美国国税局计划询问所有纳税人是否使用加密货币

Favorite

Share

Scan with WeChat

Share with Friends or Moments

PANews 8月22日消息,据Cointelegragh报道,美国国税局(IRS)日前公布了2020年个人所得税表格草稿,该表格要求每个申报收入的美国人报告是否使用加密货币。

在表格第一页,纳税人被要求回答是否在2020年接收、出售、发送、交换或以其他方式获得过任何虚拟货币。

加密货币税务软件公司Cointracker的创始人Chandan Lodha表示,加密货币问题现在是国税局明年个人所得税表格的首要和中心问题。这很清楚地表明,美国国税局正在更加认真地对待加密货币税收。

此前有一系列其他迹象表明,国税局正在加紧工作以使加密货币得到监管。

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/155929.html

Previous:欧盟将在2020年底之前公布加密法案草案

Related Reading

Countdown To August 15: What XRP Investors Need To Know

Based on community chatter, August 15, 2025 might bring a crucial turn for Ripple and its XRP Ledger...

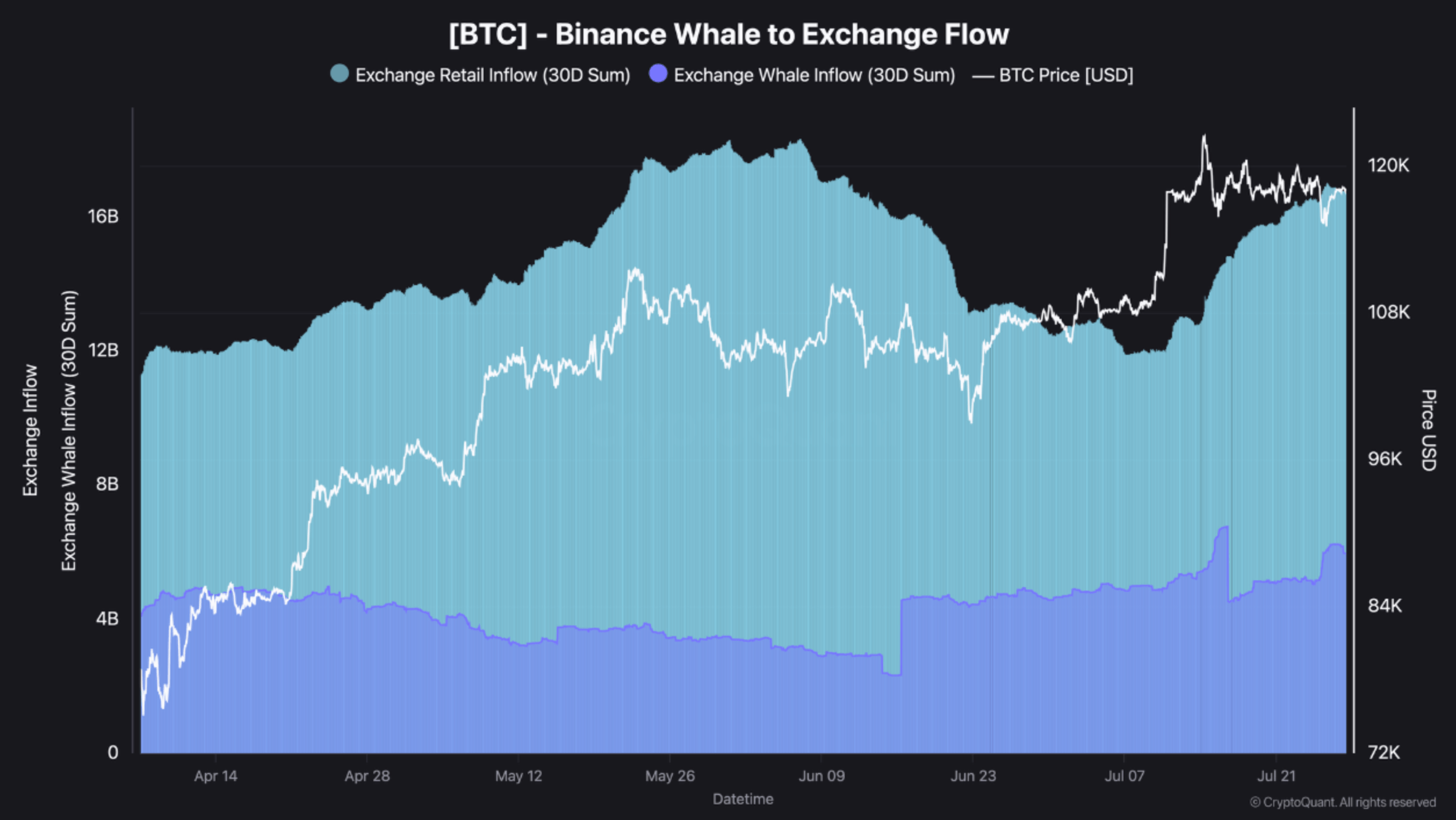

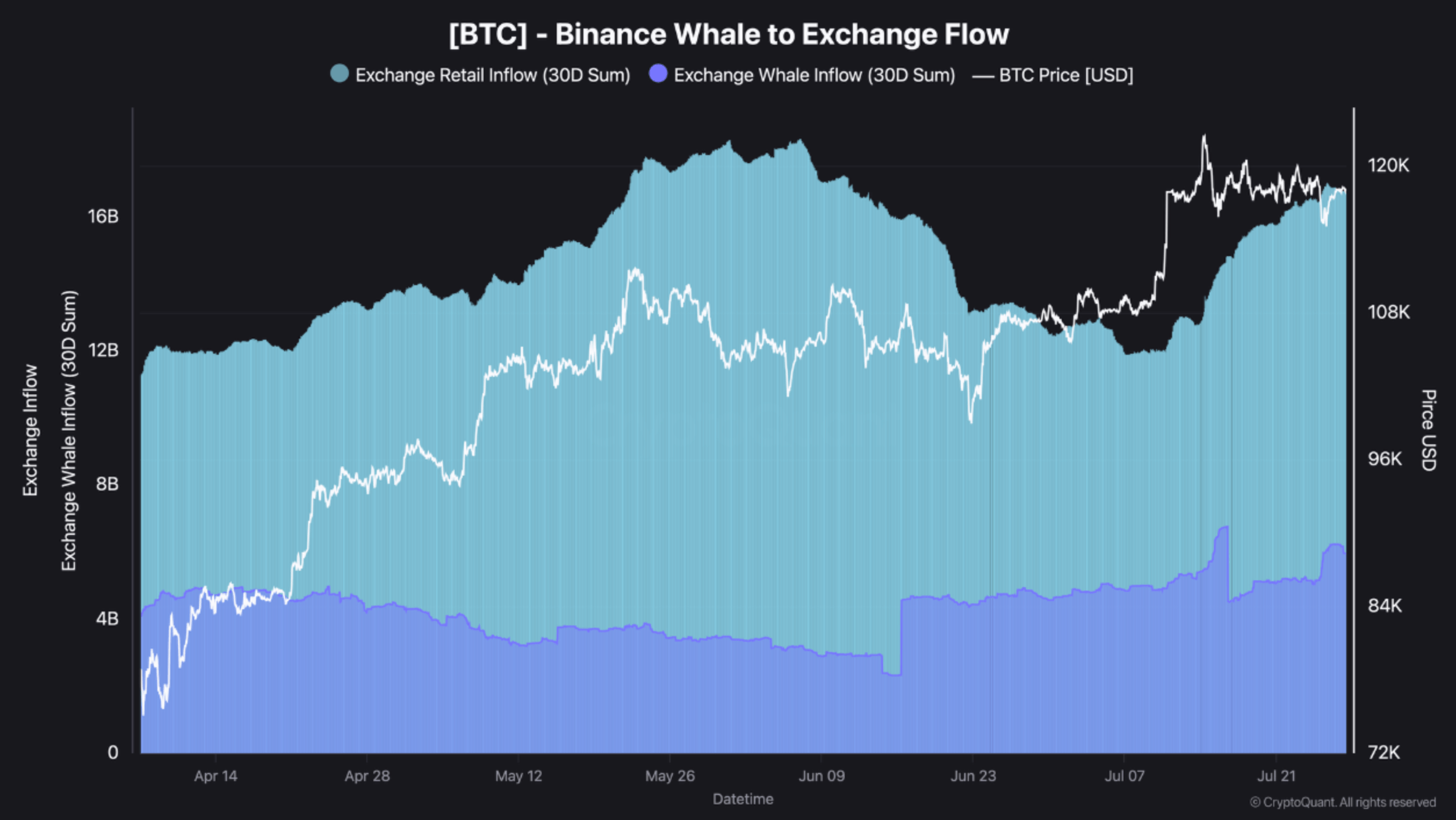

Bitcoin Rejected At $120,000: Binance Whale Inflows Suggest Possible Drop To $110,000

Yesterday, Bitcoin (BTC) once again faced rejection around the $120,000 resistance level after brief...

PayPal Unveils ‘Pay with Crypto’ to Slash Cross-Border Fees by 90%

PayPal has introduced ‘Pay with Crypto’ to slash cross-border fees by 90% as enabling U.S. merchants...