Have China’s Local Governments Just Sold 15K Bitcoin Worth $1.35B? Here Are the Facts

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Circulating reports suggesting local governments in China recently sold over $1 billion in Bitcoin might be misrepresenting facts.

Recent rumors across crypto media have stirred fears that Chinese local governments secretly offloaded 15,000 bitcoins worth $1.25 billion through offshore entities.

These stories have spread, leading to concerns of greater selling pressure on

Bitcoin

as the market already faces headwinds from the ongoing U.S.–China tariff war and tightening macroeconomic conditions.

China Did Not Sell 15K Bitcoin: Here Are the Facts

However, a closer look shows that the reports misrepresented credible sources. The claims originated from misinterpretations of a recent Reuters

report

exploring China's ongoing debate around the management of seized cryptocurrencies.

Contrary to the speculative headlines, Reuters never confirmed any recent mass liquidation of 15,000 BTC. Instead, the report clearly stated that this was the amount the local governments held at the end of 2024, not a recent sale.

Specifically, the Reuters investigation showed how local governments in China have been battling with the complexities of liquidating seized digital assets, especially in the absence of consistent regulatory guidelines.

Due to the national ban on crypto trading, local authorities often partner with private firms to sell confiscated assets overseas and convert the proceeds into yuan. According to Reuters, one of these firms is local technology company Jiafenxiang, which has sold crypto worth over 3 billion yuan since 2018.

Although these strategies are financially beneficial for local budgets facing strains from economic challenges, they exist in a legal grey area, leading to calls for reform.

Proposed Ways to Manage Crypto Wealth

Experts from the report stressed that inconsistent handling of crypto assets could result in corruption or further criminal activity. They insist that the growing volume of crypto involved in illicit transactions has raised the urgency for the government to recognize crypto as an asset and create a standard mechanism for selling them.

Further, some lawyers and academics also suggested that China's central bank could help in managing seized tokens, potentially transforming them into a strategic reserve, similar to what the U.S. is doing.

For context, the United States has taken a friendly approach to Bitcoin. Notably, in March 2025, President Donald Trump

signed

an order to create a Strategic Bitcoin Reserve.

The reserve is seeded with forfeited crypto assets from criminal cases, with the government promising to fund it in budget-neutral ways. Proposals to further grow the reserve include

reallocating

a portion of America's vast gold holdings. Currently, the U.S. holds around 207,000 BTC, the largest sovereign holder of the asset.

In contrast, China's approach remains unclear. Despite holding about 194,000 BTC, and being the second-largest sovereign holder, the country has yet to implement a centralized framework for managing its crypto wealth.

Some officials and legal experts are now pushing for the creation of a sovereign crypto reserve, possibly based in Hong Kong where crypto trading is legal.

Ru Haiyang, CEO of crypto exchange platform HashKey, says the Chinese government could follow in America's footsteps by establishing a reserve. However, CryptoQuant CEO Ki Young Ju

argued

that China might have already sold the BTC seized from the PlusToken scam. Nonetheless, there are no official confirmations yet.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/500585.html

Previous:大饼以太多空完成双杀!

Next:逍遥kol:大饼以太晚间航情分析4.16

Related Reading

Here’s How High Shiba Inu Could Rise if Elon Musk Starts Promoting SHIB Like Dogecoin

Shiba Inu could cancel two zeros if Elon Musk promotes it like Dogecoin, based on historical data on...

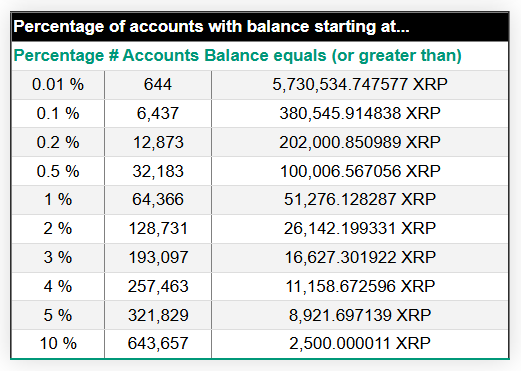

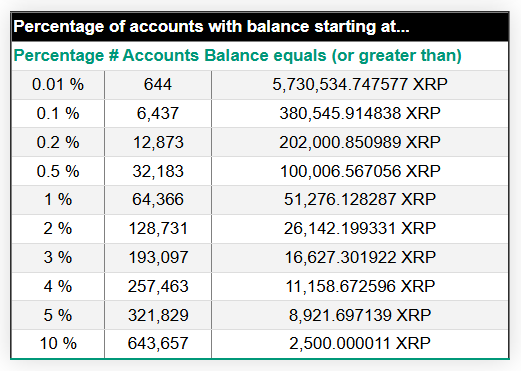

Here’s How Much Needed to be Atop the XRP Rich List, Analyst Insists 99% Will Not Make It

An XRP community analyst shares how much investors need to be among the top 10 XRP Rich list, sugges...

Here is the Only Way Other Than Shiba Inu Burns For SHIB to Reach $0.01

While aggressive SHIB burns are often seen as the only way for Shiba Inu to reach $0.01, SHIB could ...