XRP Called Commodity in CFTC Filing: Details

Favorite

Share

Scan with WeChat

Share with Friends or Moments

A document circulating in the XRP community suggests that the token has been registered as a commodity with the U.S. CFTC.

Popular community figure Xaif recently

shared

the document, claiming that XRP has "officially" been listed as a commodity under CFTC Events Contracts.

This claim stems from XRP’s description as a crypto asset commodity. The description has sparked widespread speculation, with some users, including Xaif, asserting that XRP is a commodity rather than a security.

CryptoCom Certifies Its XRP Events Contract

However, a quick search into the filing shows it relates to an application Crypto.com

submitted

to the CFTC in February 2025.

According to the application, Crypto.com requested to certify its XRP Event Contract under CFTC rules. The filing is similar to the regulatory process Crypto.com used for other event contracts tied to major assets like Bitcoin and Ethereum.

The product, which launched on February 14, is a type of swap that allows users to speculate on XRP’s price over a short timeframe of 20 minutes or two hours.

Not an Official CFTC Declaration

Even though the filing treated XRP as a commodity for the derivative product, it is not an official declaration from the CFTC. This description is similar to how some asset managers, like Bitwise,

characterized

XRP as a commodity-based trust in their spot ETF applications.

Importantly, the debate over whether XRP is a security or a commodity originated from the lawsuit between the U.S. SEC and Ripple, which has now

ended

.

During the early stages of the case, the commission alleged that XRP was a security. However, a federal judge dismissed this claim,

declaring

that XRP is not a security in itself.

The SEC never challenged this declaration, despite appealing some parts of the judge’s ruling. Meanwhile, neither the SEC nor the CFTC has specifically defined XRP’s regulatory status.

In the meantime, the current SEC leadership, headed by Paul Atkins,

believes

that most crypto assets are not securities. This deviates from the views of the Gary Gensler-led SEC, which considered only Bitcoin a non-security.

Amid the SEC’s changing stance, the Presidential Working Group on Digital Assets recently suggested that the CFTC should regulate cryptocurrencies classified as commodities.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521316.html

Related Reading

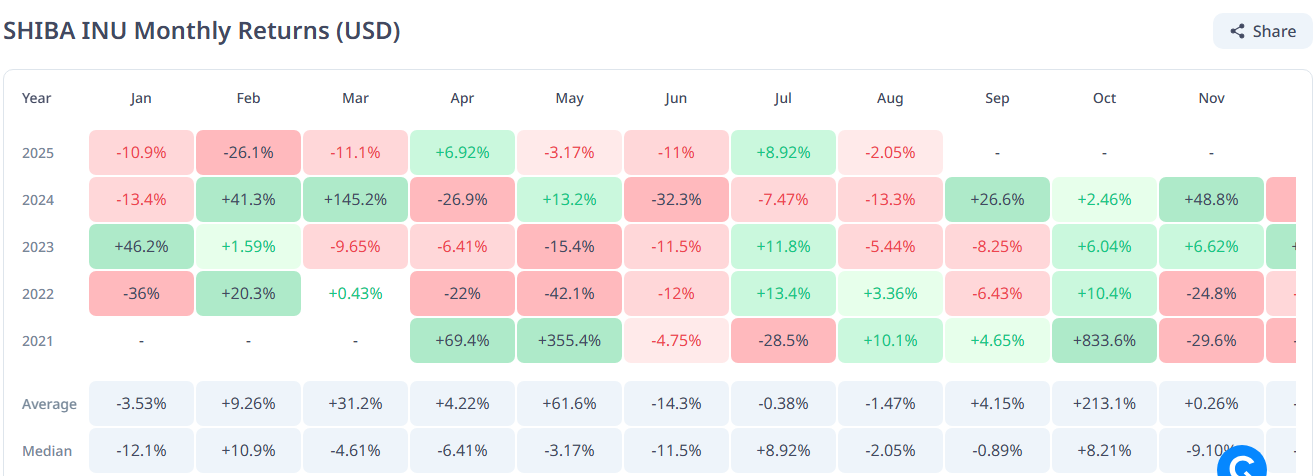

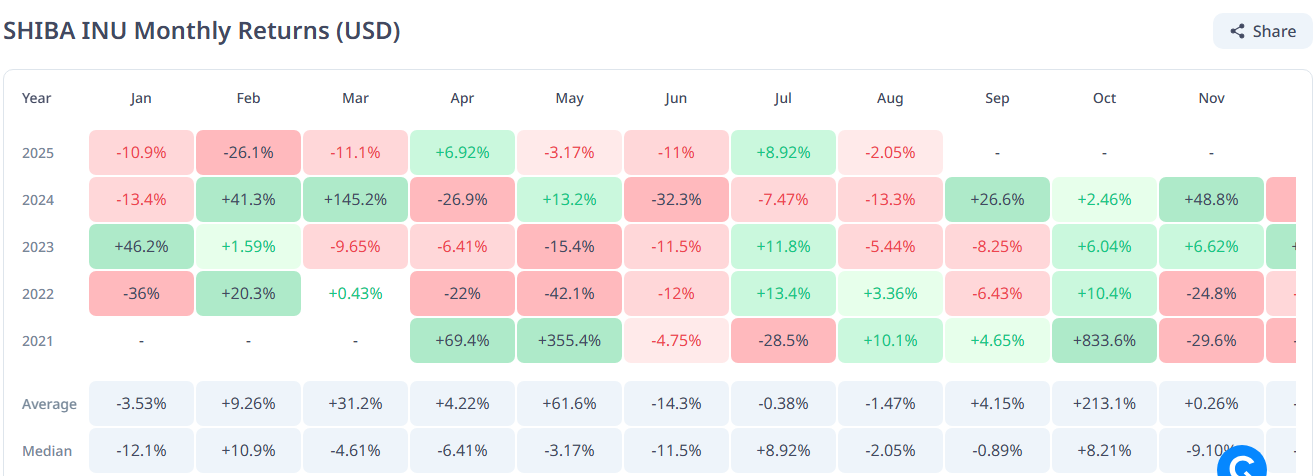

Here’s Potential Price for Shiba Inu if Dogecoin Hits $1.50

A veteran crypto investor has predicted that Shiba Inu could clinch a new all-time high (ATH) if Dog...

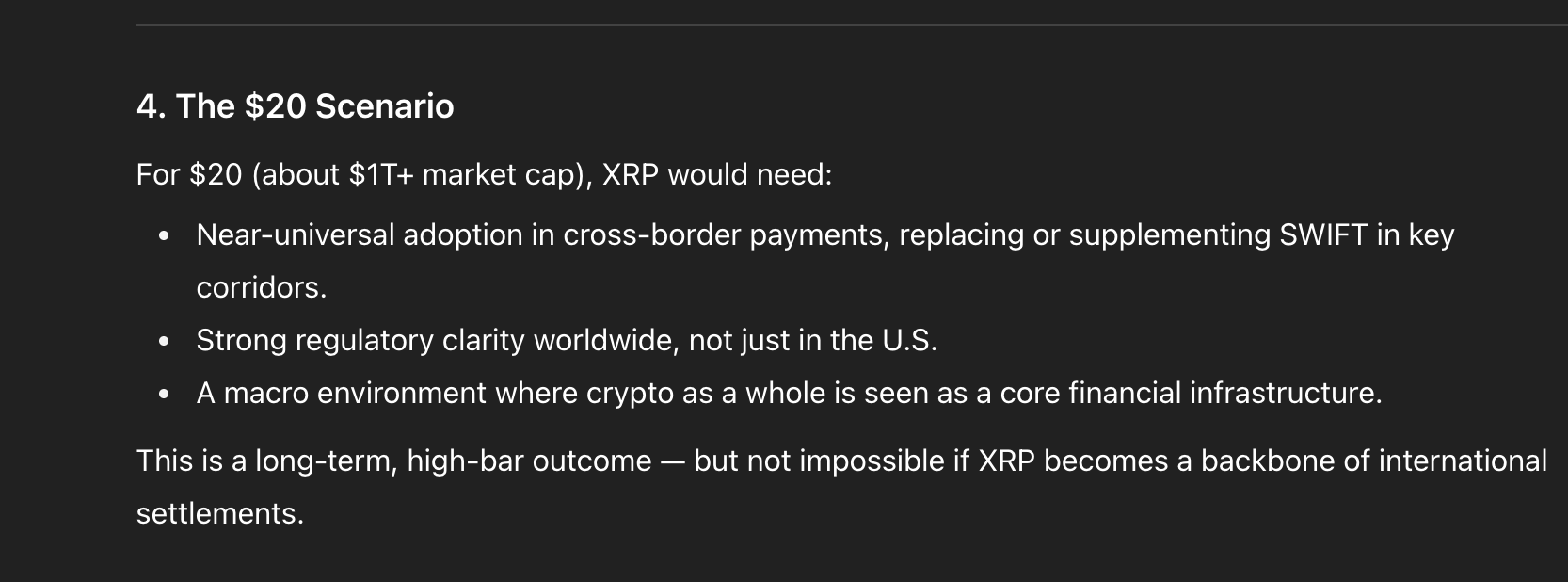

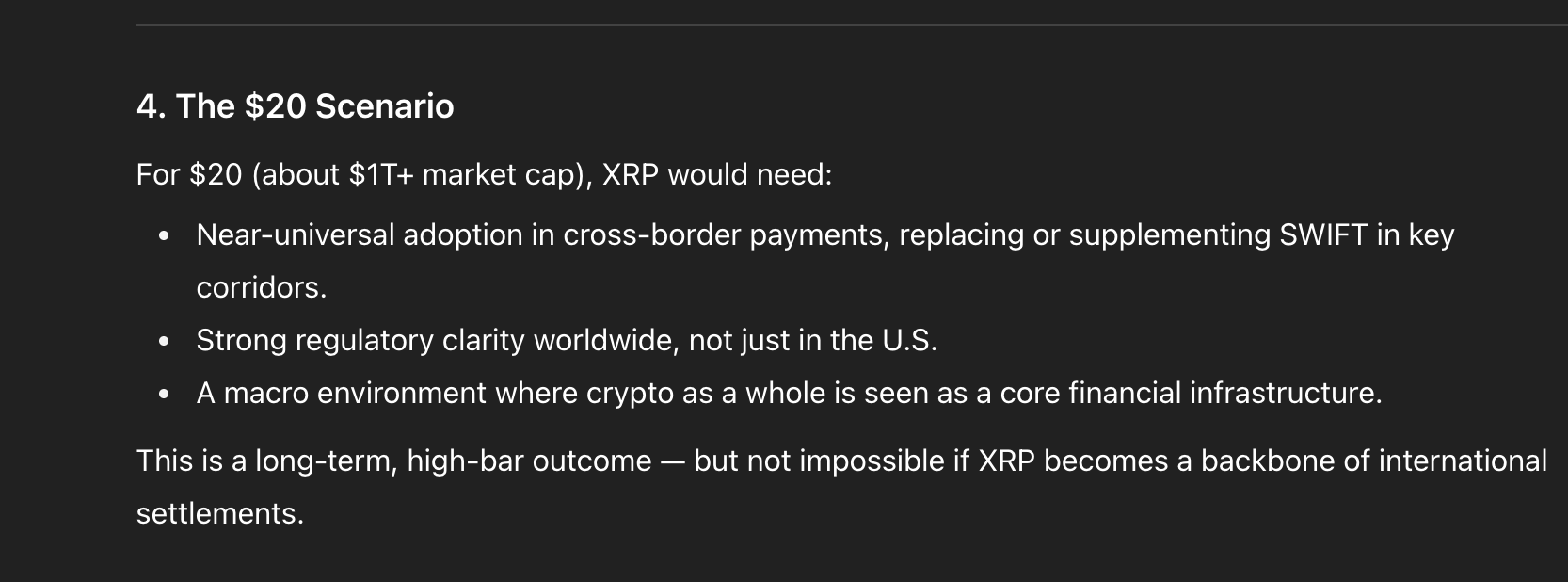

XRP Price News: With SEC Battle Over, Can XRP Hit $5, $10, or $20

The nearly five-year legal battle between Ripple and the U.S. SEC is officially over, and attention ...

Donald Trump-Inspired World Liberty Financial Exploring $1.5B Crypto Vehicle to Hold WLFI Tokens

The Donald Trump-inspired World Liberty Financial is exploring plans to create a publicly traded cry...