Bitcoin Sees Largest One-Day Long Liquidation of This Bull Cycle Worth Over $500M Amid Global Tensions

Favorite

Share

Scan with WeChat

Share with Friends or Moments

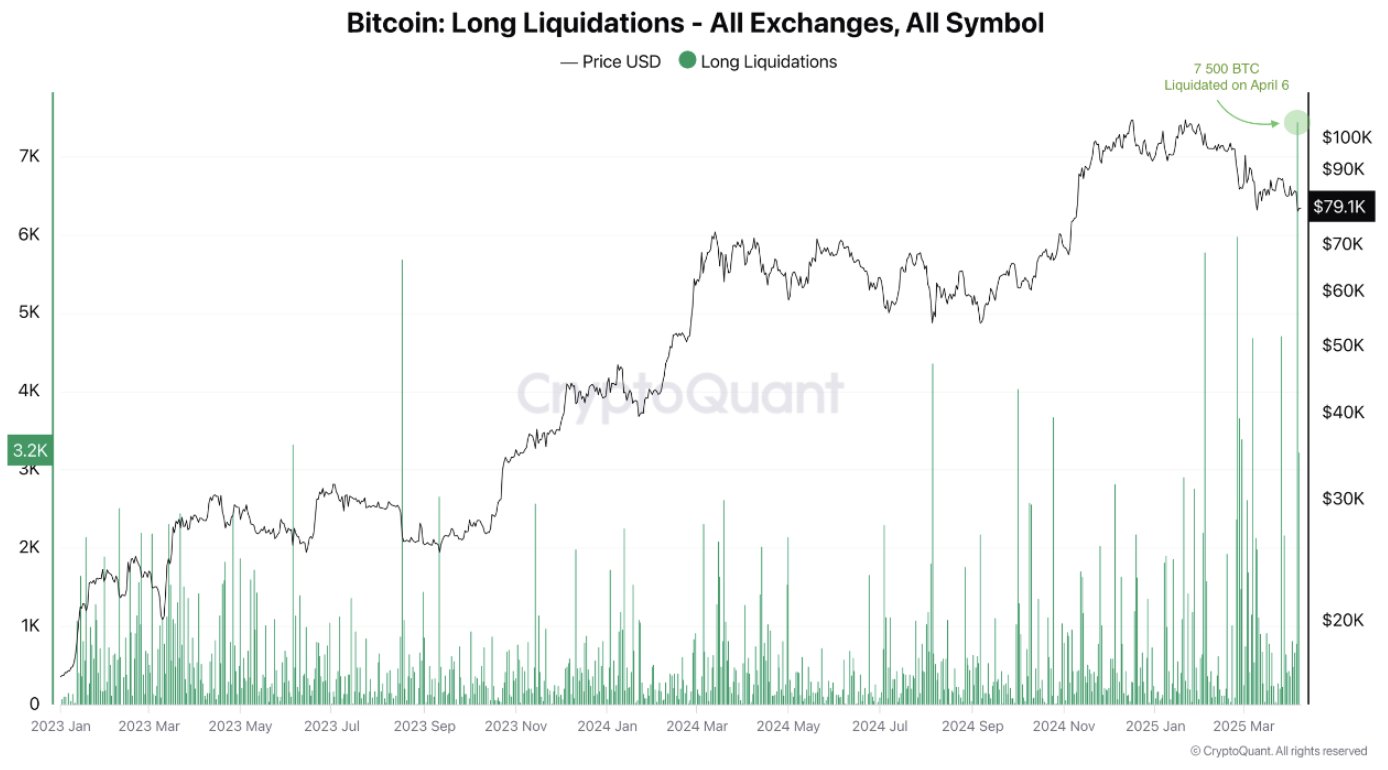

The dramatic shake-up that Bitcoin experienced this week has led the market to witness the largest long liquidation event since the start of the bull cycle.

Specifically, on April 6, more than 7,500 BTC worth of long positions, valued at over $500 million, were liquidated across major exchanges. This single-day liquidation event marked a significant blow to traders who had bet on Bitcoin's continued rise.

Largest Cycle Long Liquidation in Bitcoin

According to

Darkfost, an analyst at CryptoQuant, this event marked the most severe single-day long liquidation since the bull rally of this cycle began in 2023.

The chart accompanying the update suggests that similar long liquidations have occurred over the past two years, but the most recent one, which took place on Monday, set a new record.

Notably, the wave of forced selling coincided with a sharp drop in Bitcoin’s price on the spot market. It plummeted from $83,000 to a low of $74,000 before briefly stabilizing in the $77,000 range. Since then, the market has shown limited recovery, with Bitcoin still hovering around the $77,000 range.

Analyst Darkfost attributed the sudden move to growing apprehension around Donald Trump's economic policies,

particularly new tariff enforcement

, which stirred broader market volatility. The U.S. stock market has not been spared.

Reports highlight a multi-trillion-dollar loss for the stock market for nearly consecutive trading days this month. One report even suggested that the U.S. stock market has lost $10 trillion since Trump became president, just three months into his term.

Time to Preserve Your Capital

Given the brutal condition of the financial market, Darkfost reminded market participants of the risks of trading in volatile markets, especially for those holding leveraged positions.

Furthermore, Darkfost emphasized the significance of preserving capital during uncertain times, warning crypto traders to avoid excessive risk exposure or leveraged trades.

What's Next for Bitcoin?

Some market observers believe the bearish trend could persist for the next 12 months, with ongoing global economic uncertainty adding further fuel to the fire. Among the

bearish commentators

is Ki Young Ju, founder of CryptoQuant.

In his latest commentary, he noted that uncertainty drives safe-haven demand, which is evident as gold has risen 11% since Trump's comeback, while Bitcoin has dropped 25%. He stated that this reinforces the idea that Bitcoin is not yet "digital gold."

However, on a more positive note, he expressed confidence that Bitcoin will eventually claim a share of gold’s $20 trillion market cap.

https://twitter.com/ki_young_ju/status/1909961353097626009

Notably, the wave of forced selling coincided with a sharp drop in Bitcoin’s price on the spot market. It plummeted from $83,000 to a low of $74,000 before briefly stabilizing in the $77,000 range. Since then, the market has shown limited recovery, with Bitcoin still hovering around the $77,000 range.

Analyst Darkfost attributed the sudden move to growing apprehension around Donald Trump's economic policies,

particularly new tariff enforcement

, which stirred broader market volatility. The U.S. stock market has not been spared.

Reports highlight a multi-trillion-dollar loss for the stock market for nearly consecutive trading days this month. One report even suggested that the U.S. stock market has lost $10 trillion since Trump became president, just three months into his term.

Time to Preserve Your Capital

Given the brutal condition of the financial market, Darkfost reminded market participants of the risks of trading in volatile markets, especially for those holding leveraged positions.

Furthermore, Darkfost emphasized the significance of preserving capital during uncertain times, warning crypto traders to avoid excessive risk exposure or leveraged trades.

What's Next for Bitcoin?

Some market observers believe the bearish trend could persist for the next 12 months, with ongoing global economic uncertainty adding further fuel to the fire. Among the

bearish commentators

is Ki Young Ju, founder of CryptoQuant.

In his latest commentary, he noted that uncertainty drives safe-haven demand, which is evident as gold has risen 11% since Trump's comeback, while Bitcoin has dropped 25%. He stated that this reinforces the idea that Bitcoin is not yet "digital gold."

However, on a more positive note, he expressed confidence that Bitcoin will eventually claim a share of gold’s $20 trillion market cap.

https://twitter.com/ki_young_ju/status/1909961353097626009

Notably, the wave of forced selling coincided with a sharp drop in Bitcoin’s price on the spot market. It plummeted from $83,000 to a low of $74,000 before briefly stabilizing in the $77,000 range. Since then, the market has shown limited recovery, with Bitcoin still hovering around the $77,000 range.

Analyst Darkfost attributed the sudden move to growing apprehension around Donald Trump's economic policies,

particularly new tariff enforcement

, which stirred broader market volatility. The U.S. stock market has not been spared.

Reports highlight a multi-trillion-dollar loss for the stock market for nearly consecutive trading days this month. One report even suggested that the U.S. stock market has lost $10 trillion since Trump became president, just three months into his term.

Time to Preserve Your Capital

Given the brutal condition of the financial market, Darkfost reminded market participants of the risks of trading in volatile markets, especially for those holding leveraged positions.

Furthermore, Darkfost emphasized the significance of preserving capital during uncertain times, warning crypto traders to avoid excessive risk exposure or leveraged trades.

What's Next for Bitcoin?

Some market observers believe the bearish trend could persist for the next 12 months, with ongoing global economic uncertainty adding further fuel to the fire. Among the

bearish commentators

is Ki Young Ju, founder of CryptoQuant.

In his latest commentary, he noted that uncertainty drives safe-haven demand, which is evident as gold has risen 11% since Trump's comeback, while Bitcoin has dropped 25%. He stated that this reinforces the idea that Bitcoin is not yet "digital gold."

However, on a more positive note, he expressed confidence that Bitcoin will eventually claim a share of gold’s $20 trillion market cap.

https://twitter.com/ki_young_ju/status/1909961353097626009

Notably, the wave of forced selling coincided with a sharp drop in Bitcoin’s price on the spot market. It plummeted from $83,000 to a low of $74,000 before briefly stabilizing in the $77,000 range. Since then, the market has shown limited recovery, with Bitcoin still hovering around the $77,000 range.

Analyst Darkfost attributed the sudden move to growing apprehension around Donald Trump's economic policies,

particularly new tariff enforcement

, which stirred broader market volatility. The U.S. stock market has not been spared.

Reports highlight a multi-trillion-dollar loss for the stock market for nearly consecutive trading days this month. One report even suggested that the U.S. stock market has lost $10 trillion since Trump became president, just three months into his term.

Time to Preserve Your Capital

Given the brutal condition of the financial market, Darkfost reminded market participants of the risks of trading in volatile markets, especially for those holding leveraged positions.

Furthermore, Darkfost emphasized the significance of preserving capital during uncertain times, warning crypto traders to avoid excessive risk exposure or leveraged trades.

What's Next for Bitcoin?

Some market observers believe the bearish trend could persist for the next 12 months, with ongoing global economic uncertainty adding further fuel to the fire. Among the

bearish commentators

is Ki Young Ju, founder of CryptoQuant.

In his latest commentary, he noted that uncertainty drives safe-haven demand, which is evident as gold has risen 11% since Trump's comeback, while Bitcoin has dropped 25%. He stated that this reinforces the idea that Bitcoin is not yet "digital gold."

However, on a more positive note, he expressed confidence that Bitcoin will eventually claim a share of gold’s $20 trillion market cap.

https://twitter.com/ki_young_ju/status/1909961353097626009

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/499218.html

Previous:解读美国稳定币法案STABLE Act,链上美元“霸权”?

Next:比特以太坊凌晨最新行情走向分析:4/10

Related Reading

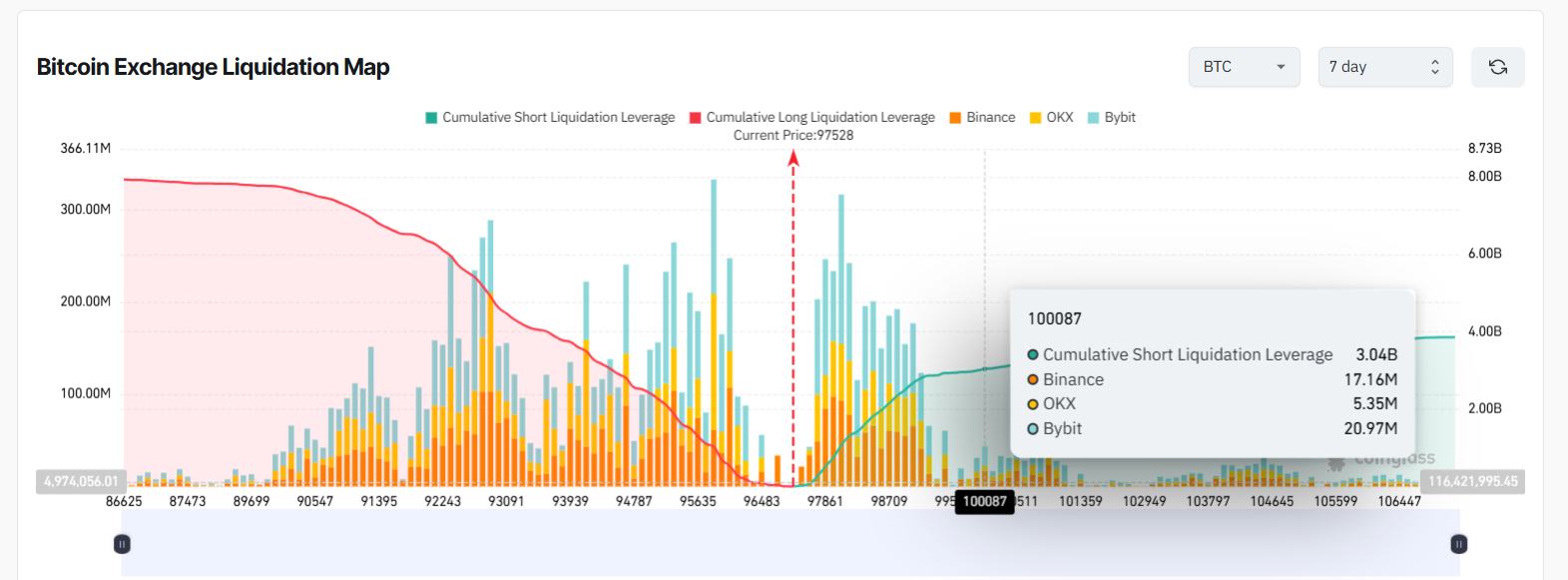

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at ri...

Goldman Sachs Ramps Up Crypto Exposure, Eyes Tokenization Opportunities

Goldman Sachs is intensifying its involvement in the digital asset space, according to its head of d...

Bitcoin Dominance Hits New 4-Year Peak: Here’s What This Means for the Altcoin Season

Bitcoin dominance has claimed a high last seen in the previous bull run, leading to discussions arou...