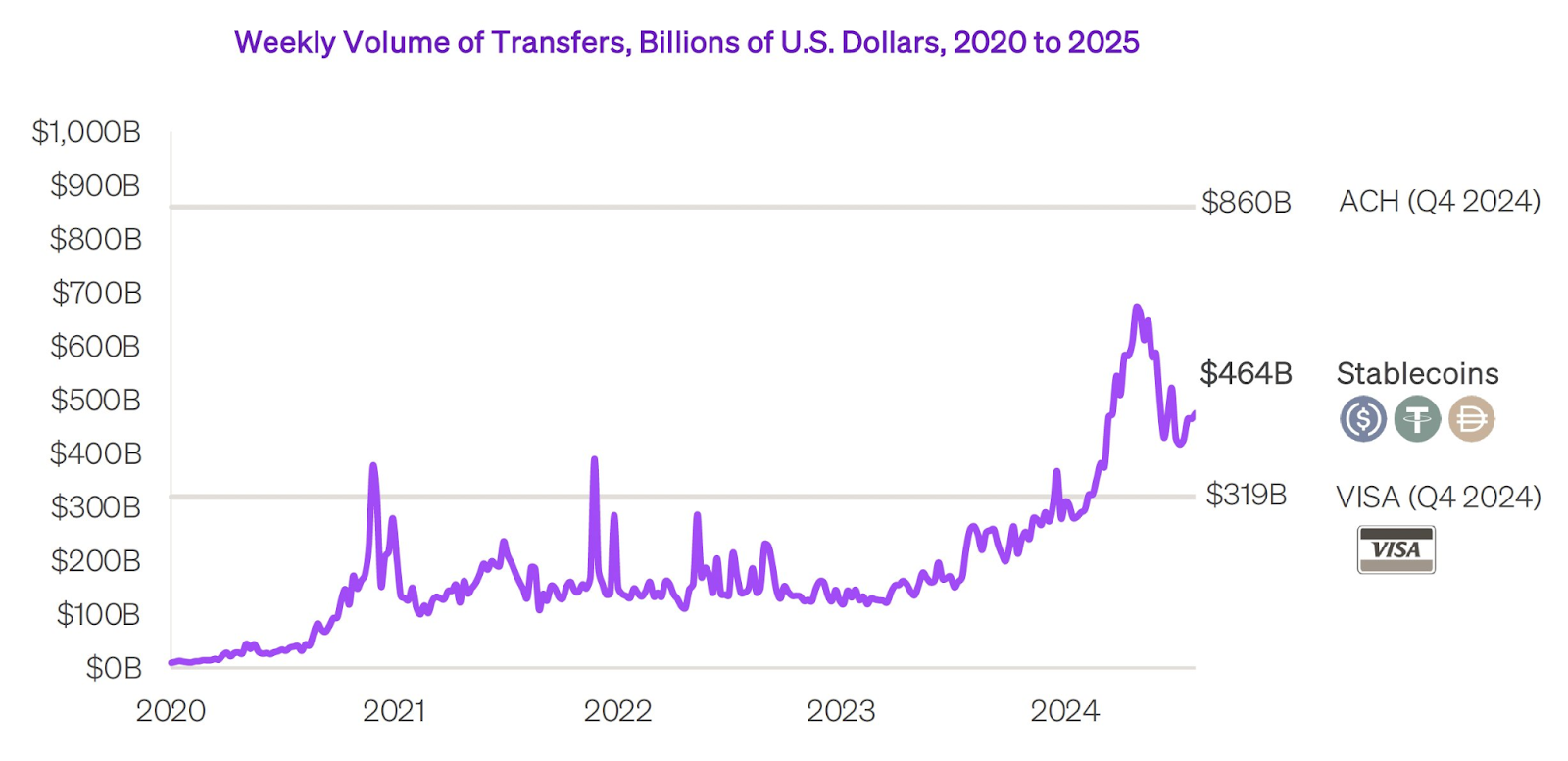

Stablecoins are rapidly evolving from a niche segment in the crypto world to a key player in global finance. With major traditional financial institutions like Visa, Mastercard, and Stripe backing stablecoin initiatives, and transaction volumes already surpassing Visa’s network, it’s clear that stablecoins are reshaping the way money moves across borders.

Visa, Mastercard, and Stripe Embrace Stablecoins

Top financial players are now embracing stablecoins, signaling a broader shift towards mainstream integration. Visa has already launched the Visa Tokenized Asset Platform to support the launch and management of stablecoins and tokenized deposits. Similarly, Stripe is testing stablecoin payments, aiming to provide businesses outside the US and EU with easier access to US dollars. Mastercard has also rolled out features allowing consumers to spend and merchants worldwide to receive payments in stablecoins.

Stablecoin Market Overview

The stablecoin market is booming, with a total market cap of $243.1 billion, according to Coingecko. Tether (USDT), USDC, and USDS lead the charge, with market caps of $148 billion, $62 billion, and $7.6 billion, respectively. In terms of transaction volume, Tether dominates with over $51 billion, followed by USDC with $11 billion.

Stablecoin Transaction Volumes Surge Past Traditional Networks

Stablecoins’ weekly transaction volume now exceeds that of Visa, signaling their growing influence in the global financial system. This shift suggests that stablecoins are quickly becoming a mainstream financial tool, challenging traditional payment networks.

The Future of Stablecoins: What’s Next?

Looking ahead, Chamath Palihapitiya predicts massive growth in the stablecoin sector throughout 2025. He believes the biggest business winner will be US dollar-backed stablecoins, further solidifying their role as a core part of the global financial landscape.

XRP Price Prediction: 85% Drop to $0.30 Possible, Analyst Warns

The post XRP Price Prediction: 85% Drop to $0.30 Possible, Analyst Warns appeared first on Coinpedia...

Solana Price Analysis and Forecast: Deviation or Market Breakout?

The post Solana Price Analysis and Forecast: Deviation or Market Breakout? appeared first on Coinped...

Strategy Releases Q1 Financial Results: Michael Saylor Remains a Bitcoin Maximalist and Raises 2025 Targets

The post Strategy Releases Q1 Financial Results: Michael Saylor Remains a Bitcoin Maximalist and Rai...