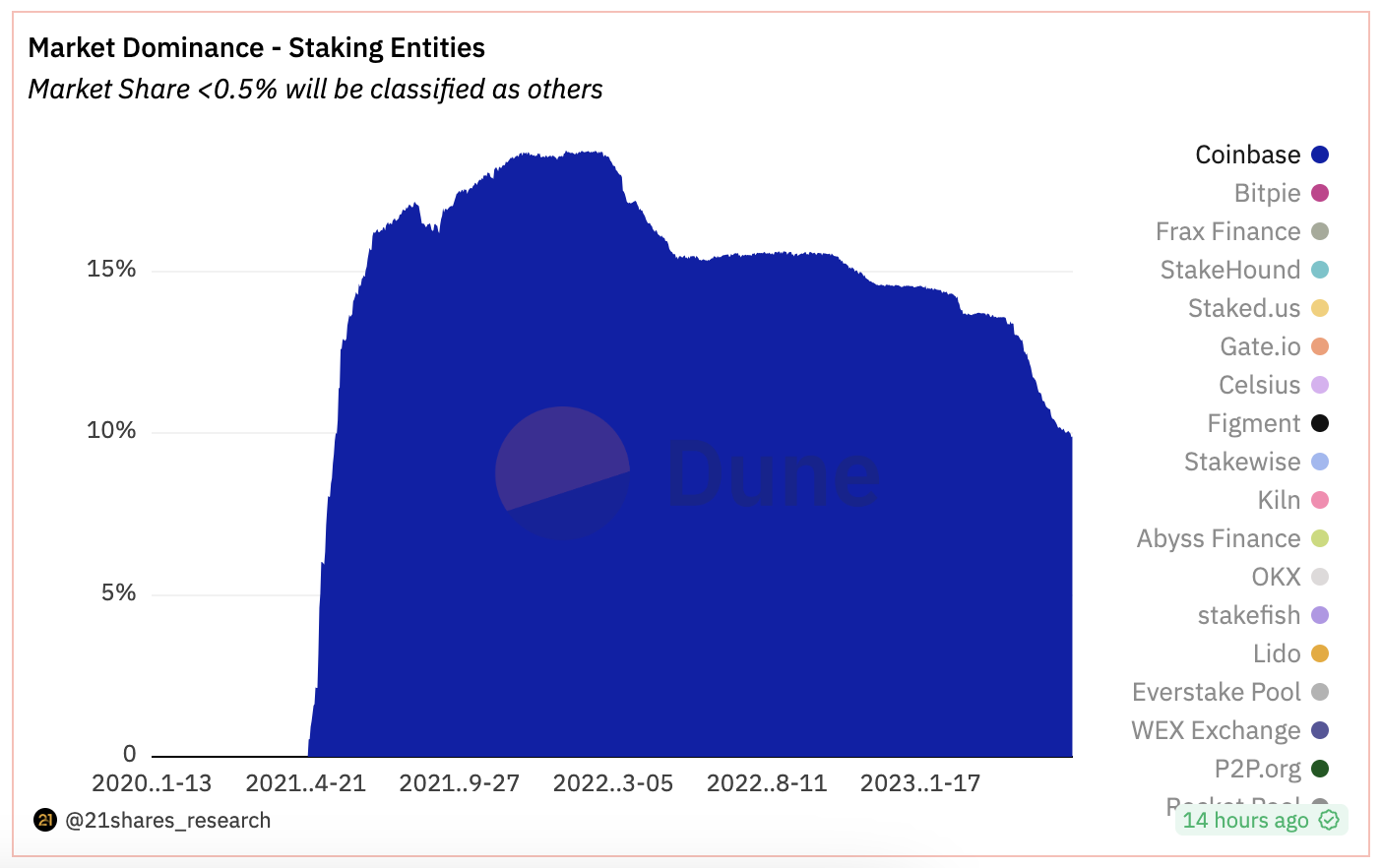

Coinbase在以太坊质押业务中市场份额下滑至9.7%,达近两年低点

Favorite

Share

Scan with WeChat

Share with Friends or Moments

博链财经BroadChain获悉,6月24日,据CoinDesk,据21Shares的Dune数据显示,由于美国监管机构对 Coinbase 质押服务施加的压力越来越大。

Coinbase 在 以太坊 质押业务中的份额下滑至9.7%,为2021年5月以来的最低水平,相较于2023年4月12日以太坊上海升级首次允许提款时达到的13.6%占比大幅下降。

Coinbase同期净流出5.17亿美元(27.23万 ETH ),仅次于Kraken。

此外,自从 SEC 提起诉讼以来,Coinbase已从以太坊权益证明网络中提取约14.93万枚ETH,而仅存入5.3万枚ETH,价值1.83亿美元的净流出表明用户正在取消质押并离开 Coinbase 。

Dune图表显示,Coinbase仍然保持着第二大质押服务提供商的地位,但Figment、Rocket Pool和Kiln等快速增长的竞争对手正在缩小差距。

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/440415.html

Previous:BRC20使用科普:比较三款比特币铭文钱包

Next:LSDfi战争,谁会成为最后的赢家?

Related Reading

Stablecoin Market Surpasses $256 Billion as USDT and USDC Retain Dominance

Stablecoins hold a $256B market cap with $USDT and $USDC leading, driving liquidity, trading, and cr...

Cboe BZX Files Form 19b-4 With SEC to List Canary PENGU ETF

The post Cboe BZX Files Form 19b-4 With SEC to List Canary PENGU ETF appeared first on Coinpedia Fi...

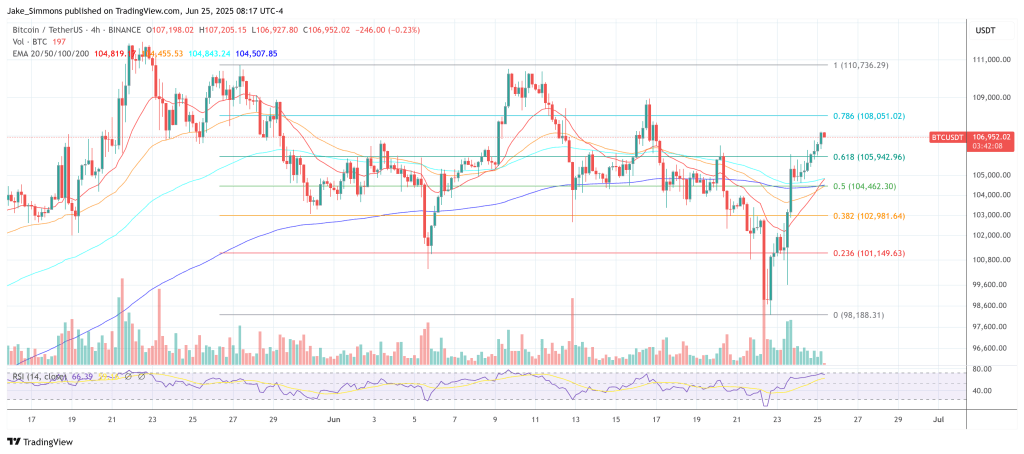

Global M2 Can’t Predict Bitcoin Price, Says Quant Analyst

Sina—co-founder of the hedge fund 21st Capital—publicly dismantled a popular Bitcoin price model pro...