Cardano Sentiment Crashes To 5-Month Low As ADA Defends Key Price Level

Cardano’s mood music has flipped. Even as ADA has rebounded about five percent from its late-August lows, on-chain analytics firm Santiment says the asset’s typically optimistic retail crowd has swung to its most negative stance in five months.

In an X post accompanying its sentiment chart, the firm wrote: “Cardano has quietly seen its normally optimistic crowd start to turn bearish. After the lowest sentiment recorded in 5 months, $ADA’s price is +5%. Patient holders and dip buyers during this three week downswing should root for this trend of bearish retailers to continue.”

Santiment framed that shift in classic contrarian terms. “Prices typically move the opposite direction of the crowd’s expectations. When small traders sell off their bags out of impatience and frustration, it is generally the key stakeholders who accumulate and drive up prices again,” the post added.

The graphic shared by the firm plots ADA’s price against a running ratio of bullish versus bearish social commentary and annotated three distinct phases over the past month: an early-August “greed” spike where the bullish-to-bearish ratio surged to roughly 12.8:1 and was followed by a pullback; a mid-August “fear” pocket near 2.0:1 that preceded a rally; and, most recently, the most bearish reading in five months around 1.5:1, coinciding with ADA’s +5% bounce.

The sequencing in Santiment’s chart supports the firm’s message that outsized crowd optimism or pessimism frequently appears near short-term inflection points. The short-term price path into that rebound has been marked by a three-week downswing that began around August 14.

Cardano Faces Decision Zone

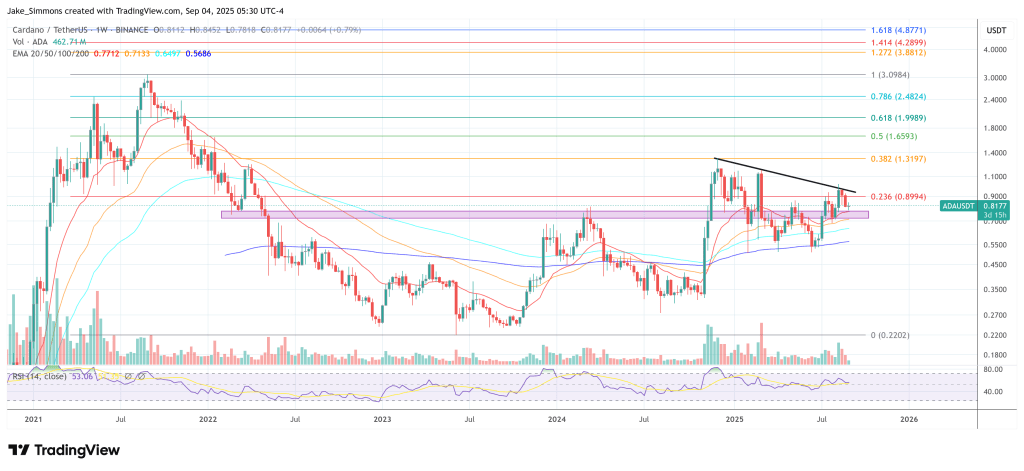

Independent market analyst Quantum Ascend ties the bounce to a clearly defined higher-time-frame structure. Posting a daily ADA/USD chart, the analyst wrote: “ADA Respecting a channel on the high time frame dating back to early June. Higher Highs, Lower Lows. Short-term decline dating back to August 14 channeling as well. Price Currently sitting atop the .382 Fib at $0.82. Cardano’s decision point appears near, but we still need to be looking to the Macro. Regardless, I’m very bullish long-term.”

In Quantum Ascend’s view, ADA is tracking an ascending channel that has contained price action since mid-June. The short, blue corrective channel from August 14 sits inside that broader up-channel and has carried price back to the lower end of the channel as well as a Fibonacci retracement cluster derived from the June–August advance.

The analyst’s chart places the 0.382 retracement near $0.821, which has acted as first support and the immediate “decision point.” Below that, the same mapping highlights the 0.309 retracement around $0.762 and the 0.236 near $0.702 as deeper pullback areas inside the macro structure.

Overhead, the analyst’s levels mark successive checkpoints at the 0.5 retracement near $0.879, the 0.618 near $1.043, the 0.702 around $1.083, the 0.786 near $1.151, and the 1.0 extension around $1.326—levels that also align with prior supply pockets and the upper boundary of the ascending channel later in the quarter.

At press time, ADA traded at $0.8177.

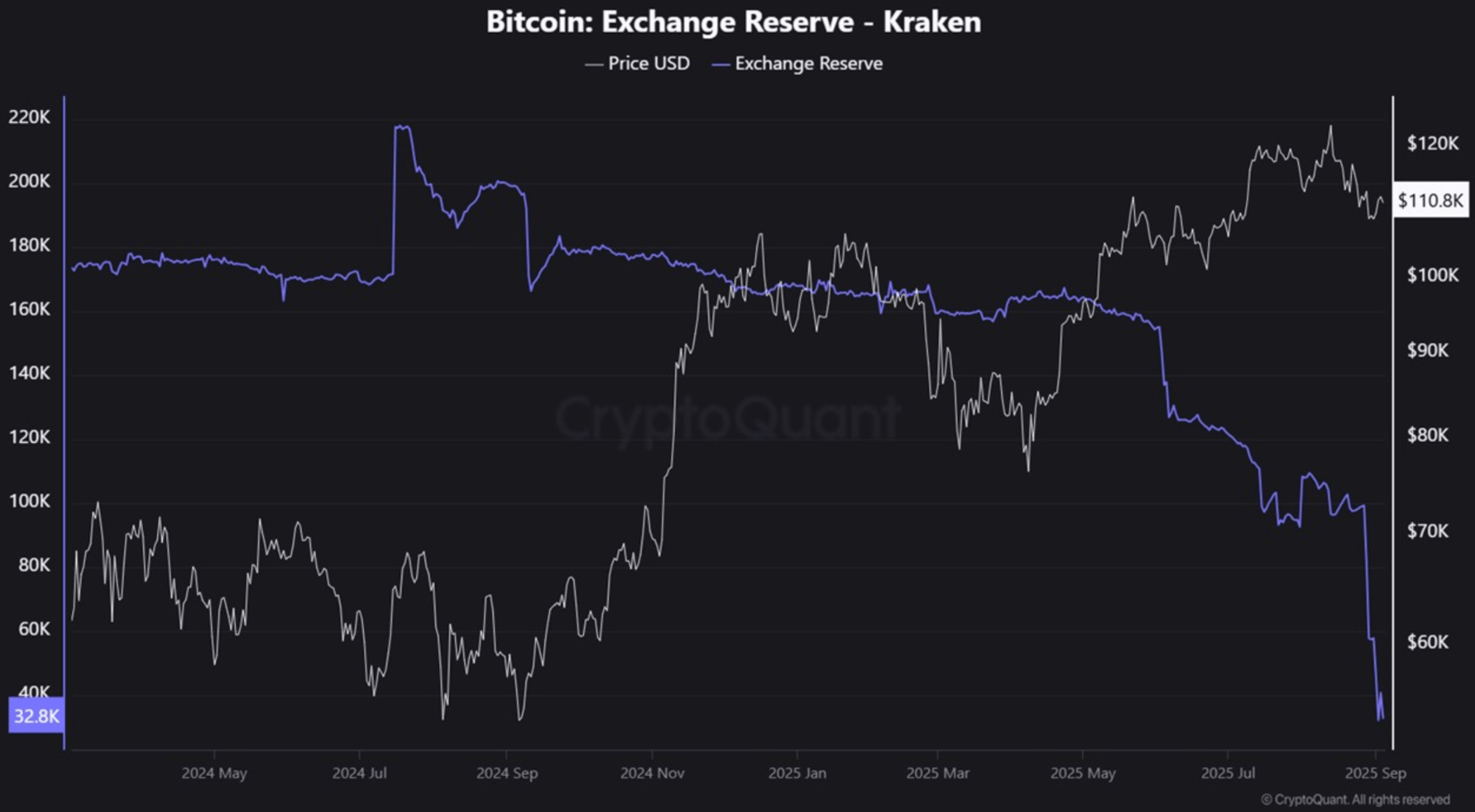

Bitcoin Withdrawal Wave Points To Another Major Leg Up In The Bull Cycle, Analyst Says

After hitting its latest all-time high (ATH) on August 14, Bitcoin (BTC) has been on a steady declin...

You Won’t Believe How Much Of The Shiba Inu Supply The Top 10 Addresses Control

New data from Santiment has revealed that the top 10 Shiba Inu (SHIB) addresses control over 62% of ...

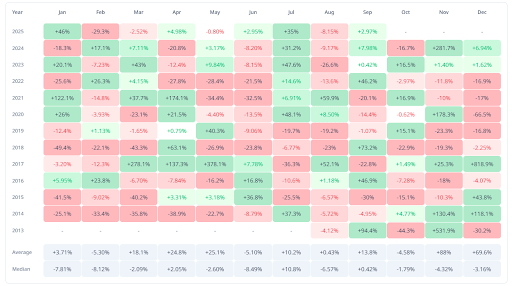

Average Monthly Returns Says XRP Price Could Fly High In September

Historical data provides a bullish outlook for the XRP price this month, with the altcoin likely to ...