Bitcoin Withdrawal Wave Points To Another Major Leg Up In The Bull Cycle, Analyst Says

After hitting its latest all-time high (ATH) on August 14, Bitcoin (BTC) has been on a steady decline, trading just above the $110,000 level at the time of writing. While some analysts opine that the crypto bull run may be over, on-chain data suggests that there is at least one more major leg up ahead for BTC.

Bitcoin Bull Market Over? Not Quite

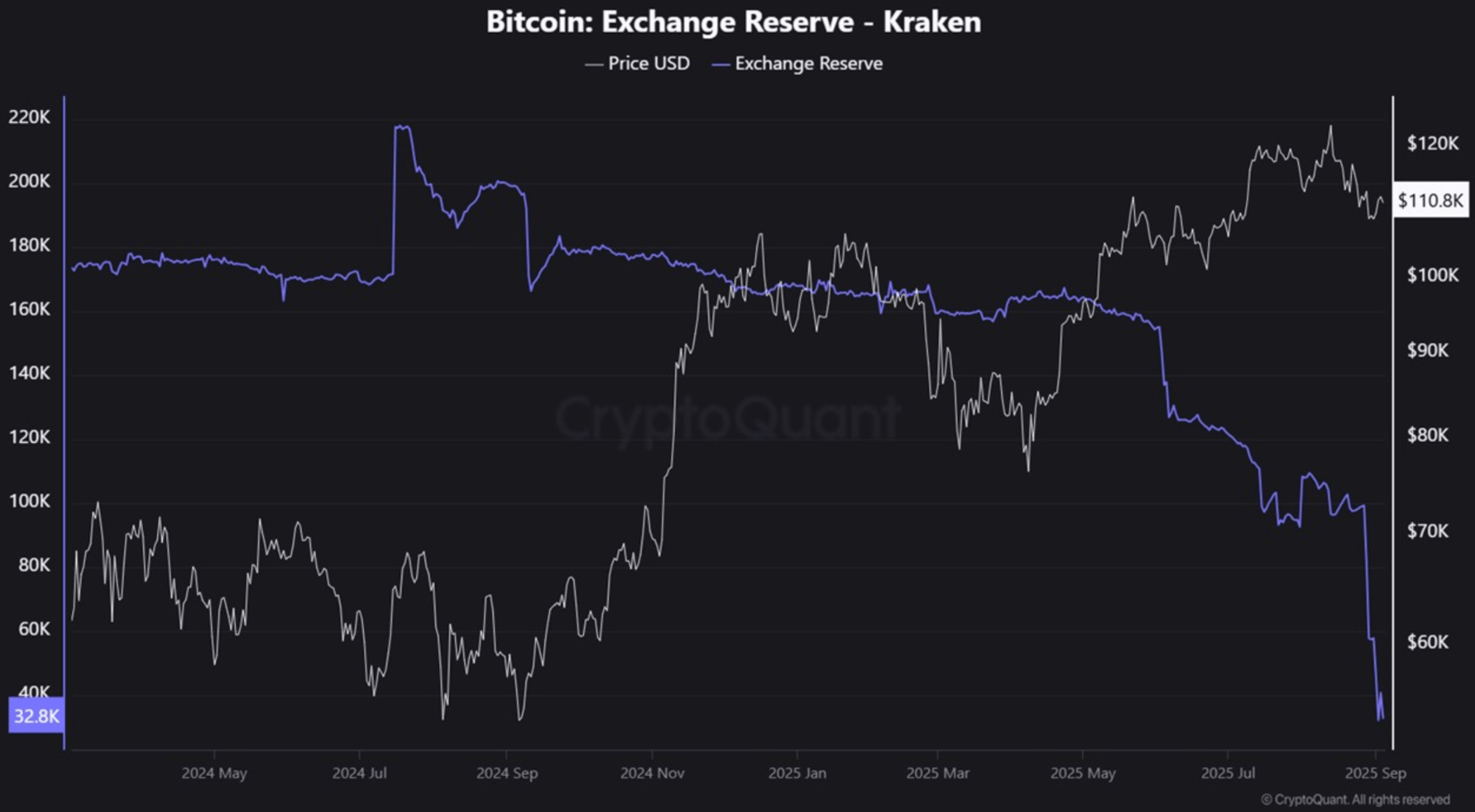

According to a CryptoQuant Quicktake post by contributor CoinCare, as much as 50,000 BTC has been withdrawn over the past two days from crypto exchange Kraken. This was followed by another major withdrawal of 15,000 BTC.

The CryptoQuant analyst stated that such significant withdrawals are not something that is typically observed near the peak of a bull market cycle. Instead, at market tops, exchanges witness an influx of BTC or other cryptocurrencies, signalling distribution.

Although retail demand for BTC is currently fragile, a few big wallets are still accumulating BTC in large quantities. Past data shows that retail demand for BTC surges rapidly at bull market tops. However, the current tepid demand suggests that BTC has “at least one major leg up ahead.”

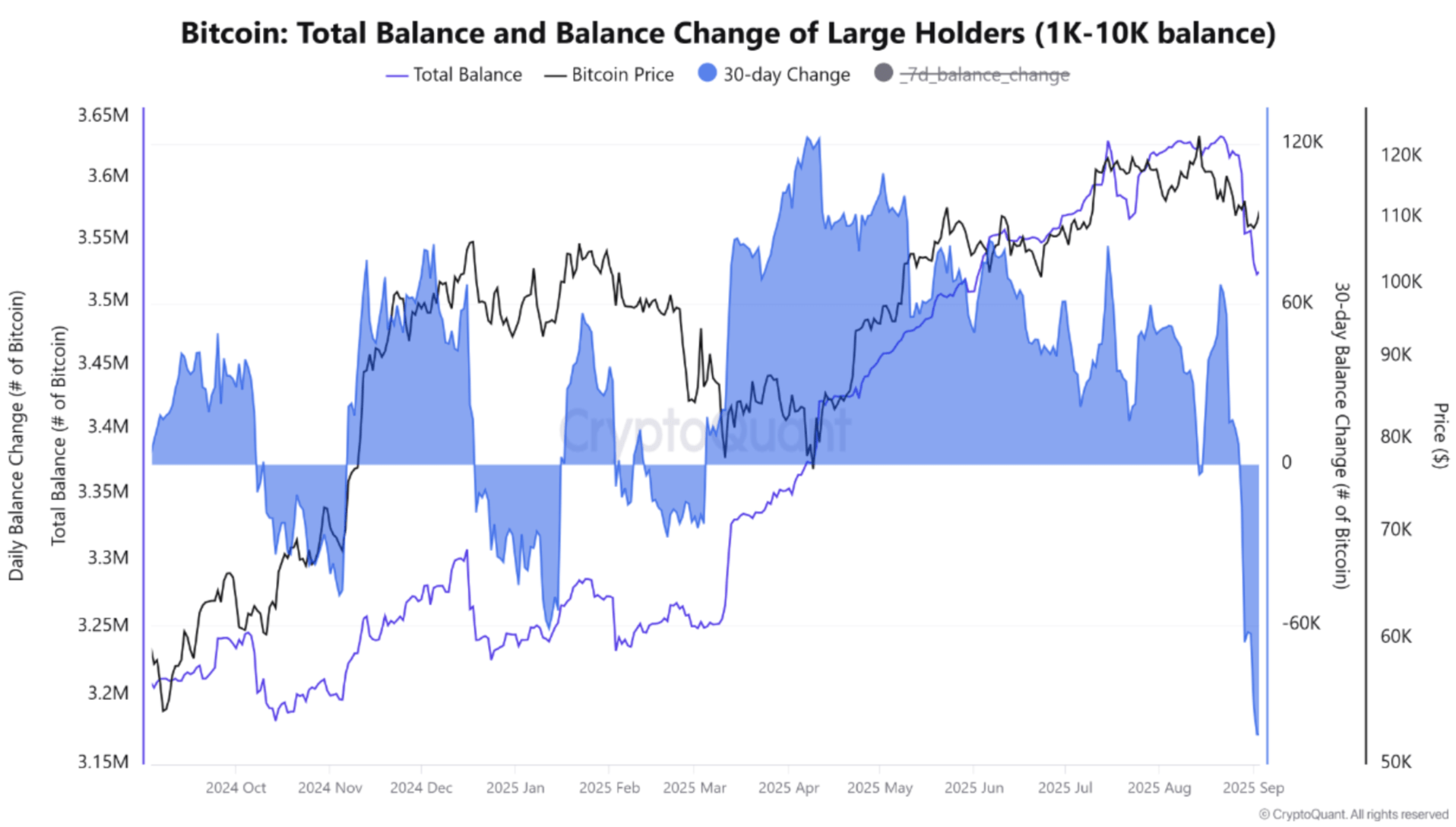

That said, fellow CryptoQuant analyst caueconomy offered a contrasting take. According to their analysis, major BTC holders continue to reduce their exposure to the digital asset, recently reaching the largest coin distribution in 2025.

Notably, BTC whale reserves have tumbled by 100,000 coins in the past 30 days, showing high risk aversion among large investors. As a result, heightened selling pressure has been weighing down on the BTC price, pushing it below $108,000 in late August. The analyst added:

At this time, we are still seeing these reductions in the portfolios of major players, which may continue to pressure Bitcoin in the coming weeks.

Technicals Point Toward Renewed Strength

While BTC whales – investors holding 1,000 to 10,000 BTC – may be reducing their exposure to the cryptocurrency, technicals point toward further room for growth for the leading digital asset by market cap.

For instance, noted crypto analyst Titan of Crypto shared the following chart on X, saying that BTC is close to invalidating the bearish double-top pattern on the daily chart. Once BTC convincingly pushes above the neckline, it could provide new bullish momentum to the asset.

That said, there are some signs of caution. For instance, crypto analyst Doctor Profit recently stated that if BTC fails to defend the $107,000 – $108,000 support level, then it may risk falling all the way down to $90,000.

Similarly, a breakdown below the $98,000 level could spell disaster for the flagship cryptocurrency. However, the long-term bull case for BTC remains intact. At press time, BTC trades at $110,460, down 0.9% in the past 24 hours.

Bitmine Adds Another $65.3M In Ethereum – Details

Ethereum continues to display resilience in the face of recent volatility, holding firmly above the ...

XRP Millionaires Dump After Major Accumulation Trend, Will It Be A Red September?

XRP’s large holder cohort, specifically addresses holding between 10 million and 100 million XRP, ha...

You Won’t Believe How Much Of The Shiba Inu Supply The Top 10 Addresses Control

New data from Santiment has revealed that the top 10 Shiba Inu (SHIB) addresses control over 62% of ...