Bybit Hack Perpetrators on Pace to Launder Stolen Ethereum in “Half a Month”: Analyst

Favorite

Share

Scan with WeChat

Share with Friends or Moments

An on-chain analyst asserts that the Bybit hack perpetrators could launder the stolen Ethereum tokens within two weeks.

Hackers stunned the crypto community

on Friday, February 21, by stealing $1.5 billion in

Ethereum

from leading crypto exchange Bybit in what has been described as the largest digital heist in history.

However, while the crypto market tries to pick up the pieces after the event, the culprits are already making quick work of moving the funds.

Bybit Hackers on the Move

"Half a month" or two weeks.

That's how fast it could take the Bybit hackers to finish laundering funds stolen from the exchange, according to prominent on-chain analyst Yujin, popularly known as "EmberCN."

The analyst based this view on the current pace at which hackers were moving the stolen assets. In

an X post

on Tuesday, February 25, they highlighted that the hackers had already moved 89,500 ETH worth roughly $224 million, or about 18% of the 499,000 ETH loot in the past two and a half days.

"If the frequency continues, the hacker will be able to exchange the remaining 410,000 ETH for other assets (BTC/DAI, etc.) in half a month,"

the analyst's translated statement read.

EmberCN further noted that the hackers have carried out most of the asset swaps on the embattled DeFi Layer-1 chain THORChain.

What You Need to Know About the Bybit Hack

For context, prominent on-chain sleuth ZachXBT was the first to draw attention to abnormal Ethereum outflows from Bybit on Friday, with the exchange's CEO Ben Zhou confirming the exploit moments later.

Zhou explained that hackers were able to take control of the exchange's Ethereum cold wallet by tricking signers of its wallet into signing a malicious transaction masked as a benign transfer from the cold wallet to the exchange's hot wallet.

https://twitter.com/benbybit/status/1892963530422505586

The exploit has since been attributed to North Korean hackers.

At the time of writing,

Bybit claims

that it has already covered the hole sparked by the theft. Crypto tracking service

Lookonchain

has suggested that the fresh ETH comes from a mix of

"loans, whale deposits, and ETH purchases.”

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/489909.html

Related Reading

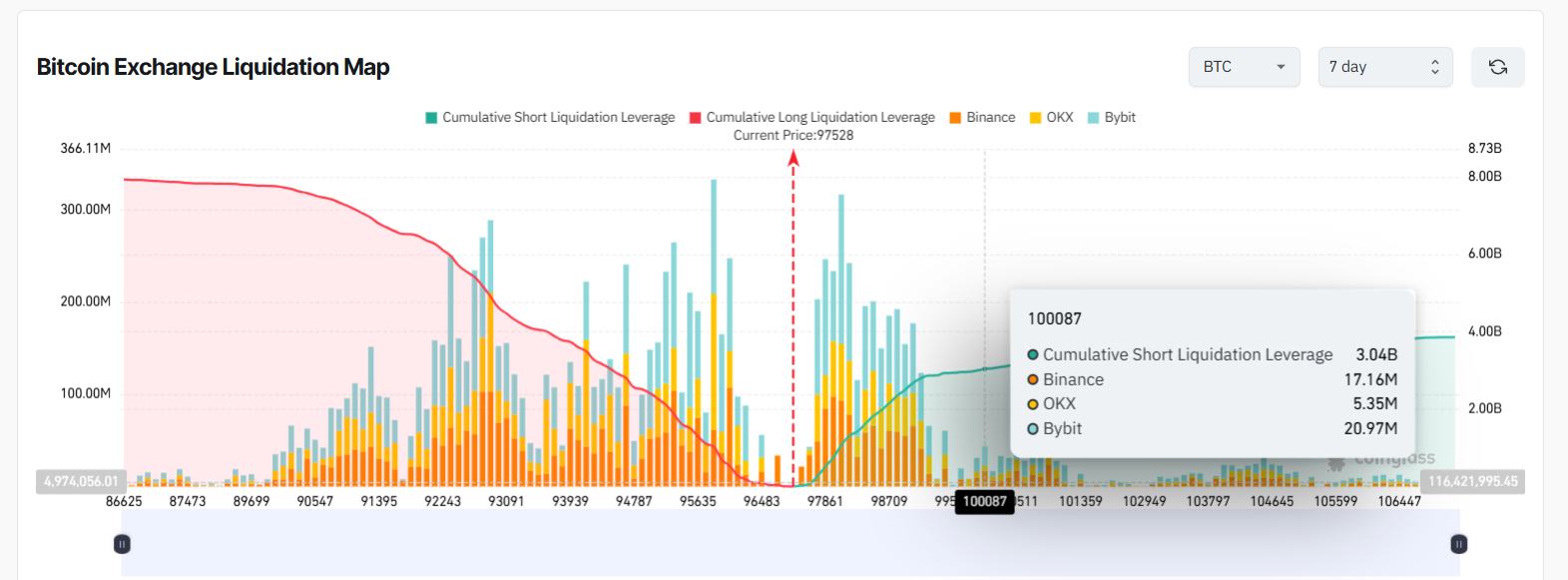

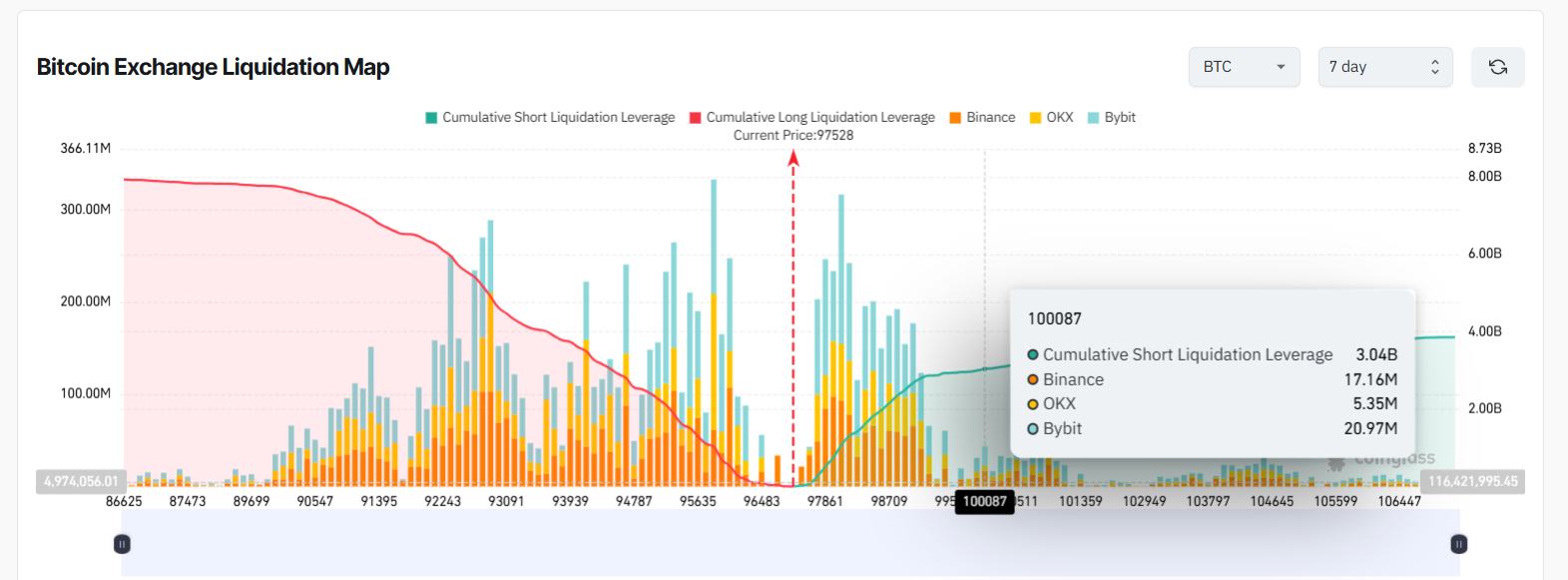

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at ri...

Goldman Sachs Ramps Up Crypto Exposure, Eyes Tokenization Opportunities

Goldman Sachs is intensifying its involvement in the digital asset space, according to its head of d...

Bitcoin Dominance Hits New 4-Year Peak: Here’s What This Means for the Altcoin Season

Bitcoin dominance has claimed a high last seen in the previous bull run, leading to discussions arou...