SignalPlus波动率专栏(20231207):价格又见顶,Skew被打穿至负值区间

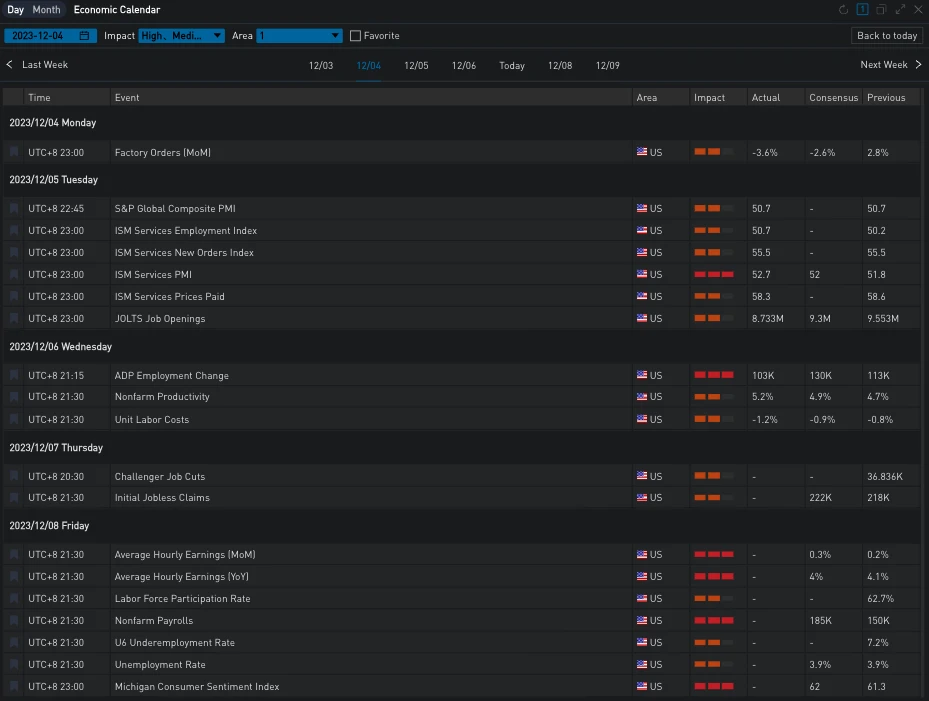

昨日(6 Dec)有“小非农”之称的美国 ADP 就业人数录得 103 K,连续四个月不及预期,再度证实了美国就业市场走软的现状,美债收益率因此再度下跌,十年期收益率在一度下探至 4.1% 之后收复部分失地,现报 4.145% ,两年期收益率仍在 4.6% 附近震荡,报 4.607% 。美国三大股指高开低走,道指/标普/纳指分别收跌 0.19% /0.39% /0.59% 。

Source: SignalPlus , Economic Calendar

Source: Binance & TradingView

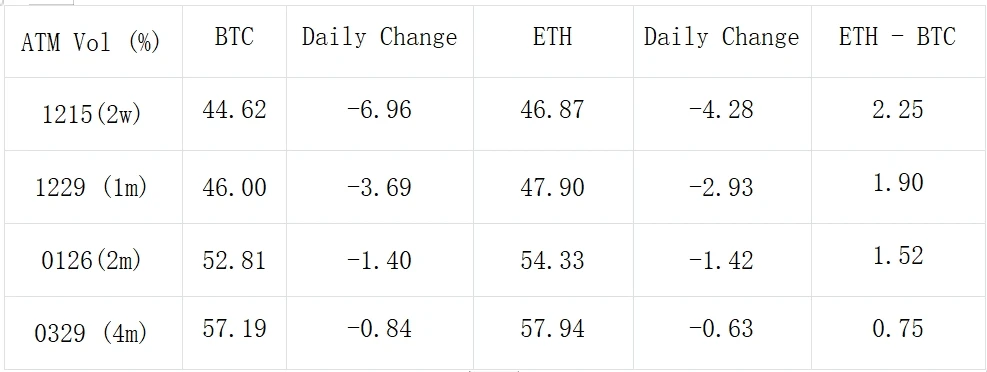

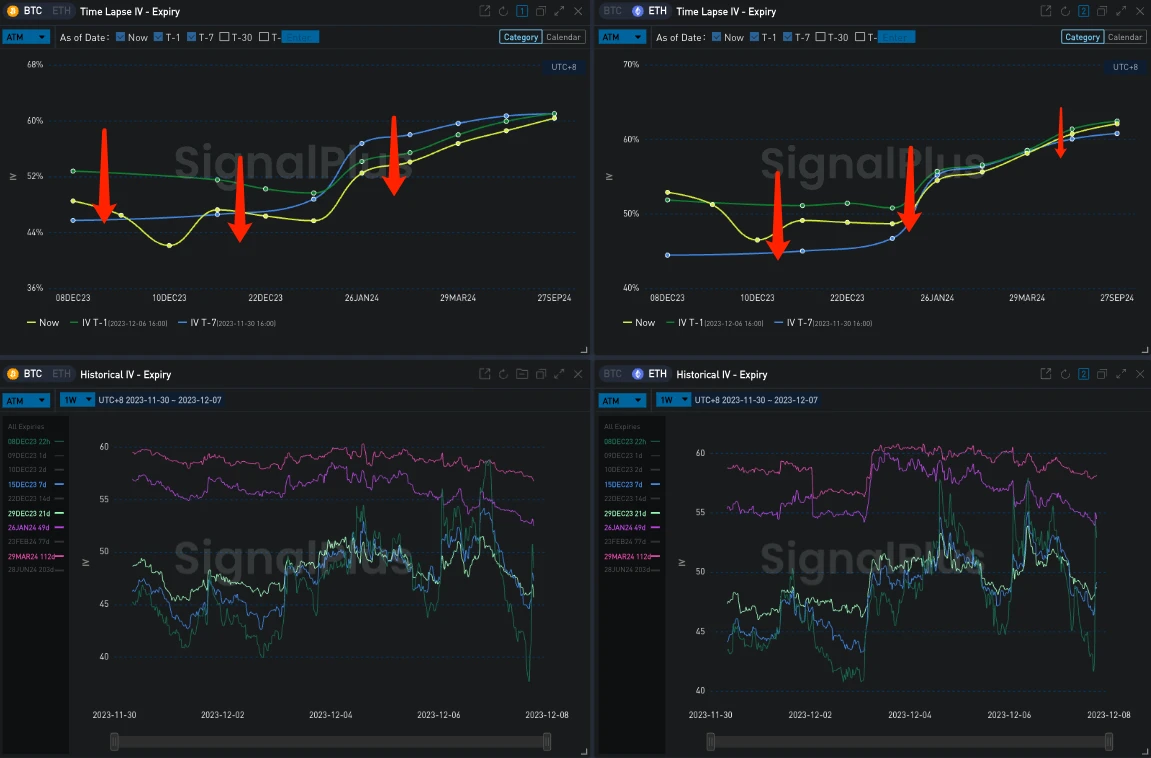

数字货币方面,此轮 BTC 上涨行情在 44000 附近再次见顶后于今日期权收盘后显露出了些许下探的苗头,前端隐含波动率与市场看涨热情一同回落,整体波动率水平也出现了明显下跌。从交易上看,散户开始在近期大量抛售看涨期权,使得 BTC 前端的 Vol Skew 被打压至负数区域,ETH 也只能将将维持在零轴上方;大宗交易主要在中远期,其中 ETH 成交相对平淡,BTC 在 Vol Curve 较为平坦的一二月份上出现卖出平仓 26 Jan 24 50000-C vs 买入建仓 23 Feb 54000-C 为代表的滚仓策略。

Source: Deribit (截至 7 DEC 16: 00 UTC+ 8)

Source: SignalPlus

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

Crypto Market Sees Sharp Declines Amid Strong Trading Volumes

On June 22, 2025, major cryptocurrencies saw price declines amid high trading volumes, reflecting co...

$312M ETH Transfer Triggers Sell-Off Fears As Ethereum Price Crashes Below Support

Blockchain tracking service Whale Alert posted a major alert showing that 129,392 ETH was transferre...

Litecoin and VeChain Prices Stall But BlockDAG’s $0.0020 Price Could Set Up a 25x Jump

Act fast as BlockDAG moves to $0.0020 with 25× potential, while Litecoin and VeChain stall in key zo...