Mastercard Building a Blockchain-Based Platform for Bitcoin and Crypto Transactions

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Card services giant Mastercard is expanding its payment success to the digital asset space, looking to facilitate Bitcoin and crypto transactions.

Having made waves in traditional finance, Mastercard’s next target is helping its over 3.5 billion card users worldwide and other interested users transact crypto. A Business Insider

report

on Tuesday shows that the payment giant is exploring means to facilitate

Bitcoin

transactions among clients, merchants, and banks.

Mastercard Eyes Expansion into the Nascent Sector

Despite its recent breakthrough, processing crypto transactions is still unpopular and tedious compared to its traditional counterpart. With this in view,

Mastercard

is looking to tap into the endless possibilities in digital asset payments while making fiat-to-crypto and crypto-to-crypto transactions more seamless.

Raj Dhamodharan, Mastercard’s executive vice president of blockchain and digital asset products and partnerships, revealed that Mastercard aims to build a Venmo or Zelle-like crypto payment system. Notably, the two peer-to-peer payment networks are popular among users in the United States for their seamless transaction structure.

Meanwhile, Mastercard has made considerable progress in its dabble into crypto payment. For context, the firm has filed over 250 unique patents related to blockchain technology since 2015 and has supported 43 crypto startups since 2021.

Nonetheless, it intends to expand its reach by simplifying cross-border and blockchain-focused payments for TradFi. Furthermore, the credit card giant is eyeing other blockchain-based endeavors, such as real-world asset tokenization.

Mastercard Multitoken Network Central to Innovation

Notably, the Mastercard Multitoken Network (MTN) would be central to this latest conquest. Launched in 2023, the decentralized finance (DeFi) platform helps financial institutions bridge the gap between traditional and blockchain-based transactions.

Mastercard has made strategic collaborations with JPMorgan, Standard Chartered Bank, and recently, Ondo Finance to bolster the network’s utility. Nonetheless, the payment giant still requires more financial institutions to adopt MTN and key partnerships to facilitate its crypto transaction infrastructural provider plans.

Regulatory clarity is also important for Mastercard’s new plan. Dhamodharan noted that the brightening digital asset regulatory clouds in the United States and globally have bolstered crypto-related innovations.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/497592.html

Previous:交易员格格:4.1-4.2比特币以太坊行情分析 如期反弹

Related Reading

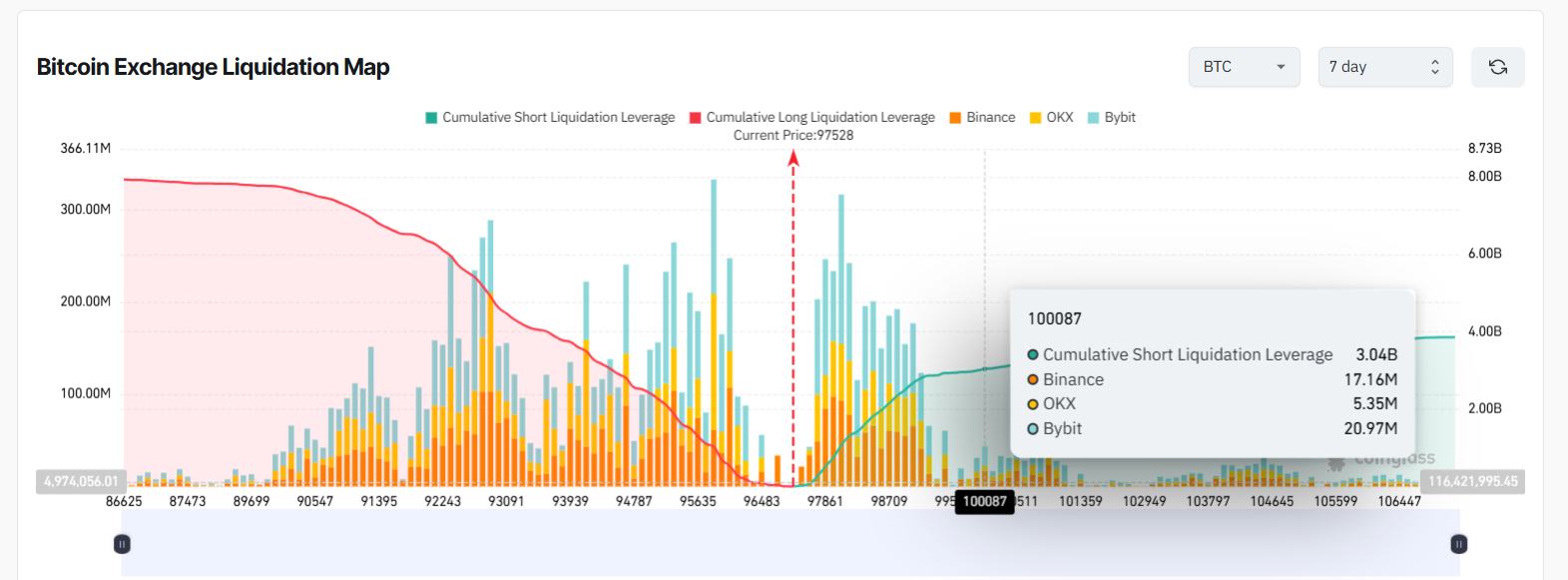

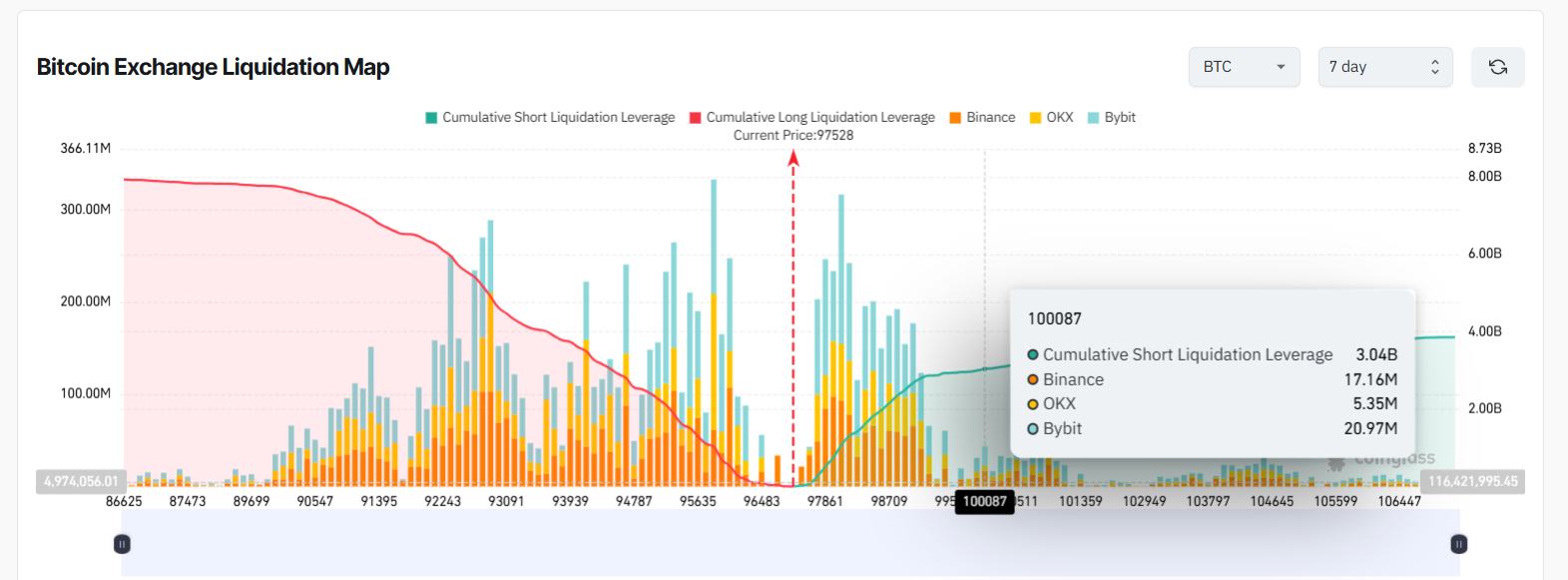

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at ri...

Goldman Sachs Ramps Up Crypto Exposure, Eyes Tokenization Opportunities

Goldman Sachs is intensifying its involvement in the digital asset space, according to its head of d...

Bitcoin Dominance Hits New 4-Year Peak: Here’s What This Means for the Altcoin Season

Bitcoin dominance has claimed a high last seen in the previous bull run, leading to discussions arou...