Ondo Launches Tokenized Versions of Over 100 NYSE and NASDAQ Securities on Ethereum

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Ondo Finance has launched Ondo Global Markets, a new platform that lets non-U.S. investors trade tokenized versions of more than 100 U.S.-listed stocks and ETFs directly on Ethereum.

In a

blog release

today, the company called this the largest launch of tokenized equities so far and confirmed plans to expand the lineup to over 1,000 securities by the end of 2025, pending regulatory approvals and jurisdictional rules.

Ondo Global Markets Grant Non-US Investors Access to US Securities

Notably, through Ondo Global Markets, investors outside the U.S. can instantly buy and sell tokenized shares of companies like Apple, Microsoft, and Tesla, along with major ETFs.

Each token matches the value of its underlying asset, fully backed by stocks or ETFs held with U.S.-registered broker-dealers and regulated custodians.

Ondo Finance

confirmed that the tokens inherit the liquidity of the real-world securities. Specifically, this helps investors to trade with minimal slippage and price discrepancies.

The platform allows real-time minting and redemption during U.S. trading hours, while transfers remain available 24/7. Also, any dividends or corporate actions feed directly into the token's value, giving holders total return exposure similar to the original securities.

https://twitter.com/OndoFinance/status/1963236536104722798

Interestingly, Ondo partnered with major crypto wallets and exchanges, including Gate, MEXC, Trust Wallet, OKX Wallet, Bitget Wallet, CoinMarketCap, Blockchain.com, CoinGecko, 1inch, LBank, LayerZero, CoW Protocol, Alpaca, Morpho, BitGo, Ledger, and RWA.xyz, to make trading seamless across DeFi ecosystems.

Per the press release, security is a top priority. Importantly, independent third-party agents will verify reserves daily, while a Security Agent will hold first-priority rights to the underlying assets on behalf of token holders. Ondo designed this structure to protect investors and reassure institutions looking to allocate larger amounts of capital.

Ondo's Broader Vision

Moving forward, the company also plans to bring its tokenized stocks to other blockchains such as BNB Chain, Solana, and its own Ondo Chain in the coming months.

The launch forms part of Ondo Finance's broader "Wall Street 2.0" vision, which plans to modernize traditional markets by leveraging blockchain technology.

Further, the company plans to add features on Ondo Chain, including automated on-chain asset management, institutional borrowing against tokenized assets, staking for network security, cross-chain token issuance, and expanded collateral options for DeFi platforms.

Growing Tokenization Trends in 2025

The latest development comes as the tokenization sector grows across the financial sector in 2025. This month alone, Trust Wallet has opened access to tokenized real-world assets for its 200 million users, with Galaxy Digital becoming the first Nasdaq-listed company to tokenize its Class A shares on Solana.

Also, Backed Finance added tokenized shares of over 60 companies, including Meta, Netflix, and Nvidia, across Solana, BNB Chain, Tron, and Ethereum.

Meanwhile, major exchanges such as

Kraken

and Bybit, along with traditional brokers like

Robinhood

and eToro, have launched tokenized stock trading with integrated DeFi features.

In April, Keyrock and Centrifuge published a report showing tokenization across U.S. Treasuries, equities, private credit, and commodities had grown 380% since 2022, with tokenized equities alone reaching roughly $341 million despite ongoing regulatory hurdles.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/526852.html

Related Reading

Here’s How High XRP Could Soar if Ethereum Reaches $62,000, as Predicted by Tom Lee

Widely followed crypto analyst Cryptoinsightuk has shared how high he believes XRP could go if Ether...

Post-Halving Cycles Point to Strong September Pullback Before Q4 Rally

While Bitcoin is on a recovery path after several weeks of declining prices, some analysts believe t...

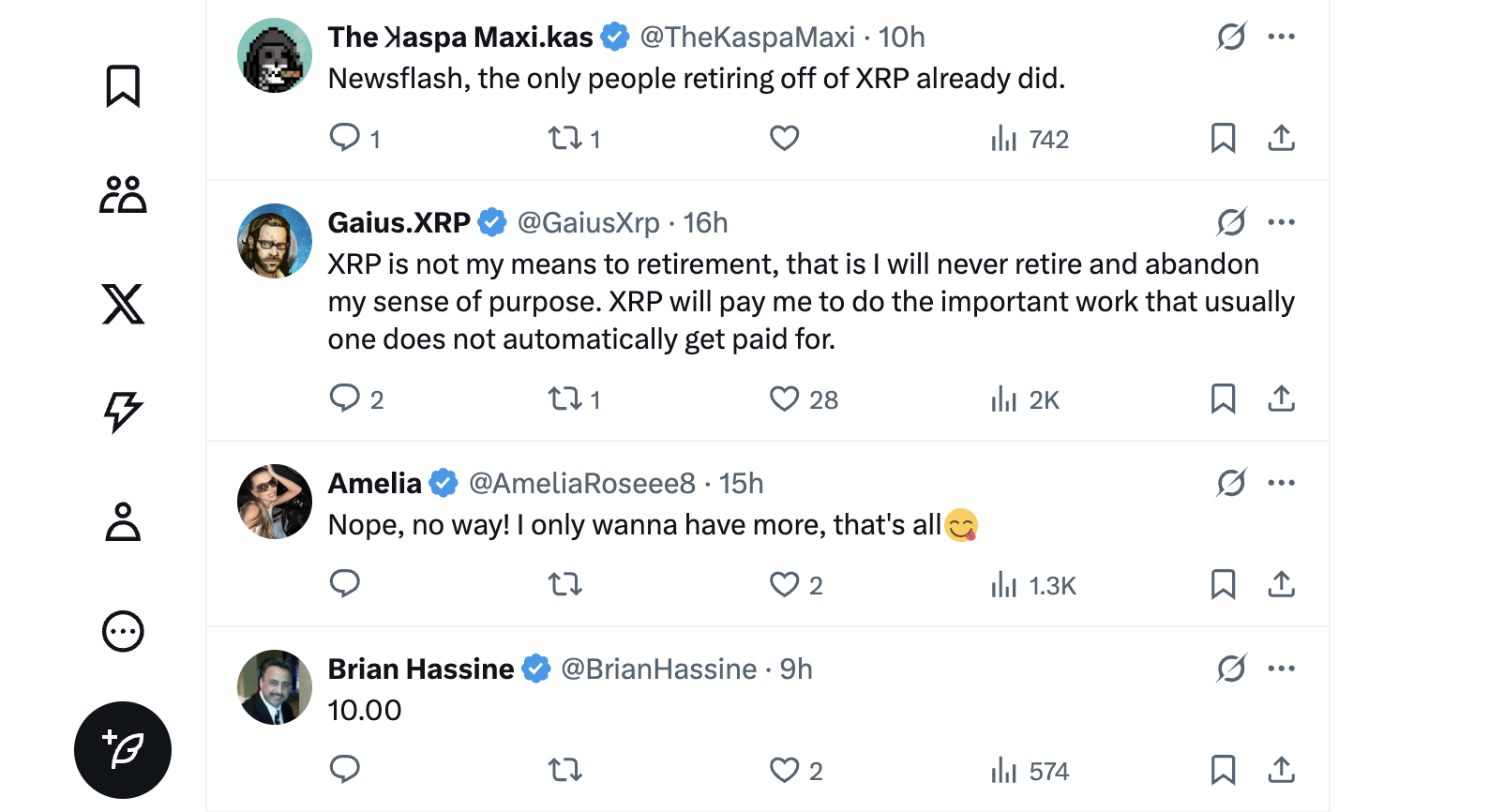

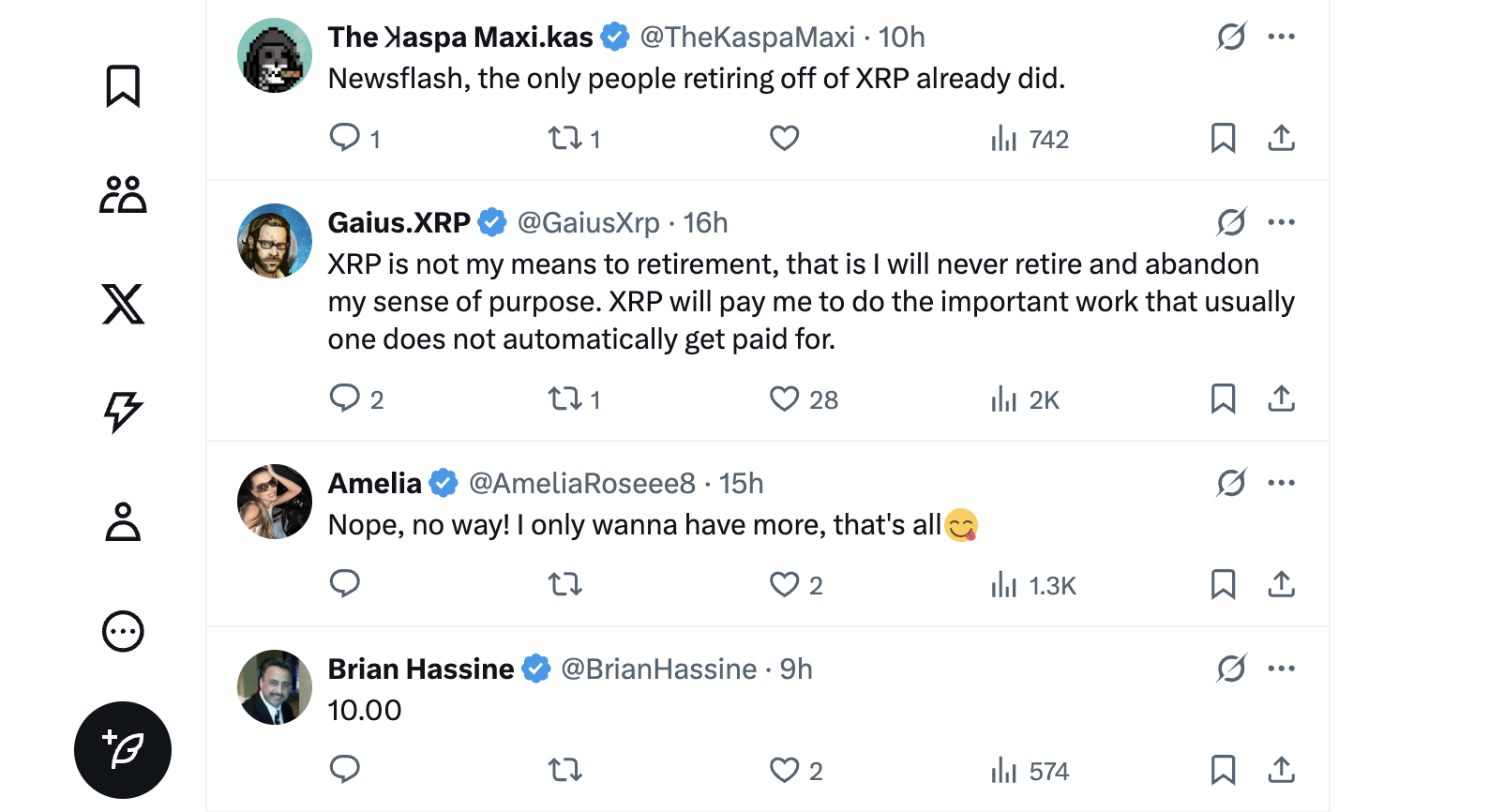

Here’s How High XRP Should Reach to Unlock Early Retirement, According to Community

As the XRP market gradually turns bullish again, the conversation around XRP as a retirement vehicle...